How To Do Your Taxes (Even If You’re Terrified of Math and Money)

This post is brought to you by TurboTax, but all opinions and stories are my own.

If, like me, you feel like the first month of 2018 has flown by in a cold blur, you may not have realized we’re now in TAX SEASON (cue lightning bolt noise), which is why your accountant friend is pulling twelve-hour days at the office, and why that random one-day gig you thought you’d cut ties with is sliding into your inbox for your number(s).

And if, like me, you have a reflexive aversion to this news, you’re not alone. While there are those who seem to embrace logistical paperwork with the ease and confidence of a stock photo model typing on a pristine laptop, while biting into a macaroon, while laughing at an empty space in the foreground, I’m fairly sure most of us do not.

Maybe you feel you just need a little hand-holding. Or maybe you feel you need an entire team of nannies to hold you down to your desk and physically guide your hand into simply opening your own mail. Either way, we must be #blessed because it seems there’s never been a better time to be a paperwork-averse, math-phobic, or just generally a lazy person. There are so many resources for us out there now to do things the easy way. And for me, few of these have been as genuinely helpful as TurboTax. As someone who has had more than their fair share of gigs (including, but not limited to, barista, catering waiter, marketing professional, and circus host) it has been incredibly helpful to have an easy way to file. It was there for me when my understanding of taxes essentially began and ended with a Schoolhouse Rock! segment from the early 90s, and it was there when I got my first full-time management job.

At the risk of sounding glib, TurboTax at this point feels almost like an old friend–a chill, smart friend who I visit once a year so it can convince me not to leave town, change my name, and go off the grid just to avoid some simple forms.So we’re very excited to be partnering with TurboTax to bring you this intro to doing your taxes yourself, and to tell you a bit about a new product–TurboTax Live–which is a tax preparation experience that combines the user-friendly technology I’ve been using for years now with an extensive live virtual network of credentialed tax experts.

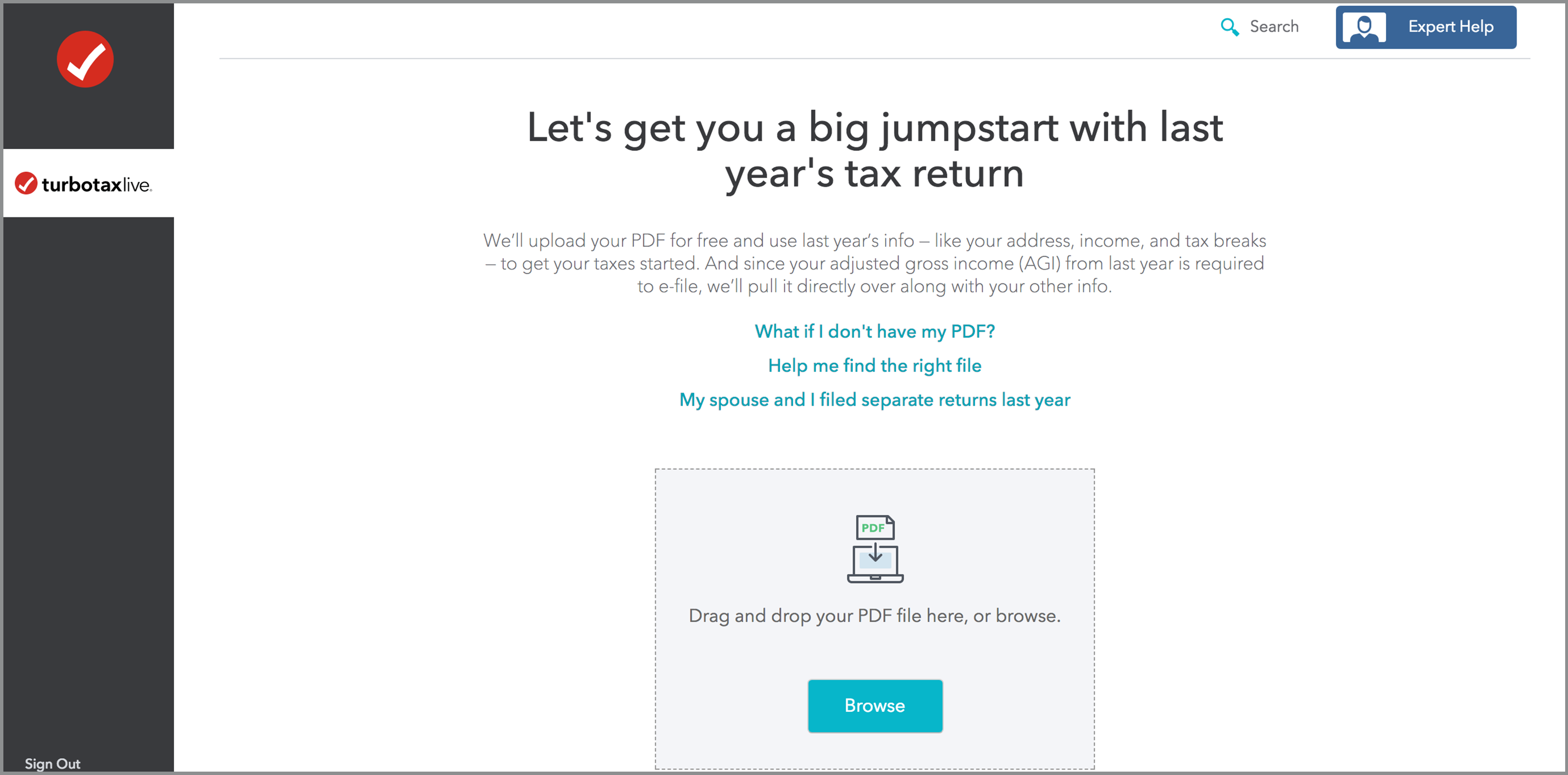

The first time I filed myself, I dreaded it so much that I recruited a couple friends to come over to my apartment for a “Taxes Party”. We sat around my tiny kitchen table on our laptops and tackled the task in sync over chips and leftover Valentine’s candy. While it was a fun (if somewhat weird) approach, the reality is that it turned out I didn’t really need the help or emotional support. TurboTax is honestly very easy to navigate, even for a relative Luddite. It guides you through the process with conversational language, asking simple questions about your past year like, “Did you have a baby?” or “Did you get a new job?” and then personalizes the experience to make sure you get all the deductions you can. And it’s very fast–the whole process has never taken me more than a few hours. I also got a nice refund so that helped motivate me to do it the next time around. (Apparently the average tax refund last year was close to $3,052, if you need motivation to get it done sooner…)

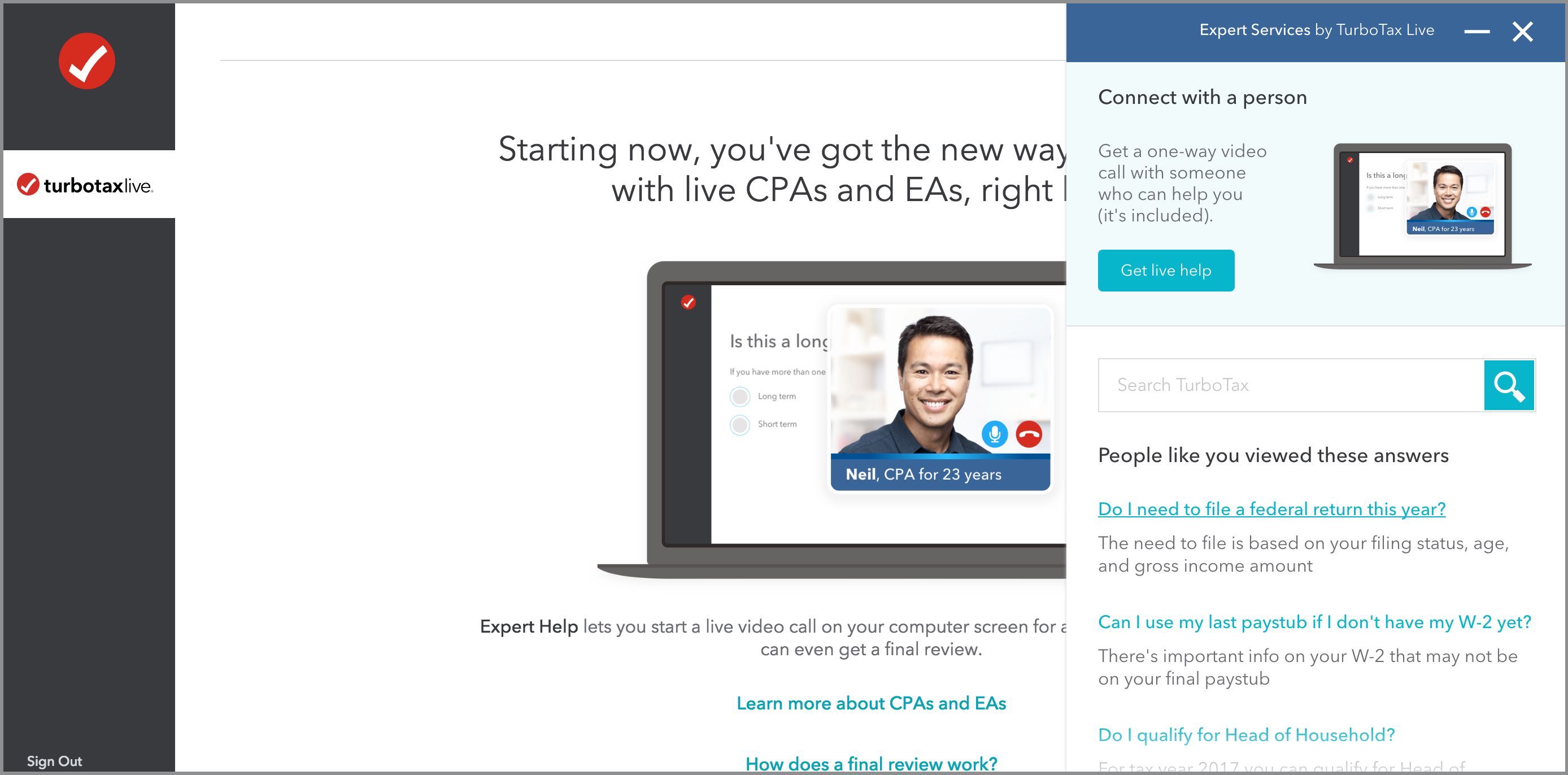

This year, my taxes are a bit more complicated. But I’ve found that with the various different levels offered I can adapt pretty easily. One nice new benefit from TurboTax Live is that you can connect to live expert help from a Certified Public Accountant (CPA), Enrolled Agent (EA) or Practicing Attorney, via one-way video technology. They can give you personalized tax advice and answers, and review your return so you know you’re getting the best outcome. If needed, the credentialed tax expert can even sign and file your return on your behalf. So rather than asking my equally clueless friends, I can now ask experts (!) which is very reassuring and helpful.

As I just recently created my own LLC and opened a bank account for it, next year I’ll be using another version of this service–TurboTax Self-Employed. For those of you who go that route this year, there are some new features such as a tool that helps you find deductions specific to your industry, and a free subscription to QuickBooks Self-Employed, which is a year-round financial management tool that lets you do automatic mileage tracking, expense categorization, and other forms of tracking, making tax time more simple.

Lastly, it’s worth noting that TurboTax has many helpful, up-to-date articles on common questions. If you’re feeling hesitant, I’d recommend looking over a few of these before you get started just to familiarize yourself with basic concepts. You can start with their Personal Tax Prep Checklist, get help deciding whether to use the standard deduction or itemize, and read about some common deductions you might not have thought about.

After that initial “Taxes Party,” I repeated the ritual one more year for good measure. But I can honestly say that the process just doesn’t freak me out that much anymore. I still might try to justify some indulgent snack to enjoy while filing, or recruit my partner/roommate to do it with me, but my new goal is to approach the process not purely as a chore but with a sense of pride and appreciation. Even if I didn’t get a refund, filing is a reminder that I can afford to contribute to the services and safety of my community. And as cheesy as that sounds, I really think that with the right frame of mind, even filing taxes can be a meaningful experience.

Check out TurboTax Live to get started on personalized tax assistance today.

Image via Unsplash