Exactly How I Tracked Every Dollar I Spent (And Earned) For 5 Years

When I graduated college, I had $60,000 in debt. My parents carried $25,000 of that debt in their name, plus $15,000 worth of their own consumer debt on various credit cards. Shortly after I started earning an income through the military, my parents got behind on their credit card payments and their interest rate was hiked up to 29%. One night, my mom finally had the courage to tell me that she had made some mistakes handling her consumer debt and could no longer contribute to my school loans as she’d originally intended. I told her to give me the account information for her credit cards, and I built spreadsheets to plan out how I would help pay off the cards and the remainder of my student loans. I was fresh out of engineering school, so I set it up like any engineer would; I wanted to collect all of my spending and earning information because I needed to understand how much debt I could afford to pay off each month, and what the long-term timeline would be.

The lessons I learned from my mom (both good and bad) pushed me to get an early start on tracking my spending. After I paid off her debts, I started making aggressive payments ($1800/month, which was 38% of my income) toward my student loans. In the last email my mom sent to me before she passed away, she reflected on her trying debt situation, and she encouraged me to keep up my habits so that I could pay off the remainder of my student loans in just a few more years. Little did she know, I was planning to surprise her just a month later by making my final payment on my student loans, but I, unfortunately, never got the opportunity to. It’s now years later, and I want to share my story with people who have similar financial burdens to the one I had after college. I started sharing my quirky spreadsheet rituals online. Some people were intimidated, but many were genuinely interested in learning more so they could get serious about improving their own spending habits. I love sharing my spreadsheets because, whether or not we like to admit it, money and personal finance play a very significant role in all of our lives. If I can help encourage people to discuss their finances, and be honest about the money coming in and out of their lives, then I see that as a valuable use of my time.

I’ve been tracking every penny I earned and spent for five years and it has made me incredibly aware of my finances. Tracking my spending habits forced me to confront my priorities and take a firm, honest look at myself to distinguish between what I want and what I need. I now know exactly how much money I’m willing to dedicate to hobbies, living comforts, and investments. I intuitively know when I need to dial my spending back. I’ve built an emergency fund, and know what spending habits I would need to tweak if something unexpected happened. This awareness gives me the confidence I need to enjoy my life without feeling guilty about spending when I need to, or feeling anxious about being unprepared for the future. I can comfortably turn down spending temptations because I have a clear view of my bigger financial picture. I can determine what spending is right for me using my own data, rather than having to rely on other people’s dogma. I can make better, more accurate predictions about what my future will realistically look like and improve my financial decision-making with that foresight, especially when planning for investments and big-ticket moments in life.

I made a tidy version of my budget for TFD and posted it on Imgur recently. It was the most viewed post of the day on Imgur, gathering over 10,000 upvotes and 500,000 views. I think this proves that people truly are interested in getting their finances in order, and the start of the new year is a great time to make saving or paying off debt (or both) a priority.

Here is a breakdown of my budgeting routine:

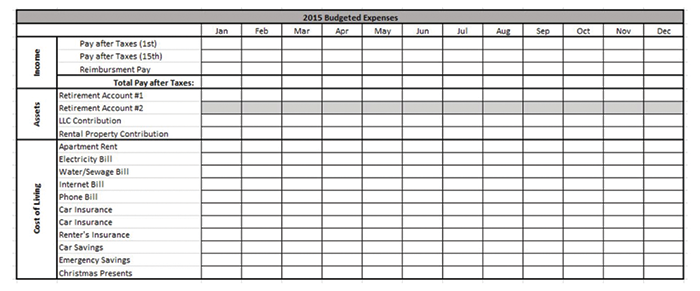

I print out this spreadsheet at the beginning of every year:

Every month, I populate the columns by figuring out three numbers: how much I earned (“income”), how much I invested (“assets”), and how much I paid for rent, utilities, and other bills (“cost of living”). I use this to extrapolate how much I can afford to spend (recreationally) in one month because I never spend more than I earn.

Here is the step-by-step process:

1. Write down how much cash you earned.

2. Write down how much debt you paid off. (I color this number red.)

3. Write down how much you contributed to your appreciating assets like retirement accounts, stocks, and other investments. (I color this green.)

4. Write down how much you paid for rent/mortgage, utilities, and bills. Then decide how much money to give yourself for expenses like savings account contributions, emergency fund contributions, gas, groceries, and other costs that you wouldn’t necessarily consider recreational spending. I put all of these numbers under “total cost of living.” (I color this blue.)

5. Subtract the red, green, and blue numbers from your total income. That’s how much money you have left in your account that you can spend on recreational activities if you so choose. (I color that number gold.)

When I have completed each month, I take all of the data and plug it into Excel. I use these Excel sheets to make “annual spending reports” for myself.

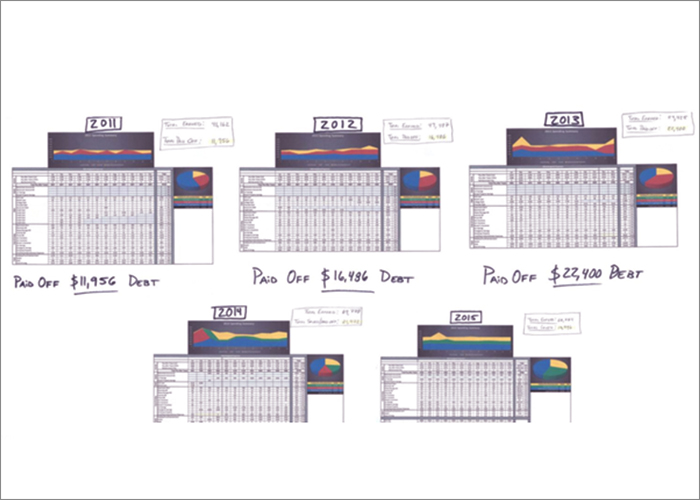

I treat my finances like a personal business. I make five-year progress reports to see how well I’m doing at paying off debt, saving, investing, and growing my net worth. I then use the data to predict a more accurate budget for the coming year. You can find those spreadsheets here.

I think this system makes things easier for me because my background is in military astronautical engineering. In the world of spacecraft, everything revolves around the philosophy that you can’t control what you can’t measure. And military missions, especially those dealing with rocket science, live and die based off their ability to gain situational awareness and set up effective feedback loops. From my perspective, tracking my personal spending is simply another feedback loop.

My experience since college has taught me that we need to think about this stuff more often than we realize. As a member of the military, my salary is set by congress and freely available to the public, so I have the unique advantage of being able to share this information comfortably and gain a reasonable understanding of how much my income will change decades into the future. But I also hope that my approach can help other people gain a better understanding of their larger financial picture.

Jason is currently a full-time graduate student. He has five years of financial & technical experience serving as a resource advisor, research engineer, and analyst for the US military.

Main image via Pixabay

Body images courtesy of Jason Lowery