9 Things Every Recent College Grad Should Do Immediately Before Entering The “Real World”

This is a sponsored post written by me on behalf of Sallie Mae Cash Back Credit Cards for IZEA Worldwide. All opinions are 100% mine.

In some ways, being an adult is awesome. School nights are for staying up way past “bedtime” and eating dessert before dinner if that’s what you want. But in other ways, it can be much harder than it sounds. You have to hold down a job, pay your bills on time, and learn how to balance planning for the future while having fun in the present. The real world doesn’t come with a textbook, like biology 101 does, but luckily, some good advice can help keep you on track. Besides tossing your tasseled cap into the air for that perfect Instagram graduation picture, there are a few key things that every recent college graduate should do before entering the real world.

That’s why we’ve partnered with Sallie Mae Credit Cards to bring you this one-stop-shop list of resources for getting your adult life together. From getting your finances under control to harnessing the skills you developed living that student lifestyle, check these nine items off your list before you step off-campus.

1. Understand your student loans.

If you’re still in school, right before graduation, sit down with your financial aid office to understand your student loans. Some schools actually require you do this before graduation. It may feel overwhelming, but it’s a great way to get a very clear understanding of how much money you owe, to which lenders, and how long it will potentially take to pay it off.

If your school doesn’t offer this kind of one-on-one counseling, make a date with a family member or trusted friend who can help you walk through the fine print and understand your loans. Figure out how long you have before you need to start making payments and what the requirements are for a deferment. Knowledge is power and putting your head in the sand will not make your loans go away.

2. Start establishing your credit.

If you’re getting ready to enter the real world, you probably don’t have much credit history. That’s totally okay — we all have to start somewhere. Take advantage of being young and start establishing your credit now. In 10 years, when you want to get a mortgage or negotiate better car insurance rates, your future self will thank you.

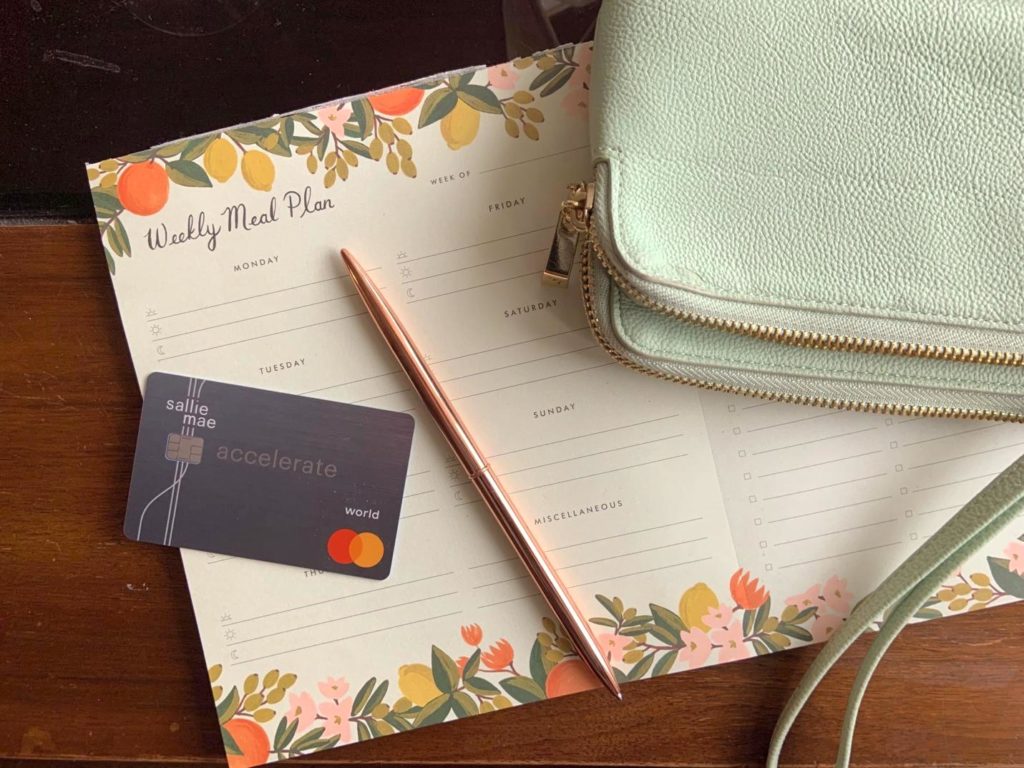

One of the simplest ways to start building credit history is by opening up a credit card and using it responsibly. If you qualify, choose a card that has some benefits, like the Sallie Mae Accelerate℠, which gives you 1.25% cash back on all purchases, and a 25% bonus on your cash back rewards to help pay down student loans. Find a card that works for you and treat it responsibly. Start establishing your credit before entering the real world, and you’ll really be ahead of the game.

3. Figure out a budget.

Along those same lines, figure out a workable budget for yourself so you can cover rent, make your loan payment, and pay off your credit card balance in full each month — which can, in turn, help boost your credit score. Even if your monthly income is going to be super tight, following a budget will help you gain control over your finances during a major transitional period in your life. Whether you use a smartphone app or just the old-fashioned envelope method, figuring out a budget where you know how much money you have to spend in each basic category will help you head into the real world fully prepared.

4. Make some new goals.

Graduating from college is a huge accomplishment, so now that you’re crossing that off your list, think about the future. What do you want to do with your life? It’s all about continuing the momentum, so as you celebrate finishing school brainstorm what other goals you want to work on. These can be a mix of financial and non-financial goals, like paying off your loans in five years and running a marathon in the next 12 months. They can also be a mix of short- and long-term goals, so nothing is too big or small for your list. Whatever ideas have been floating around in your head for the past four years, put them on paper and outline a plan to make them happen.

5. Build an emergency fund.

If you don’t already have an emergency fund, start one now. Did you get cash for graduation? Earmark at least some of it for your emergency fund. Say you’re able to sock away some graduation money into a savings account, and a few months later your car window stops working during the rainiest September ever. Since you saved some of that money, you’re able to pay for the replacement on the spot. This is way better than plan B, AKA driving around with a garbage bag taped to the driver’s side door until you have enough for the repair fee.

Even if it’s just $25 for your textbooks at the end of the semester, start an emergency fund and add a little to it every chance you get. You never know when you’re going to need it.

6. Understand that education doesn’t end at graduation.

While it’s true that you won’t get a grade for the work you do, it’s important to realize that your education isn’t over just because you’ve graduated. In fact, in some ways, it’s just now starting. At your first full-time job, there’s a good chance that everyone there is going to be more experienced than you. Instead of letting this be intimidating, think of it as an opportunity to learn new things about your workplace, your industry in general, and how people succeed in your field. Ask questions, be proactive in scheduling meetings or getting training, and go the extra mile to gain valuable knowledge from your coworkers and supervisor.

If you don’t have a job nailed down yet, schedule some informational interviews with potential employers and explore other networking opportunities. By working hard and showing that you are eager and motivated, you will set yourself apart from the other recent graduates and make yourself stand out as you build your career.

7. Open a retirement account.

Even though retirement probably seems unfathomably far away, begin contributing to your retirement now. If you’re graduating with a job and have an employer-sponsored account, take full advantage of any match that they offer. It’s free money! If that’s not an option for you, there are plenty of individual retirement account options out there that you can open and contribute to on your own, without an employer. Don’t wait until you’re earning more money or have vanquished your student loans. Use compound interest to your advantage and start building your retirement savings now.

8. Continue to live like a student.

Instead of leaving it behind, take advantage of being young and embrace the broke student lifestyle for as long as you can. Don’t waste money trying to keep up with friends who get high-paying, flashy jobs and buy the fancy wardrobes and shiny new cars that will tether them to these jobs. Instead, continue to embrace simple and inexpensive pleasures, like a weekly potluck night, thrift store shopping, and hosting happy hour rather than going out after work. The longer you can live like a student and keep your spending low, the more money you will have to save, pay off your student loans, and build the life you want instead of enduring the only life you can afford.

9. Celebrate and say thanks.

Graduating from college is a huge life milestone, and you should celebrate your success. Before you get too bogged down with responsibilities in the real world, take some time to enjoy your accomplishment and mark the occasion with all the people who helped you along the way. Thank your family, your teachers, and your friends and let them know you understand that you couldn’t have done it without their love and support.

*****

Congratulations on graduating from college and becoming a grownup. While working full-time and paying your bills on time doesn’t sound all that glamorous on paper, it can be as much fun as you want to make it. And with the right credit card, like the Sallie Mae Accelerate Credit Card or other Sallie Mae Cash Back Credit Cards, you can start making real moves on your student loan debt. Welcome to the real world!