An Honest Look At Whether Buying My Home Was A Good Financial Move

I’m still settling into the whole home-ownership thing (literally — there are somehow still unpacked boxes around the house), but now that I’ve been living there for four months, it’s worth it to consider next steps. But first, did the plan even work?

CURVEBALLS: -$675.00 to date

Literally two weeks into living in the house, my shower broke. And I don’t mean the shower head needed to be replaced — I mean when we tried to replace the shower head, the whole pipe popped out of the wall. Turns out there was severe corrosion that neither the seller, my agent, my inspector, nor I could see.

Thank goodness for a home warranty, amiright?

No. I’m not. I’m not right. In fact, working with my home warranty from Fidelity cost me more than if I had just gotten the damn thing fixed myself. I called, explained the situation, and told them, “If you’re just going to say ‘it’s your fault for trying to change the shower head, pay us,’ don’t bother coming.”

They did bother coming, though, and ultimately that set me back a pretty $675 that I’ll never see again. Oh, rental maintenance, what a blessing you were.

Other unexpected expenses have yet to pop up, but give it time. I’ve only lived here four months, so anything could happen!

UPGRADES: -$262.49 to date

I moved into a perfectly functional house (aside from the shower), but there must be some psychological tendency to want to nest it up. Even before I moved in, I was playing with Hutch, an app that 3-D renders your space and lets you swap furniture and decor on your phone, to imagine exactly how to make the space the best designed for me. Suddenly I found myself needing rugs in every room, or big, beautiful round mirrors in the entryway. What’s worse, I convinced myself that the tiles could be a more neutral shade instead of keeping my entryway pink — although, let’s face it, that’s on the list.

Luckily, I’m spacing it out — and using my shopping hacks to help save on whatever I do buy. The things that I thought were necessary two months ago are feeling less important now, and I’m only buying the things that still feel like they’ll make a big difference in my level of comfort or happiness. And even then, it’ll be a few months.

In the meantime, I set up alerts on Craigslist for the exact items that I want. This has included:

- New counter stools

- Entryway bench (with shoe storage)

- Big, blue rug for my bedroom

- Bistro set for the balcony

- Entryway mirror

Out of those things, I was able to pick up:

- New bar stools: $0 — wrong height, but they were beautiful, and the owner let me have them for free. They are now gorgeous, artsy plant stands in the corners of each room.

- A big, blue rug for my bedroom: $200, but great quality and that perfect shade of turquoise.

- Entryway bench with (some) shoe storage: $15 — thanks to Craigslist, I got a bench that needed just a few adjustments to make it perfect! The $15 covered the cost of fabric to reupholster the seat with something cheery!

- Entryway mirror: $47.49 from Target. What can I say? It matched the ideal that Pinterest told me I needed.

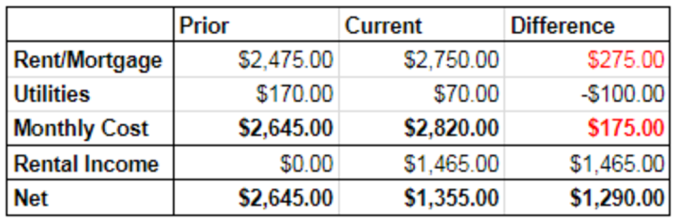

CASHFLOW: +$1,290/month

You bet your buns, hon! It’s a damn good feeling to see my biggest expense get cut down by just under 50% (48.77% to be precise). That’s over $1,200 that I can put into my passive income streams, or save up for my next down payment for my master plan — FIRE!

EMOTIONS: Priceless

The relief of being done with the purchase is unbelievable. I had pinned so many life events around actually owning this home. I was scared to ruffle feathers at work because if I lost my awful job, I could lose the house. I fell out of touch with my routine, spent a lot of time running to and from the property, and – oh yea — put every possible purchase on hiatus until I was confident that there was literally nothing that could kill my approval with Quicken Loans.

And I can’t wrap my head around the fact that, hey, this is my place. I can put art all over the walls, put my pole up wherever I like, do laundry in the middle of the night… Watch out world!

I can also put things like heavy furniture somewhere without thinking, “Why bother bringing it up the stairs when it’s just coming back down in a few months” — it’s not. It’ll live there for years at least. That’s a surprisingly good feeling.

GROSS TO DATE: +$4,222.51

*****

Having a net savings of 4K+ in four months — that’s a win for me! I’m pacing myself on silly furniture and interior upgrades, but the savings from my lower rent/mortgage far outpace that spending — thank goodness!

Plus, it’s been a huge relief to actually own the space I’m living in. Yes, if the sky fell and my mortgage failed, it wouldn’t technically be mine, but short of that, it’s a nice weight off my mind. And, while I would never advocate for someone to buy a property to feel more “adult,” it definitely doesn’t hurt.

So, buying a house seems like the right call for me so far — both for my personal happiness and my personal finances.

Tis is a 20-something recruiter, startup enthusiast, finance blogger, and proud feminist-slash-crazy cat lady. Find her on Twitter or check out the blog for lifehacks and musings on personal finance, professional growth, and enjoying the journey to early retirement.

Image via Unsplash