7 Tips To Quickly Increase Your Credit Score

I know many people think a credit score isn’t a sexy topic, but did you know having a crappy one could potentially cost you a year’s salary?

When I bought my home in 2013, we were just beginning the incline out of the recession that had blindsided (most of) us in 2008. It was a buyer’s market, meaning homes were priced to sell, and there were a lot on the market. On top of that, my credit score was sitting pretty in the high 700s, meaning I qualified for the lowest interest rate on my mortgage. Did I know prior to that point how much money that score saved me? Absolutely not. But when I started crunching the numbers on my house situation, I soon found it.

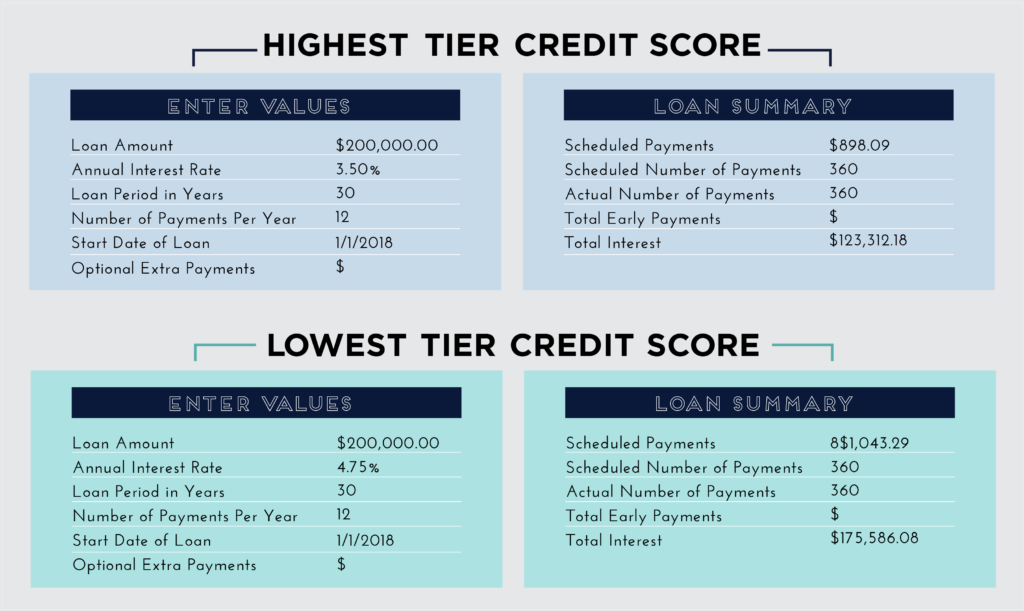

Between the highest credit score tier (760 or above) and the lowest, there could be as much as a 1.25% interest rate spread. Doesn’t sound like a lot, but that spread on my loan resulted in an $11,000 savings for me, and the higher your loan amount, the worse it gets. Let’s look at the effects this 1.25% difference could have on a $200,000 30-year mortgage:

That’s a difference of $145 per month and over $50,000 in interest over the course of your loan. Yes, that means for the exact same house, you could pay $50,000 more than someone else just because you have crappy credit.

This is exactly why focusing on your credit score, even if you’re in college, is so important: it can save you tens of thousands of dollars down the road just for being a good risk. That’s it.

If your credit score is currently in the crappy zone, don’t fret. It is an ever-moving number, and in less than a year, you can make significant leaps to a higher tier. Let’s take a look at how your credit score is calculated, and the steps you can take to improve your score in each area. Who’s ready to save enough for about 10 kicka$$ vacays?

Payment History (35%)

Here comes no surprise: Your payment history is the most heavily-weighed factor in your credit score. Lenders look at this first because it’s one of the best ways to verify whether or not you’re a good risk to take on. If you’ve missed your fair share of payments in the past, your lender is going to think you’ll do the same to them. But make every payment on time, and they’ll be throwing money at you.

If you’ve gotten the best of yourself in the past and missed payments, never fear. Like I said before, your credit score isn’t stagnant, and you can be in charge of moving it further up the totem pole. Here’s how to better your payment history in a few quick and easy steps.

- Pay on Time, Every Time. No brainer, right? But let’s be honest, life can get in the way sometimes, and you can find yourself three days late on your electric bill. Not a huge deal, unless you’re looking to take out more debt in the future and need a good credit score. To ensure you never miss a payment again, set alerts on your phone, or sign up for automatic bill pay. Or be like me and download Prism, which is a bill tracking app that notifies you anytime a bill is available or coming due. I’ve been using it for YEARS, and yes, it has even saved super-organized me from making late payments a time or two (or 12).

- Review Your Credit Report. Sometimes random bills get lost in the mail, and you never know they exist. It happens. Reviewing your credit report periodically for these is important to making sure your credit is clean. Every four months, download your credit report from one of the three credit bureaus (Experian, Equifax

, and TransUnion

) and give it a good look-over. If you do find something, contact the lender and ask if they will remove it from your credit report if you pay it in full. Normally they’ll agree, and you’re credit will get a nice little bump.

Debt Utilization (30%)

Fancy words for an easy concept.

Debt utilization basically means how much of your credit that you’re actually using, and the lower it is, the better. For instance, let’s say you have a $5,000 limit on your credit card and use $1,000 on average. You’re debt utilization ratio is 20%, and this signifies to lenders that you are able to responsibly fund your lifestyle without maxing out your credit. If you find your debt utilization is on the higher end of the scale (think 70%+), use these tricks to bring it down to scale.

- Rapidly Pay Off Debt. If you want to make a significant impact on your debt utilization ratio, you need to make a significant dent in your debt. This will increase the gap between what you owe and the amount of credit you have available, and will therefore lower your ratio.

- Increase Your Credit Limit. There’s only two ways to affect your debt utilization ratio: decrease your debt or increase your limit. If you’re looking to do the latter of these, the best way is to utilize your credit card. Call your credit card company and see if you can get your limit increased. This one step will help lower your ratio, but remember, only do this if you have the willpower not to spend up to that amount. If not, it’s not worth the small uptick in your credit score for the added debt.

Length of Credit History (15%)

The longer your credit history, the more information lenders have on how good of a credit risk you are. And this makes sense: Would you rather lend your money to someone who shows a good payment history for the past year, or someone who has a good payment history for 10?

All your student loans, auto loans, mortgages, credit cards, store cards, utility payments, and rent payments play into your credit history. If you haven’t had much exposure to these, I would suggest opening a store or regular credit card (again, only if you have the self-control to do so). Start by just putting gas or groceries on it, pay it off every month, and that will be enough to start building a decent credit history.

Credit Mix (10%)

While many people tout that there is no such thing as good or bad debt, lenders think otherwise. Mortgages and student loans are considered investments, and having those on your account signify much more responsible behavior than large credit card balances.

If you have large credit card debt or auto loans, work on paying off those balances as quickly as possible. They normally carry the highest interest rates anyways, so you’ll kill two birds with one stone: saving money and increasing your credit score in one fell swoop.

New Credit (10%)

Opening up a lot of new credit in a short amount of time signifies that you could be extending yourself beyond your means. Not something you want lenders to think about you. Now, then, or ever.

If you’ve opened up a lot of new accounts or taken on a lot of debt recently, it’s time to slow your roll. Put on the brakes, and let your credit take a breather for a little while — like six months to a year. For those of you looking to take on additional debt, make sure you don’t do it all at once. Try not to open more than two new accounts in a six-month period, and no more than three over the course of a year.

One of the biggest factors in improving your credit score is time, so remember to be patient. Putting off buying a car or home for a few months is definitely worth it if it means you’ll be able to save thousands of dollars in the process. You got this, ladies…now let’s go show lenders how great it is to invest in us.

Brittney is a CPA in Indianapolis who loves any & all carbs and in her spare time runs the blog Britt & the Benjamins, which is focused on helping people, especially women, achieve financial independence and kill it in their careers.

Image via Unsplash