5 Money Professionals On The One Resource Everyone Should Know About

Everyone needs to start somewhere when it comes to money, and until recently, my starting point was “doesn’t even know what an IRA is, or what my credit report looks like.” Yes, that’s embarrassing, but only by being open can we ever hope to improve. And while there are obviously many channels out there to learn and inform yourself about finance, the sheer quantity of (often-conflicting) information can be overwhelming. Where do you even start?

To get a better idea of the kind of resources we should all be using to improve our financial lives, I spoke to five money professionals about the one resource they swear by. Sometimes it’s a website, sometimes it’s a book, but it’s always something that provides a fundamental understanding of where you stand, and how to get better.

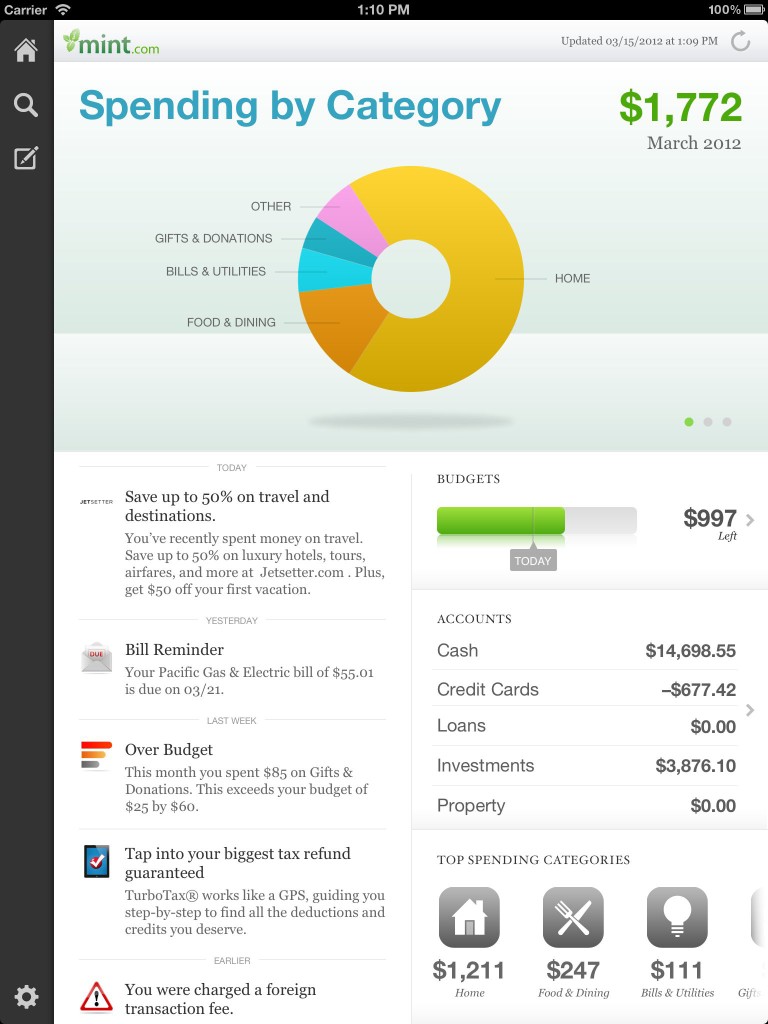

1. Mint

“It really depends on where you are, but if you are a total beginner, your immediate focus should be on getting your budget under control and understanding what you spend. You should have a savings and checking account, ideally an investment account, and at least one credit card that you use and pay religiously every month for credit building. And you should know them very well.

“Apps like Mint will help you follow all of these things at once, and see how they interact in detail. I have three kids who are all in their teens and up, and they all use it to track their earnings from their jobs and save for college. It doesn’t matter if you don’t have much money, you always need to see where it’s going or you’ll never be able to start saving.” -Ann, Personal Banker

“I would recommend this book to anyone who is looking to invest, or who wants to just understand the fundamentals of the landscape. Many people feel really overwhelmed by investing, because they think that it is something only professionals can understand, or that they don’t have enough money to participate. This book makes it feel more easy and manageable. It’s the ultimate resource on the subject.” – Les, Portfolio Manager

3. The Wall Street Journal and Planet Money

“When i was at [my bank], i used to read all the Wall Street Journal front page stories every day, for wider context, so i understood why things were happening. I also really like the Planet Money podcast on NPR.” -Erin, former Financial Advisor

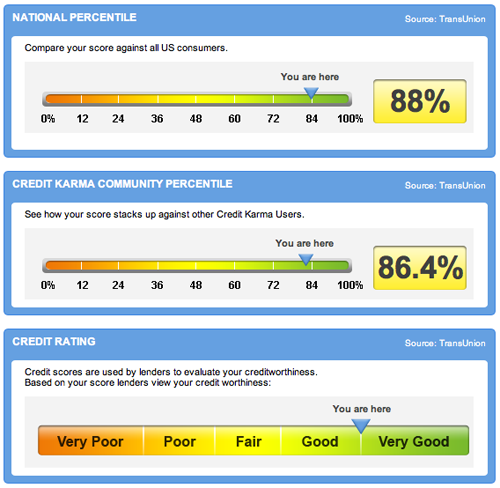

4. Credit Karma

“Knowing, owning, and improving your credit rating is one of the most important elements of personal financial literacy. Credit Karma is a free and easy way to get to know everything about your score, and to start to improve it. Credit involves a mix of things that you can negotiate or change, and things that you can’t, but it is always better to understand so you know what you can do. Sometimes it’s paying off an old debt you forgot about, sometimes it’s getting a higher-limit card so you can spend a lower percentage of it, it can really vary widely. But you have to know it, and do something about it.” -Sara, Accountant

5. The Money Book for the Young, Fabulous & Broke

“I gave this book to my daughter when she was in her twenties and had her first salary, but no idea what to do with it. (If I’m being honest she was spending a lot, too, but at the very least she didn’t have credit card debt.)

“It’s a very smart, easy-to-follow book for young people who maybe spend too much, and don’t know anything about investing or the financial world, but who want to get better at it. I know that a lot of people (especially young people) think of Suze Orman as that woman who yells at you about savings accounts on TV, but she really has a lot of smart, good advice. I would recommend this book to anyone who wants to make the most of their twenties, financially speaking.” -Michael, Finance & Business Journalist

Feel like you’ll never save enough money to be a real person? So did Steph Georgopulos. Read about it in Some Things I Did for Money.

Image via Unsplash