How To Create A Student Loan Payoff Plan

In partnership with SoFi, we’ve put together this student loan repayment worksheet to help you make informed debt repayment decisions through the rest of 2021. Keep reading for a text version of this worksheet and download the full file here. SoFi is a different kind of finance company whose goal is to help people get their money right. Schedule a complimentary call with a SoFi Financial Planner to create a plan to pay down your debt and start investing in the future — an exclusive TFD offer!

Evaluating Your Current Loan Situation

- Are your loans private, public, or a combination of both?

- Are you currently taking advantage of federal student loan payment suspension and 0% interest that’s part of the COVID-19 relief package?

- What is your plan for the money you’re saving from suspended student loans? (emergency fund savings, investments, high-interest debt payoff, etc.)

- What is your current student debt commitment? List out each debt’s info, both before and after forbearance is planned to end on September 30. (You can find a template for this list here.)

Looking Beyond September 30

Federal student loan forbearance due to COVID-19 relief is temporary, and you don’t want to be caught off guard after October 1 hits. Here are some steps to prepare for your payments to resume:

- Check that all your contact information is updated on your StudentAid.gov profile and your lender’s website, so you don’t accidentally miss important information (or a payment!) about when your loan collection is resuming.

- Make a note of when your first resumed payment is due. You should receive notice at least 21 days ahead of time.

- Make a plan to redirect your funds. If you have automatic deposits currently set up with funds you’d otherwise be directing towards currently paused student loans, set a calendar reminder to make sure those are turned off before your payments resume.

- Reevaluate your repayment plan for your collective student loans. More info below!

Revisiting Your Repayment Strategy

While this is focused on student loan repayment, these strategies can be used for any type of debt repayment:

- Debt Avalanche: Focusing on your highest-interest debt first, so you pay the least overall.

- Pay as much as you can afford to each month towards your loan with the highest interest rate.

- Make minimum monthly payments towards all other debts until your highest-interest debt is paid off.

- Focus on debt with the next-highest interest rate next, while continuing to make minimum payments on other debts, and so on.

- You’ll save money on interest in the long run and reduce the overall amount you pay towards debt.

- Debt Snowball: Focusing on your smallest debt first, so you wipe out individual debts faster.

- Pay as much as you can afford to each month towards your lowest student loan debt.

- Make minimum monthly payments towards all other debts until your lowest debt is paid off.

- Focus on the next-lowest debt next while continuing to make minimum payments on other debts, and so on.

- You’ll wipe out debts faster, which can build momentum and help you stay motivated in your payoff journey. This does mean you’ll end up paying more in total towards your debt over time.

- Choosing your strategy: Which plan makes the most sense for you? Do you need to build debt payoff momentum, or are you trying to pay off your student loans as quickly as possible? There’s no right answer, but it will impact both your monthly payments now and the amount you could save in the future. (Refer to this student loan calculator to help give yourself a timeline.)

Final Considerations

- Forbearance: Find out everything you need to know about federal student loan suspension here.

- Refinancing: If you hold federal student loans, now may not be the time to refinance. But if your student loans are private, refinancing could save you lots in the future, or lower your current loan payment. Read more here.

Advisory services are offered through SoFi Wealth, LLC an SEC-registered Investment adviser.

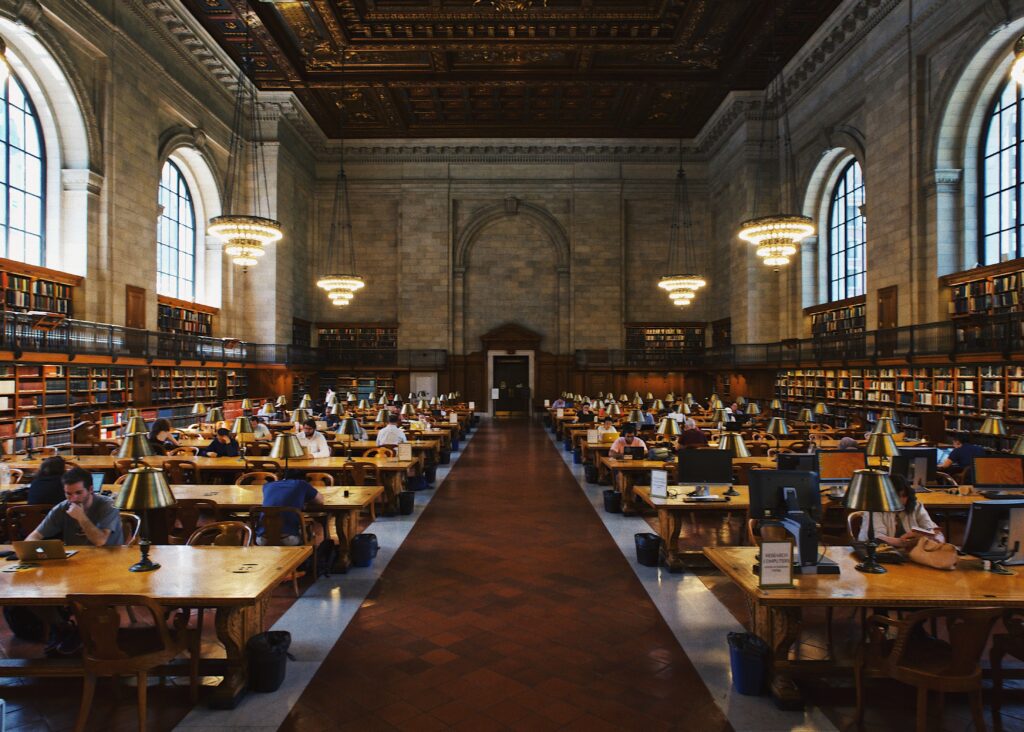

Image via Unsplash