5 Things You Should Know About Home-Buying (But No One Tells You)

This post was brought to you by Lennox. Innovation never felt so good. Contact your local Lennox dealer today to learn more about the precise and efficient HVAC products Lennox offers.

This post was brought to you by Lennox. Innovation never felt so good. Contact your local Lennox dealer today to learn more about the precise and efficient HVAC products Lennox offers.

One of the things we are most frequently asked about here at TFD is — in some form or another — how to buy one’s first home. It’s one of those things that feels at once like an inevitability of “real” adulthood, and like something we’ll never be able to have ourselves, particularly if we are weighed down with a lot of student debt. But one thing we have learned in running TFD these past few years is that home-buying, like almost any other financial hurdle, is something we can all have access to if we plan for it in the right way. It may not be the right choice for everyone, but there is almost no situation in which it’s totally out-of-reach. And the rumors are true: generally speaking, owning a home is a really good thing for your long-term finances, and buying one in your 20s is a great way to ensure that the investment has a long time to mature.

All that said, there is a whole lot of conflicting information out there, and more importantly, a lot of things that everyone should know but which very few people will ever tell you. Home-buying is such a life-changing event that can vary so widely for the individual, and it can often feel like the most difficult part is knowing which are the right questions to ask. So, in partnership with Lennox, who provides efficiency, control, and (cool) comfort with the most valued and innovative appliances in our homes, we have decided to bring you five things we have learned about buying a home that no one is likely to tell you about.

It’s not an exhaustive list, but it’s a good way to make the process a lot more understandable — even to the total beginner.

1. You can put down less than 20%, but it comes with asterisks.

Chances are, you are going to have to borrow some money to buy your home, which means you will have to provide a down payment in order to secure the loan. But don’t let that whole “down payment” thing cloud your mind and make like you can’t afford to do it — it doesn’t have to be the mythical 20% you’ve heard so much about. In fact, you can buy a home for as little as 3.5% down (!!).

However, if you put less than 20% down, you’ll have to pay Private Mortgage Insurance, or PMI. As TFD contributor Britt and the Benjamins recently put it, “Until you have 20% equity in your home, you will have to pay 1-2% of your home’s value annually (split into monthly payments) in what they call “private mortgage insurance.” Basically, this insurance protects the bank in the event that you can’t pay your loan back, and it is an expense that can easily pile up, but this calculator is an easy way to see how much you can expect to pay in PMI based on the kind of loan you’re getting and the money you can put down. So short answer, yes, home loans are available to people who can’t put the full 20% down, but the longer answer is, like anything else, there is always a cost for that benefit.

2. Home inspections are serious (and they’re not free).

Before working at TFD and reading a metric crap-ton of information about buying a home, I really didn’t know much of anything about home inspections (least of all, the fact that they aren’t free). A home inspection can run you up to $500 — and you might even pay that and not even buy the home afterward! It’s extremely important to you as the buyer — everything from the plumbing, to the electricity, window treatments, floors, foundation, insects, to the potential mold need to be checked — and is your big chance to catch any detail that might need repairing before you sign. Everything from plumbing to foundation to HVAC systems need to be inspected and accounted for, and regulations for heating and cooling can vary depending on where you live, which means you can be in the dark about how your HVAC is truly functioning. A total home inspection checklist can be found here.

3. Heating and cooling your home can be very expensive (if you don’t do it right).

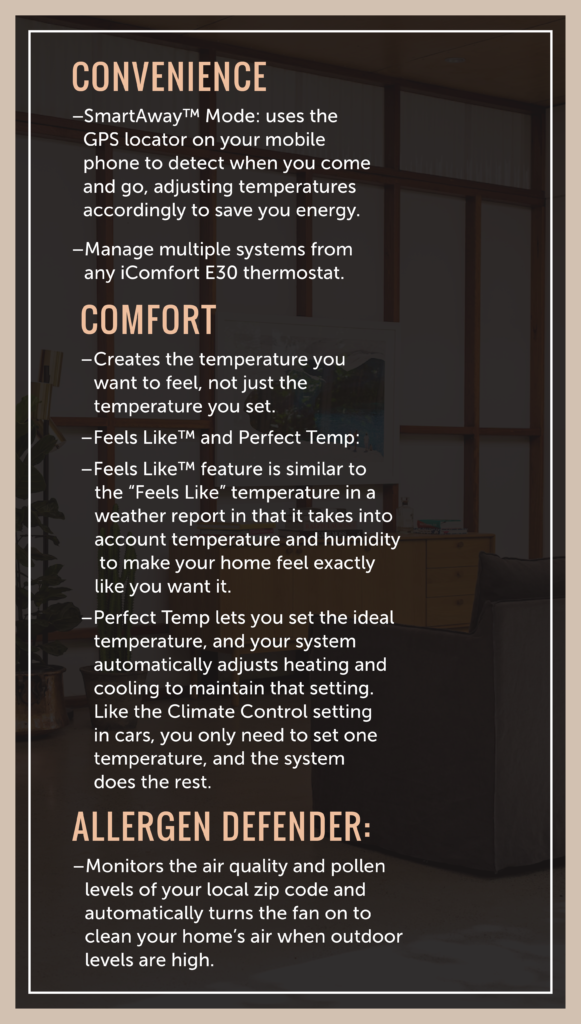

Along with the amount of electricity and water we tend to waste in our homes (admit it, you are guilty of leaving the faucet running while you brush your teeth, too), how you control the air in your home is going to be a big part of the day-to-day costs. You tend not to think about it when looking at a home, but something as simple as “how much light, and from what direction, each room gets” can be the difference of hundreds or even thousands of dollars each year in temperature-maintenance costs. (Take it from me, someone with an office full of big, south-facing windows that feels like the surface of the sun if not well-air conditioned). And no matter how your house is set up when it comes to heat and light, you should always be investing in the tools to keep your home comfortable while saving thousands of dollars in utilities, like the Lennox iComfort E30 Smart Thermostat. Just some of the stuff it will do for you:

4. You shouldn’t buy for the life you have today.

Whether you’re working with a broker in selecting your first place, or binge-watching 10 episodes of House Hunters while eating cookies (not like I’ve ever done that or anything…), chances are, you are used to home-buying being discussed in terms of what you need at the time. It’s rare to push ourselves to think of who we will be, what we’ll want, and what our day-to-day lives will look like a decade down the road, but that is incredibly important when it comes to buying a home. And while the things that make our heart swoon today can feel difficult to ignore (bay windows!), the things we’ll want eventually (a good home office for when I finally go freelance!) are what is ultimately the most important choice. Forcing yourself to look at the home in terms of who you will grow into, and ignore what you are attracted to in the moment, are key. (Yeah, today a school district might not matter to you, but what about in five years?) A good way to approach this is to give your list of Future Self requirements and hand them to a neutral party, like a parent or friend, who can accompany you on some home visits, and help act as the (relatively)-objective Future You when making a decision. Their heart won’t swoon over that temporary benefit the way yours will, and they can help push you towards the things you know are better in the long-term.

5. It’s up to you to notice every detail.

Long story short, once you agree to buying a home, you agree to everything basically as-is. It’s up to you to notice everything from air quality, to cell phone service, to whether or not the freaking ceiling is collapsing. And yes, a lot of that is going to happen in the home inspection as I’ve mentioned above, but there are a ton of tiny details that you may not notice that you will then be on the hook for. Take it from TFD reader Cara — who prefers to not use her real name — who found herself in a mountain of legal trouble after buying a house with a serious (and unnoticed) problem:

“About a year ago, my husband and I signed on our first house after going through what we thought was every detail. It turns out, we didn’t notice that there was a serious problem in the basement that had been hastily covered up — water damage that was causing the foundation to be unstable, needing over $20,000 in repairs — that we were now responsible for. My husband and I ended up taking these people to court, and as they owned the home through a shell company, the process was even more complicated than it would have otherwise would have been. We are likely going to get them to pay for it, but not after we spend nearly as much in legal fees and lose months (if not years) of our life in court about it. We were so naive, and thought that an intentional lie like that would not be our responsibility. We were wrong.”

Buying a home can be a pretty intimidating thing, and as we can now see, lead to serious problems. But it can also be one of the best investments of your young life, if you plan correctly, know what you need, and ask the right questions. Everything from the energy you use to the floors you’re walking on make up the investment that is your home, and the first step is knowing exactly what you’re getting into.