5 Money Lessons I’ve Learned By Writing Down Every Purchase Since I Was 13

Growing up, I was always aware of money. It was always in the back of my mind. I grew up in a lower-class Asian family in Calgary and didn’t have the luxury of not knowing money existed. As a kid, I put toys back at the supermarket because I saw the price tag and didn’t want to ask my parents to buy it. Now that I’m older, I realize they probably would have bought me anything I wanted, but because I was so aware of money and its limitations, I never wanted to put it on them to do so. I guess that was pretty mature for a child who thought the world ended at the Rocky Mountains.

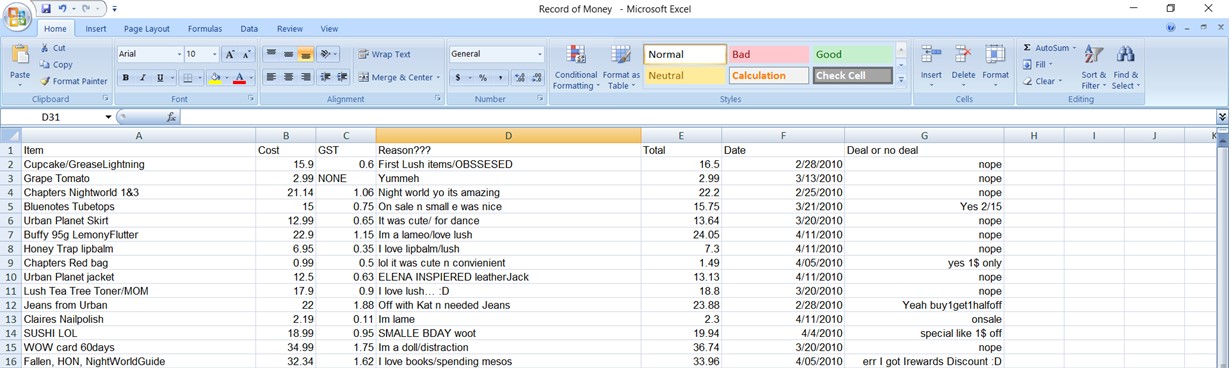

On February 28th, 2010, 13-year-old me, without knowing it, created something that would change my financial life forever. I created an Excel document called “Record of Money,” and I saved it onto my desktop. I just wanted a place where I could write down purchases so I wouldn’t forget about them. I wanted to be able to look back months later and remember that vanilla Frappuccino I bought with my best friend Kathy on the first day of school.

I treated my Record of Money like a virtual money diary to accompany my real diary so I could remember all the small memories of purchases throughout the years. I never thought that, 10 years later, that habit would turn me into a financially savvy 23-year-old who loves personal finance. And I learned some important money lessons along the way.

Lesson 1: Writing down what you buy makes you more money conscious, no matter what.

At 13, I didn’t know that tracking purchases was a popular tool financial experts recommended. I stumbled upon it myself. If I hadn’t started looking at my money from a young age, I wouldn’t feel as financially secure as I do now. Because I write it all down, I never feel lost in my finances. I know how to budget automatically because it’s so easy to see what goes in and out of my bank accounts.

I encourage you to start a little money document on your computer, even if you’re already great with money — but especially if you’re not. Begin by treating it like a fun money experiment and try to track every purchase for a month. The trick is in the act of writing things down. When you do this, you automatically bring your attention to it. This helps your brain digest what you bought, and if you also write down why you bought an item, then you can really evaluate your spending. Evaluating your purchases is powerful. It’s the one difference between an Excel document and your credit card statement. Even if it’s admitting, “I was bored and I wanted it,” it’s a valid reason to buy something. Now if that item appears again and again, and the reason is always boredom, you know that boredom is a spending trigger. When you see all of your spending in one place, you will be able to better understand your spending habits.

Try this: Write everything down for a month in a spreadsheet or some kind of trackable document and save it somewhere easily accessible on your computer. Begin your own Record of Money by writing down what you bought, how much it cost, the date of your purchase, if you got a deal on it, and most importantly — why you bought this thing. After a month you look at this little money journal, and I bet you’ll find yourself more money-conscious.

Here’s the beginning of my money journey:

Lesson 2: Your spending evolves as you evolve.

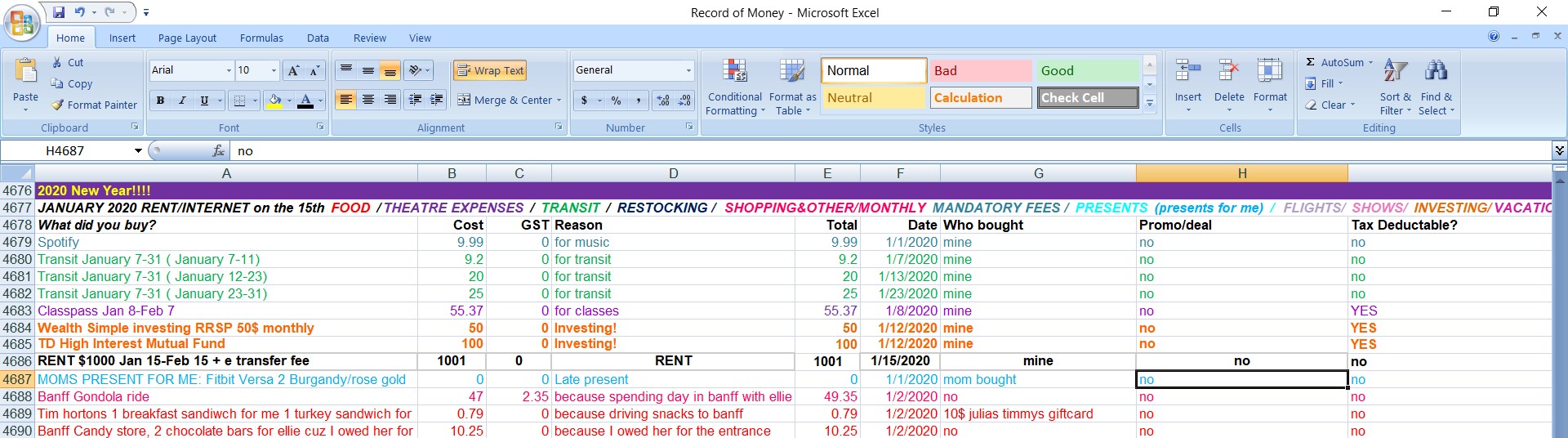

As I got older, my responsibilities and expenses changed, and so did my Record of Money. Gone were the days of frivolous Lush face masks and $2 lip glosses. When I moved out, rent was a new expense, along with tuition and business expenses — things my 13-year-old self didn’t even know existed.

My spreadsheet looks completely different today than it did 10 years ago. My items shifted from purely frivolous wants to include more necessities and recurring bills. I wanted to know exactly how much my recurring monthly expenses were, so I placed them at the top of the list each month and added the rest of my purchases underneath. I made my document work for me as I grew up and implemented a color system for different categories of spending and totals at the end of each month so I could glance at my screen and know exactly where my money was heading.

Try this: Customize your document with colors to categorize spending so you can look at a glance and know your biggest expenses. Keep any recurring costs at the top of your list so you know what to expect each month.

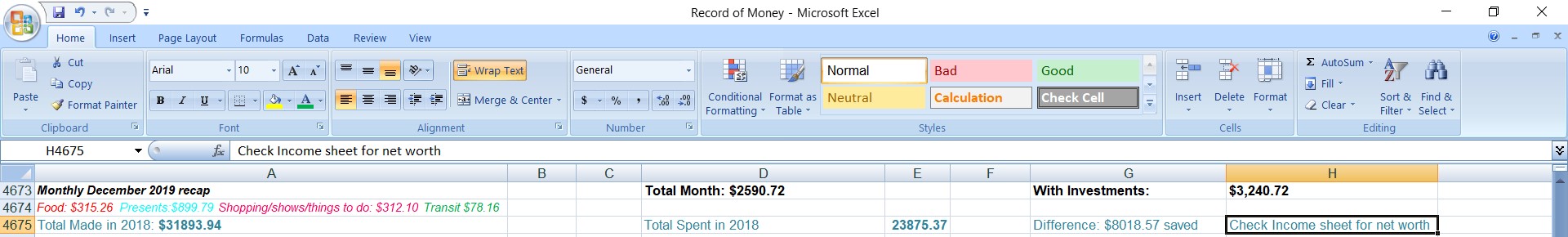

Lesson 3: Your end-of-month totals are so insightful.

Being able to look back month-to-month and see how much you’ve spent helps you actively work on your budget and decide what you actually need. At the end of every month, I have a few running totals that are helpful.

First, I have the overall amount I spent, then the amount I spent including my investments. Next is the total I’ve spent on food, shopping, shows, experiences, gifts, and transit. I like to keep tabs on how these categories go up and down, and if I have a particularly high food total for one month, I try to bring it down the next. Make a note of which months you spend a lot on gifts, then budget for those months in advance. For me, this is June and December because all my family and friends have birthdays in June, and December is Christmas. I also love tracking when I buy airline tickets because they’re around the same price year to year. Once you have this data about your spending, it makes your life super easy going forward — you can prepare for expenses you know are coming up and avoid going over budget or going into credit card debt.

Try this: At the end of each month, create a few categories for total amounts. If you have food purchases that are all in red, create a total category in red to match! Review your document monthly and highlight the totals of each red item you bought and add it to a grand total. Do this with all your categories so you know how much you spent in that category each month. Month after month and year after year, you can tally up what you’ve spent, and you’ll have a grand total for your lifetime! (If you’re fairly savvy in Excel, you can even create these categories as a color-coded dropdown list under Data > Validation)

Lesson 4: The more you pay attention to money, the less power it has over you.

You might be the type of person who doesn’t really pay attention to money. You might make a lot of money but find that it somehow all slips away. Or you might not make that much money and still feel like money controls you. I learned that the more I paid attention to money, the less power it had over me. Simply knowing how much I’m spending each month made my life so easy, because I knew when I wouldn’t be able to afford something. I didn’t just put everything on a credit card and try to forget about it.

If you view money as a chore, it becomes one. But if you work on it and turn it into a habit, then it becomes as easy as washing your hair. If your first month of tracking feels like too much work, know that getting good with money doesn’t come quick, but week after week it does get easier and less daunting. Even if you have a healthy income, knowing where your money is going will help you be better with it.

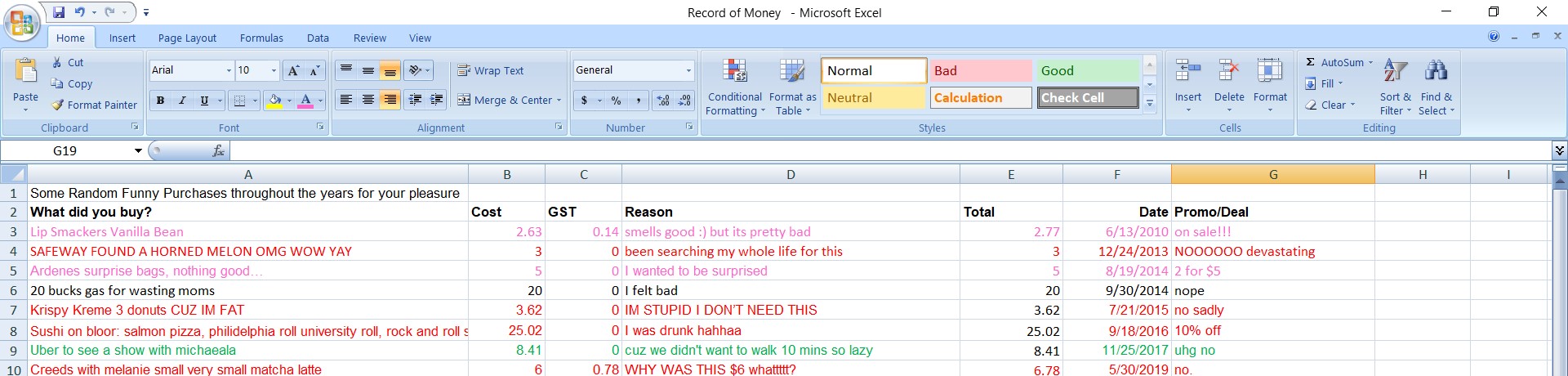

Try this: Find pleasure in taking care of your finances. Use your Record of Money as a journal, a place to reflect and reminisce on your life and what you bought, and use it as a tool to help you go further in your finances. Be honest with yourself and forgive yourself for your mistakes. Some fun purchases I forgot about over the years:

Lesson 5: It’s rewarding to look back on your journey.

After 10 years, I’ve created this helpful, and often hilarious, document about my childhood, my travels, my love life, my mistakes, and my accomplishments. It also has some money in it. In less than 10 minutes, I can pull up the grand total of what I’ve spent on my life in the past decade. If you’re curious, the last 10 years of spending is equal to only $147,670.07!

On the one hand, this number feels huge. But it also feels quite small in the bigger financial picture. I don’t consider myself poor, but I also don’t consider myself rich. I make around $30,000, and I live a pretty damn good life. Seeing all of my spending laid out in this way puts a lot of things in perspective. It makes me aware of the privilege I had growing up, but it also motivates me to do better and continue upgrading my life. Now, and for the next 10 years, my goals are to continue what I’m already doing and upgrade my earning potential. I might not make that much now, but at least I can say I am master of my own money.

Samantha is an actress, singer, and dancer living her best life in Toronto, Canada. You can follow her on Instagram.

Image via Pexels

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.