Measuring Up: How I’m Balancing Saving Money With Living My Life

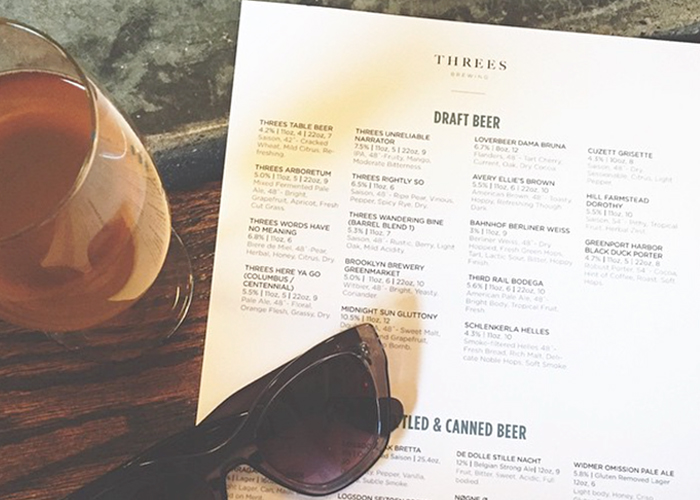

I came across this infographic the other day, and it got me thinking about whether I really put into practice what I set as my frugal aspirations. The verdict? I am not saving all that I could, but, I learned a lot about my financial values by going through the infographic above item by item. Seeing the information visually underscored the fact that I subconsciously make financial decisions that diminish my savings but accommodate a certain quality of life that I’ve deemed more important than money. The graphic helped me take into account the trade-offs you sacrifice when you over save.

Frugality is not just about saving every penny wherever possible; it’s about saving the pennies that matter, so you can have the freedom to live the life you want within your means. For example, I could save money if I didn’t go out and do something I really wanted, but I would be giving up a level of comfort and human connection by seeing my friends, which has a value that you can’t assign a dollar amount. While there are some things that (should) have no value in spending money on (i.e, smoking, duh), there are other expenses that have to be decided upon for each individual and are effected by different variables such as your profession, long-term goals, geographic location, household size, preferences, and taste.

Below is an example of my frugal self-evaluation and quality of life balancing act in action. When I evaluated myself against the content featured in the infographic, I discovered that the way in which I spend my money is correlated to one of three broad categories: no-brainers, debt management, and quality of life. Try measuring your own spending habits against what the info graphic illustrates — you might learn some interesting things about what frugality means to you. And as always (winks at camera), I’ve included some tips on how to be more frugal without sacrificing too much of your precious quality of life.

Items where it’s easy to save money.

Landline: The only way this is not a no-brainer is if you live in a location where cell service doesn’t work.

Washing in cold water: Washing in cold water saves $$$. Always do this except with linens, rags, and really gross yard/gym clothes. Make sure your detergent activates in cold-water (check the bottle).

Bottled water: In some cities (hello, West Virginia) there are good reasons to avoid tap water, otherwise, tap water is totally fine. If you find the taste not to your liking, you can improve it with a minimal expense by installing a filtration system under or on your faucet ($50 at the hardware store), or by using a Brita.

Cable: I’ve already got bunny ears and a bunch of streaming subscriptions (for free, because I either requested them as birthday presents or traded account information with my friends and family). The only time a person NEEDS cable is in two situations: 1) reliable and affordable home internet is not available where you live (which is common in rural America), or 2) you really love watching sports and watching at a bar is not an option.

Coffee: If you drink a cup of morning joe there is no excuse not brew your own at home. If you, like me, occasionally need to stop at a coffee shop to mix up your freelance/study routine, see if your favorite place has a rewards program (Starbucks has one on their app) or ask if they will potentially start one for you if you frequent the shop often. Always bring your own mug/reusable thermos, and see if they’ll give you a discount (it’s environmentally friendly too!).

Lunch: This is a no-brainer unless you have a job with good subsidized lunches/cafeterias. Once a week I’ll grab lunch with my co-workers (who never bring their lunch) to stay feeling connected, or I’ll grab lunch with friends who work nearby to get some much-needed socialization (not to mention an opportunity to gripe/gossip with one another). One way to still get the mental benefits of breaking for lunch while saving money is to bring your lunch and sit outside. Cities like DC and NYC have lots of parks in their business districts designed especially for this purpose. Since it’s 90 degrees May-September where I live, and there is no public space, eating lunch outside is not an option. I’ve accepted the fact that I will spend $8 once a week for my friendly griping sessions — hey, it’s cheaper than therapy.

How to save money by managing debt properly.

I don’t have a mortgage so the mortgage section on the infographic didn’t apply to me. However, if there’s one thing I know, paying the mortgage on time each month is essential. We’ll leave it at that.

Debt consolidation: How you handle your non-mortgage debt is going to depend on what kind of debt you have, how quickly you want to pay it off, and what your long-term savings and finance goals are. The general first rule of thumb is that you should pay down credit card debt with the highest interest rate first. Then, you should pay down other consumer debt (like car payments or payments for other tangible objects).

If you have educational debt try to consolidate it, and if you have federally funded loans, try to federally consolidate them first. If you cannot consolidate under the federal program, there are various private companies that allow you to consolidate and refinance, but be warned, it comes at a price. For me, that price was freedom/flexibility in my career. I knew that if I consolidated my federal loans with a private institution those loans would become private loans. As a result, I would no longer be eligible for public interest federal student loan forgiveness. Since my dream was to go to law school and do public interest work, I wanted to give myself the option of using federal loan forgiveness if I landed my dream job. But, when I ran the numbers through SoFi’s calculator (all legit consolidation/refinancing providers should allow you to do this for free), it turned out that my monthly payments and interest rates would not really change if I consolidated and refinanced through a private institution. After doing my research, I discovered that the decision to not consolidate my law school loans made more sense for me, and I was free to pursue my career as planned.

Areas where skimping doesn’t make sense for me personally, because my quality of life is impacted too greatly.

Having a car: Although I have tirelessly tried to avoid driving, not having a car just isn’t worth the savings. I live in a town with a minimal/unreliable public transportation system, and so I need my own car. I steadfastly refused to buy a car for three years while first living in this town, and I would bike the two miles (each way) to and from school in weather ranging from 20 degrees to 90 degrees. Whenever I would go to my internships or on interviews and could not be sweaty or have time to change, I would use the bus system. Although it was annoying because I was harassed by assholes in trucks, I liked the exercise and feeling of being hardcore committed to my political and environmental beliefs about transportation. But then I moved, and the bus route took me almost an hour each way (a car ride would take me a maximum of 20 minutes in heavy traffic). I ended up getting a car after I stacked up the effects of not having one with the benefits of having one. For me, owning a car was a no-brainer.

Electric: If you own your home, there’s a lot you can do to save money from things like optimizing your insulation and appliance usage to make your home more energy efficient. If you rent, you’re probably reliant on windows, an AC unit, and a thermostat (if you’re lucky enough to have one!), so use them sparingly. I manage fine with a thermostat that never goes below 75 during the summer or above 65 in winter. An added benefit of keeping your home slightly cooler during the winter is having another reason to ~cuddle~ under the blankets.

Dry cleaning: You can clean most dry-clean items yourself on a gentle cold cycle with woolite, and then air-dry them. I tried the Dryel at-home dry-cleaning kit, and it kind of sucked, so I had to bite the bullet and take coats and suits to the dry cleaner about once a season.

Gym: Before you sign up to run like a hamster on the treadmill wheel, see if you can bike or walk to work, run a few times a week, or use free-weights in your apartment. Working out at home kept my fat ass in check for years until I started at a desk job and began commuting by car. Now, I get zero cardio activity unless I get it from strenuous exercise. Since running is too hard on my knees to do daily, and I don’t really push myself doing YouTube HIIT videos in my living room, I needed to find an alternative solution. I ended up deciding that I needed a gym membership because I found swimming to be my new favorite exercise. Swimming is better for you than running because it works your body without the chance of impact injuries, and also really works your lungs by mixing up your aerobic breathing. However, for most of us, the only reliable swimming location is within the confines of a gym. So, when my health insurance offered a sweet $30 a month deal for the YMCA, I signed up immediately. I swim at least once a week, go to a HIIT-style class, and, when my schedule permits, I’ll do a weekly yoga and piyo class. The $30 I pay per month is worth it for the pool alone and, if I’m honest with myself, the group exercise classes are super beneficial because they really push me to do all the burpees I am too lazy to do at home.

Emma is an attorney who moved from NYC to Nashville for law school and decided to stay. She will never again live North of the Mason Dixon line or pay more than 1/3 of her salary in rent. Follow her blog or her Instagram.