6 Things You Didn’t Know Were Ruining Your Credit

When I first started my financial journey, I didn’t know that much about credit, so it came as a bit of a surprise when my credit score came back so high. It wasn’t until after I learned more about personal finance that I understood how a credit score works that I realized why. A credit score is based on your financial habits and how credit bureaus interpreted that data. So while I never obsessed over my credit score, working on having good financial habits resulted in a high score.

Although I didn’t have a full financial education from my parents at the very beginning, I had resources that instilled good financial habits. Now that I’ve learned how a credit score works, maintaining a high score is actually quite easy no matter what my financial situation (I will get more into that later on!).

However, there is a lot of confusing advice out there that actually ruins your credit and at the end of the day it comes down to your financial habits and how it’s interpreted.

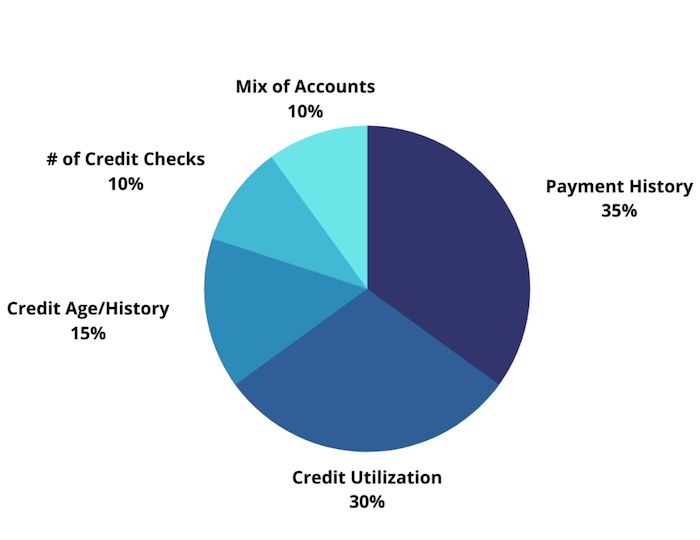

Before we start, let’s talk about the factors that determine your credit score. According to Credit.com and Equifax, your credit score is determined by:

- 35% – Payment History

- 30% – Credit Utilization

- 15% – Credit Age/History

- 10% – Number of Credit Checks

- 10% – Mix of Accounts.

It’s important to note that the two biggest categories that impact your credit score are payment history and credit utilization. While the other categories are important and should be considered, at the end of the day, these categories have the largest impact.

1. Fear Of Credit Reports

A lot of people don’t check their credit at all because they are afraid that it will affect their score, but there’s a difference between hard and soft checks. Performing a soft credit check does not affect your credit score and is a good resource for understanding where you stand. It also allows you to detect identity fraud and catch mistakes. A hard check is like when your bank checks your score for a loan, and soft checks can be conducted through free online tools like Credit Karma.

The additional consequence of not checking your credit report is not being able to catch mistakes. In a nightmare situation, my friend’s bank messed up her mortgage payment and she ended up missing two installments. This mistake by the bank tanked her credit score. While you can call and provide documentation to the credit bureau for a correction, it can be a very frustrating process. It’s easier to prevent credit mistakes from happening than correcting them afterward. It can be dangerous to constantly rely on others in order to keep your credit situation in check.

2. Canceling Old Credit Cards

When you embark on your financial journey, it is tempting to want to start with a clean slate by canceling old credit cards. What you may not know is that this will hurt you because it erases your credit history. I haven’t used one of my credit cards for about five years, but I still keep it active because it was my first card at sixteen years old. Credit history doesn’t have a huge impact on your score, but it still counts. And not canceling your oldest card is easy; you literally don’t have to do anything.

3. Accepting Promotional Balance Transfers Without A Plan

Banks and credit card companies are businesses. And during times of economic uncertainty, it can be easy to get sucked into the promotional interest rates out there without reading the fine print. Specifically, what the interest rate and terms will be after the promotional period.

Oftentimes, these low or zero interest rates are only for a short period of time and then the rate skyrockets. And while it can be tempting to say “oh I have 6 months of 0% interest!,” if you don’t actually calculate the monthly payments, then it’s not actually benefiting you and could possibly put you in a worse situation. Usually, you are able to negotiate interest rates with your credit company due to your history with them. However, if you open a new card to do a balance transfer, you have no rapport with them and they are less likely to help you.

Balance transfers can be super beneficial if you have a plan to pay them off. However, you can end up with a higher interest rate than your original credit card. Or you can end up spending more because you underestimate the amount of money you “save” by transferring your balance by forgetting about it. Balance transfers can be helpful, but they don’t make the problem go away that much.

4. Not Having an Emergency Fund

Accidents will happen. There will be many unexpected events in your life that you won’t be able to predict or control (re: COVID) which is why it is crucial to have an emergency fund. In the event that you lose your source of income, the emergency fund will allow you to continue paying your bills such that your credit score.

5. Accepting Credit When You Can’t Manage It

While it doesn’t seem like it, someone is making money off of your credit score. It can seem like a “nice” thing to do to give you more credit, especially when it’s for a tangible item like increased loans for school, a mortgage or a car.

However, there is a big difference between accepting credit you can control (like credit cards) and credit that locks you into monthly payments. When I bought my apartment, I did not utilize all the pre-approved credit my bank gave me. Not because I couldn’t “afford” it but because I couldn’t afford it according to the bank’s analysis of my assets and the lifestyle I want to live.

Accepting credit with fixed payments you can’t handle can drive fixed expenses up. It can be hard to juggle a student loan, a car loan, and mortgage all at the same time and any missed payment can have a huge impact on your credit score. It is so easy to rely on the financial advice out there that really tries to speed up the process of growing up so make sure you are taking on credit that you can handle.

All bills count toward your credit score. So even small things like a few missed Netflix payments or a water bill can have a large impact on your credit especially if it goes to collections. And while you cancel certain things like Netflix or a subscription box to avoid a missed payment, fixed payments like mortgages and utility bills are not easy to escape.

6. Not Accepting Credit When You Can Manage It

On the flip side, there are consequences to not accepting credit. When I got my first credit card, there was fear-mongering around accepting credit, justifiably so because of the 2008 financial crash.. I used to only have one credit card that had a balance of $1000 dollars. When my credit card company card would call to see if I wanted to increase my limit I always declined because I was taught that having a lot of credit was a bad thing.

One day, a bank teller explained to me why increasing your limit is good. If you are able to accept the increased limit and still pay off your balance, it shows the bank that you are responsible and they will be more willing to loan you money later down the road for things like a car or home.

After learning more about personal finance, I understood why increasing my limit (while utilizing the same amount) is a good thing. I now have over 30K worth of credit over my 3 credit cards, and I only use about 3% of it every month. And that’s not because I have low or no expenses, I actually use my credit card for everything humanly possible. However, because my payments are always on time and my credit utilization is so low, I always maintain a high credit score no matter what the rest of my financial situation looks like.

One of the things I learned extremely early on my financial journey was to concentrate on living within my means and learning to understand my emotional/impulsive purchases instead of always feeling shamed in my habits. I used to reflect on every purchase and how it made me feel through my budget template and now I have developed the conscious self-control and financial habits to never spend outside my means.

***

Lastly, one of the biggest things that can ruin your credit in the long run is not changing your strategies as you learn and develop your financial habits. The rules that served you well at the beginning can change as you can grow in your credit journey. It’s not like I’ve never made mistakes before — I’ve had a bill go to collections, I’ve opened and cancelled a credit card I didn’t need, and I used to refuse credit. I’ve since learned from those experiences and developed self-trust as I’ve become a lot better with my money. Now, I can leverage my good financial habits and have a credit score of over 860 (I’m Canadian so our credit scores go up to 900). I’m a firm believer that your financial strategies can and should change as you learn and grow.

Kimberly is a Career Confidence Coach and the founder of worklifemoney.co, a platform for women to develop the personal growth skills to meaningfully make and manage their money to create work life balance. She is also the host of Money In Integrity, a weekly podcast that takes women beyond the tips and tricks of career advice and deep dives into the self-doubt, impostor syndrome and perfectionist habits that hold high-achievers back. When she’s not working, coaching, or podcasting, you’ll find her cooking and watching reruns of food competitions. Her biggest non-career related dream (because she fully believes we are more than our careers!) is to compete on the Food Network.

Image via Unsplash