How Bullet Journaling Helped Me Conquer My Mindless Spending Habit

At 25 years old, I am part of the generation who are hooked on social media. I love the inspiration I get from Instagram and Pinterest and keeping in touch with friends from University on Facebook, Twitter, and LinkedIn. However, all that social media means that we are being advertised to more than any previous generation — whether or not we realize it.

Up until recently, I had fallen into the habit of spending without much thought. For my first six months out of university, while working in a full-time job for the first time, I felt that I could spend my money how I wanted and it just didn’t matter, because I was working. It was a choice I had the right to make. And I was right, of course — you have the right to do whatever you like with your money.

But the news is full of warnings about over-consumption and the damage of fast fashion on the environment. And do I really want to have a wardrobe full of clothes rather than savings to show for all that work? So, over the past six months, I took to bullet journaling to help me balance my full-time job and various side hustles (from tutoring to copywriting to facilitating writing workshops) as well as fitting in time to write, practice yoga and spend time with friends. After a few months of using my bullet journal to take control of my time, I began to wonder if I could also use it to take control of my finances.

I had used a few habit trackers to help me practice yoga and write every day or drink more water. But what if I could start treating my spending like another habit?

After some research on how to start saving, I began by tracking my spending. It wasn’t that I was worried about every penny I spent, but more that I wanted to look into my clothes shopping because I knew that was my biggest weakness when it comes to spending. To begin, I started by tracking my spending for two weeks. Every time I felt like buying something, I would take note. I would write what I wanted to buy, why I wanted to buy it and how I was feeling at the time. I found that often I was bored or stressed when I turned to online shopping and so started putting my phone out of the way on an evening or reading and crafting to distract myself from the pull of social media ads.

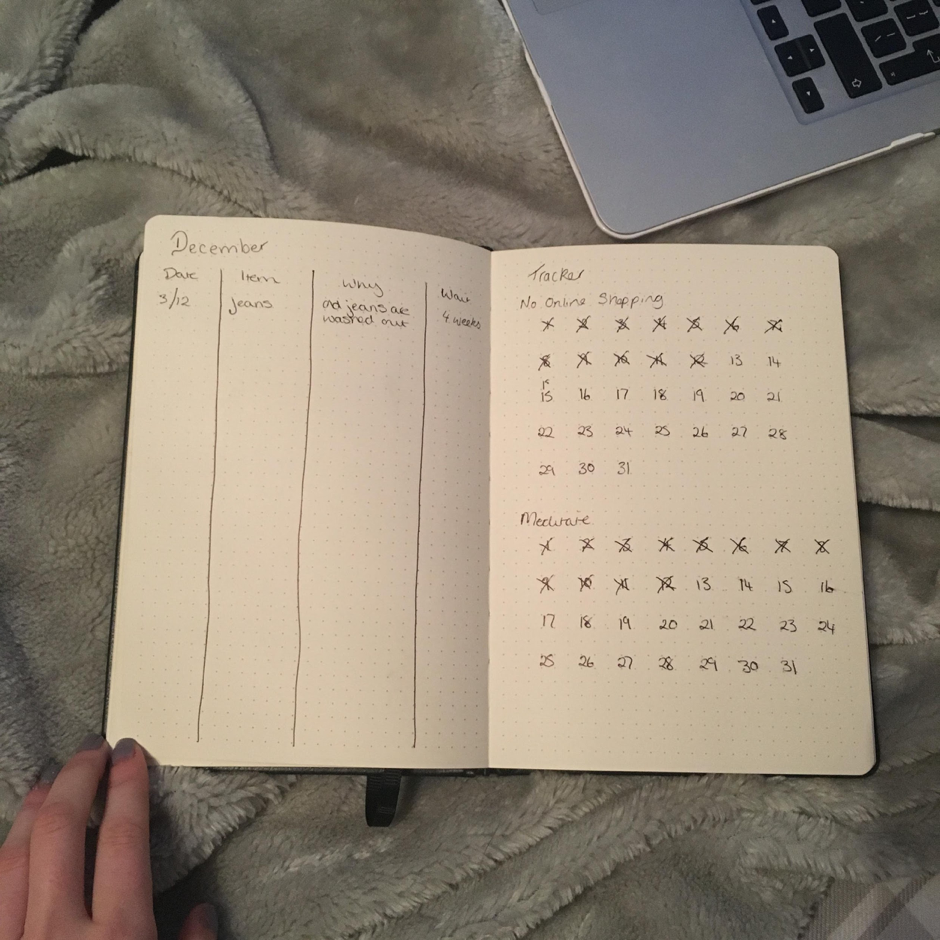

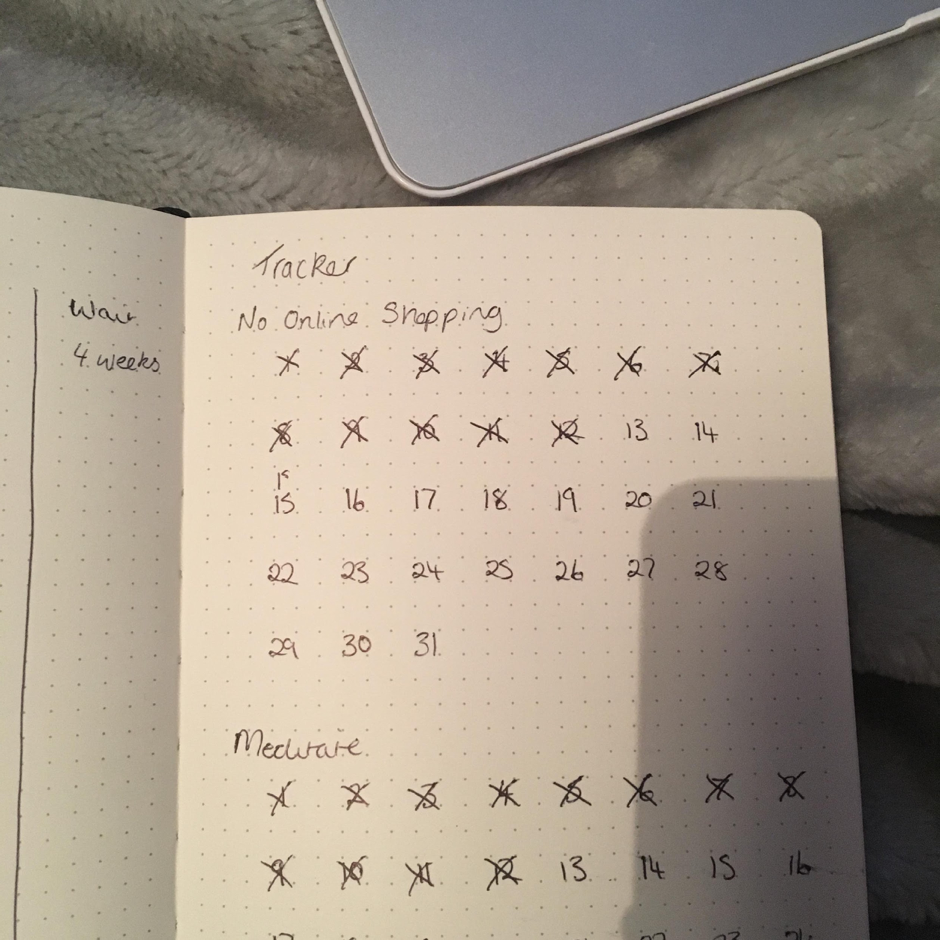

To start tracking your spending, use four pages of your bullet journal to lay out a two-week diary. Under each day, put subheadings for spending — here I will record the amount I’ve spent that day and a quick summary of what I’ve spent my money on. Then, add a section for online shopping or whichever type of shopping is your usual weakness. Then each day, if you feel like doing that type of shopping, write in what you wanted to buy, how much it would have cost you, and how you were feeling. I then set myself a monthly habit tracker of no online shopping for a month. I also tried to transfer some money into my savings every time I felt like buying clothes and this meant that my savings got a boost over that month. This online shopping ban felt like pressing “reset” on my habit of browsing endlessly through online shops and buying things just because, without any thought or real need.

To start a habit tracker, simply add a page to the beginning or end of your month in your bullet journal. Write the habit across the top of the page that you want to stop or start. Add a number for each day of that month, and every night before bed cross out or cover with a sticker on the days you manage to complete your goals.

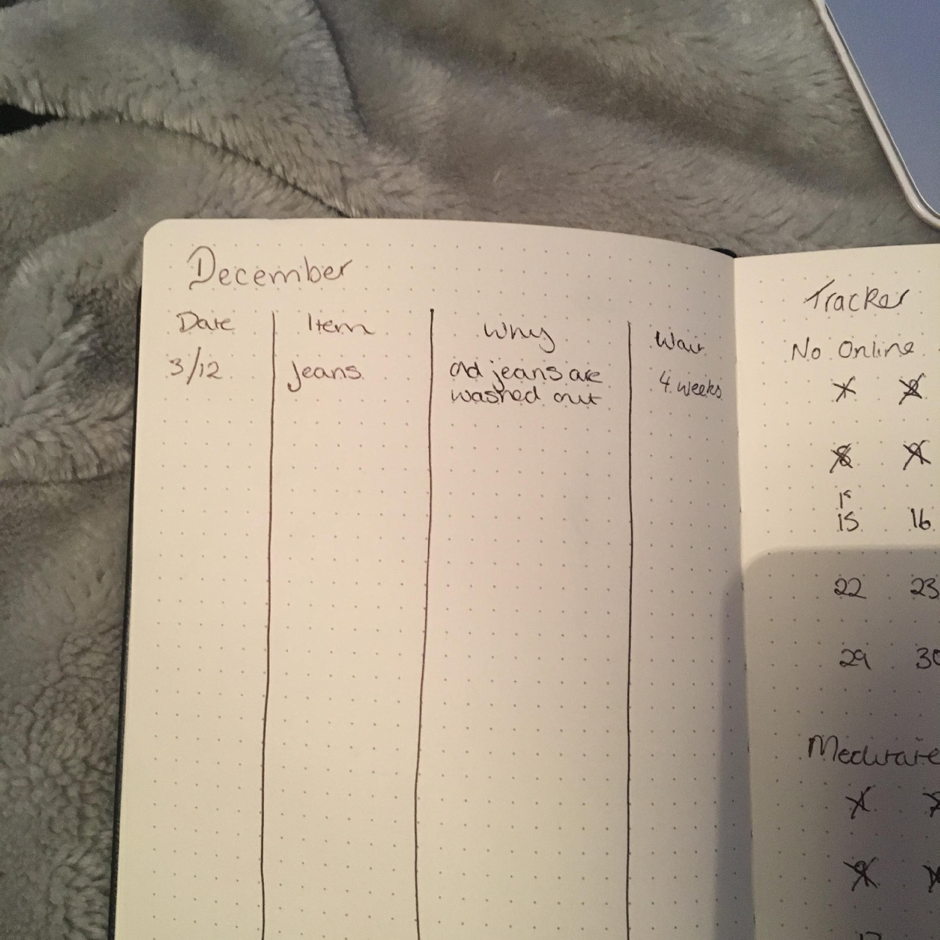

I didn’t want to keep this up during the festive season, though, as I would be using online shopping to buy gifts and would want to buy an outfit for Christmas parties. Instead, I have started a new page in my bullet journal that I use as a wish list. I’ve used this for nearly two months now, and it has really stopped me spending mindlessly. Every time I want to shop, whether I feel I need to buy something like a new pair of jeans because my current ones are looking worn or because I’ve seen a blouse I would love to buy online, I note this down. I write the date, the item, and why I want to buy it. Then I wait two or four weeks before I am allowed to buy that item.

Nine times out of 10, by the time those few weeks have passed, I’m no longer bothered about buying the item on my list. To start this Anti-Wishlist, start with four columns on a new page. Label the columns Date, Item, Reason I Wanted to Buy, and Date. Each time you get the desire to shop, fill this in, and if the reason why is because you’re anxious or bored, be honest with yourself!

I had gotten into the habit of buying and returning a lot of what I got online. Keeping track of it has stopped me doing this and curbed my spending on clothes and other quick buy items dramatically. I have started saving twice as much each month and feel more in control of my finances. As well as tracking my spending and returning to no online spending in 2019, I’ll be keeping up this wishlist in my bullet journal. Using a bullet journal has given me a physical way to see my spending and has put a stopper between my immediate reaction and my spending, taking the emotion out of my compulsive shopping.

Hannah Bullimore is a writer and blogger from Newcastle, England. She loves learning about ethical fashion, health, and wellbeing and is an avid reader. In 2019 she will be training to be a yoga teacher and continuing to teach creative writing as a form of self-care. She writes lifestyle posts and book reviews on her blog which can be found at hjbullimore.wordpress.com.

Image via Unsplash

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.