7 Necessary Things I’m Doing Differently With Money This Year

1. Actually investing. It’s high time that I start treating my money as a living, breathing thing, instead of just a lump that I get a weird, immature pleasure from hoarding in one account so it can be the highest single number possible. (This is especially idiotic, considering the fact that I have Mint, which actually lumps all your accounts altogether into one number anyway.) I have to finish saving my emergency fund first (which I’m counting as not just my bills, but Marc’s portion of them as well, which is significantly more than mine, because I want to be able to take care of everything if something happened to either one of us), but once that’s done, my next stop is investment. I’m going to start small, mutual funds and perhaps one little “fun” investment in a small company I want to support, but this is my year to make it happen. 27 feels like the right time, and when it comes to investing, better late than never.

2. Taking Uber off my phone. I know I have to do this, it just feels painful to admit. But having that Devil App on my phone at all times means that, whenever I’m feeling lazy or sad or cold or tired or full of shopping bags, I can just press a button and get a magical carriage ride home. But that carriage ride is not free, and I should be saving the money I spend on Ubers, which, if I’m being totally honest, was definitely into the four figures this year (including ones I shared with people/Marc). Yes, I know, you can commence throwing rotten tomatoes at me while hissing. But I’m getting better! Now, if I want an Uber, I have to download the whole ding dang app to get it. And that’ll dissuade me from a lot of unnecessary Ubers.

3. Starting my taxes very, very early. Three years in a row, I’ve had to file for an extension and do it at the absolute last minute, all the way in fall. (This is even with an accountant doing them for me!! I am pathologically lazy!!) But this year I am starting in January, and forcing myself to finish that shit on time once and for all, even though, in all fairness to me, my taxes are hella complicated from all my LLCs and contracts and clients. But still.

4. A 30-Day restaurant challenge. All I have to do is get to a 30-day stretch that does not involve weddings/travel/bachelorette parties/whatever, and I can challenge myself to eat every single meal at home for 30 days. I may even be wrangling Lauren and Maya to do this with me, so we can all document it together — good, bad, and ugly. Even if I have to do it alone, though, I really need to hold myself accountable for how easily I let myself “pop in” for meals at restaurants, or “treat myself” to a special meal (that happens way too frequently to actually count as special). If nothing else, it will be important to see how much money I can save in a month of simply forcing myself to cook everything I eat.

5. Making mini-decor changes for seasons, instead of total overhauls. I used to think that every change of season was an excuse to go bananas on Amazon, buying all new decor for my apartment so that I felt ~totally refreshed~. But this is ridiculous, and a huge waste of money, so I’ve already planned my spring strategy: change out really simple things, like throw pillowcases, fake flowers, the magazine cutouts I currently have in frames, books I have on display, etc. Since most of my palate is now #NeutralLife, with a few accents (currently red), all I have to do is change out those accents and it’s a totally different season.

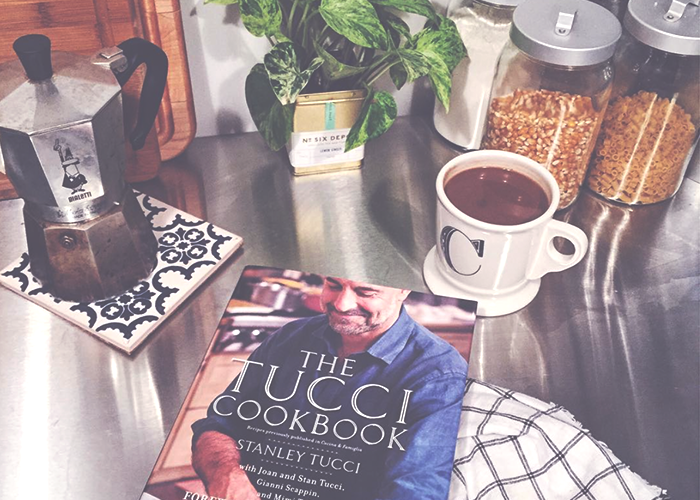

6. Strategically earning more for things, instead of dipping into savings. If I want special, expensive things (like a red oval 9.5 quart Le Creuset dutch oven GODDAMNIT), I’m going to start a fund specifically for that, instead of breaking and yet again dipping into what should be my growing emergency fund. I will take on extra jobs that are specifically for that fund, and in doing them, will be absolutely sure that this thing is worth my time and effort. I can even start a little cash box labeled “Creuset” or whatever, if that really helps me mentally. Whatever enables me to not just dig into savings because I ~have to have it~. (And also, like any savvy home chef, I will wait until the exact one I want is at the TJ Maxx/Marshalls on the UWS that always has a good selection, so that I can get it for half the price, because under no circumstances paying $450 for a fucking pot.)

7. Investing in my creative life. It started today with my birthday gift to myself, a subscription to Bon Appetit magazine. But I’m also giving myself permission this year to put a small amount of my monthly income back into things that enrich my creative and artistic life. It may not end up making me money back (thought it very well could!), but I fundamentally disagree with the idea that all investments have to have a direct money reward. I feel my quality of life go up markedly every time I spend on something that makes me more creative and thoughtful, and that is more than enough for me.