If you’re currently in your twenties or thirties, preparing for retirement might seem as unnecessary as covering your bald spot. The reality, however, is that the longer you put off saving and investing, the harder it becomes to make ends meet when you’re finally out of the workforce and need a stash of cash.

Now, you might be thinking: “Starting to save now means I won’t be able to party like a beast!” WRONG. I’m here to show you how it’s possible to save a small amount everyday, live your life mostly the way you want to (some minor sacrifices will need to be made here and there), and invest for your retirement. Let’s get into it.

Small Numbers Become Gigantic Snowballs When You Invest

$10 a day adds up to $3,650 each year — a measly $146,000 after 40 years of sitting in a savings account. But, if invested wisely, that initial small amount of $10 can grow exponentially over a long period of time. In finance, this is due to an effect called “compounding interest.”

What do I mean by this? Say you start with $100 and it grows 10% a year. After the first year, you’ll have earned $10 and your base becomes $110. At this point, it might seem intuitive that after the second year, you’ll earn another $10. However, with compounding, the amount that you earn every year after the first is not a fixed amount. Your base grows from $100 to $110 after Year 1. Since 10% of $110 is $11, your investment at the end of the second year becomes $121. If your money didn’t compound, you would have $120, not $121. Every year, as your base keeps increasing, your money grows by larger and larger amounts. That’s what we mean by small numbers becoming gigantic snowballs.

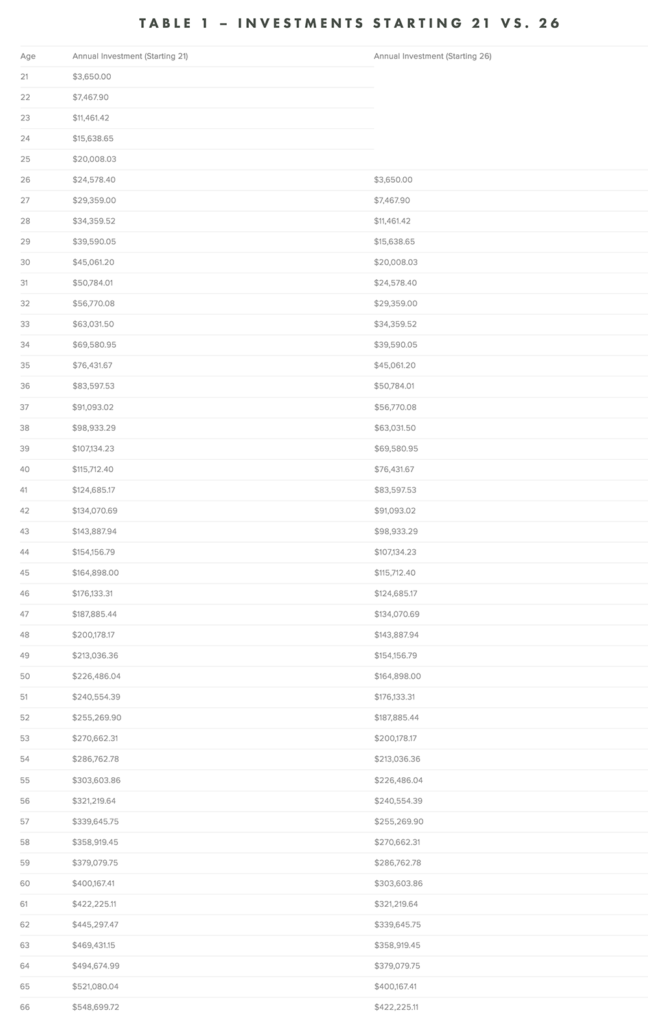

Now, here’s just how gigantic those snowballs can become. The following table shows you how much you’d earn if you consistently invested $3,650 a year ($10 a day) for 40 years starting at the age of 21; the calculations assume that you earn a 2% “dividend” on that money every year, and your underlying investment only increases by 3% in value annually. (When you invest in big and established companies in the public markets, you’re likely to get payments called “dividends” on your investment every quarter.) A 2% dividend yield implies that every year, you receive 2% of your investment value paid to you as income. Every quarter, you’d therefore have a 0.5% dividend yield (2% divided by four). We’ve also assumed that your dividends get taxed at 20% and that there are no taxes on the increase in your underlying investment (The IRS currently has no taxes on this, though that may change in the future).

As you can see in the table, investing $3,650 annually for 40 years leaves you with a grand total of $548,699.72! That number is almost four times the $146,000 dollars you would have if your money stayed sitting in a savings account. A savings account may one day pay you a decent interest rate for keeping it there, but not currently. With compounding, investing your money earlier makes a huge difference. If you were to start investing five years later, at the age of 26 instead of 21, the final amount you would end up with would be $422,225.11: around $126,000 less than if you started investing at the age of 21! This is because you lose five years’ worth of compounding interest and dividend income.

To take maximum advantage of compounding, consider participating in an employer-sponsored 401K plan or opening a Roth IRA account. Roth IRAs allow you to make annual contributions of up to $5,500 after taxes and let the investments in the account grow without further taxes until you retire. Roth IRAs can be opened at places like Fidelity or Schwab. Once you contribute your after-tax money, you can invest in whatever asset classes you like (stocks, bonds, et cetera).

Opening accounts like a Roth IRA or participating in a 401K plan may sound like a lot of work to set up, but it’s worth the trouble. If you look at the S&P 500 over the last few decades, there is a clear upward trend. This means that over a long period of time, you’re likely to make positive returns.

“How Often” Matters Just As Much As “How Much”

In the previous section, I talked about how starting early with your investments really pays off. Now, you’re ready to see that the more often you invest, the faster your money will compound. The following chart shows the difference between investing quarterly vs. annually. If you break up the annual investment amount of $3,650 into four separate investments, you would be investing $912.50 per quarter. With quarterly investing, you glide into retirement with $571,168.59. If you invest your $3,650 just once a year, or annually, you end up with $548,699.72. How often you invest matters to your eventual outcome.

A note of caution, here. Although investing more frequently increases the compounding effect in theory, it doesn’t work out that way in real life because of transaction costs. All investments have a transaction cost — sometimes $10 for a trade, or much higher if you’re at a big investment bank. If you’re doing something impractical like investing every day, your transaction costs balloon and start to eat into your returns. The financially wiser route would be to make a plan to invest consistently, perhaps quarterly, semi-annually, or annually, and stick to it. When you’re starting out with a small investment size, it’s better to only invest once a year to minimize the damage of transaction costs, and then step up the frequency as the base amount increases.

Diversification Is Good

Weathering the market’s ups and downs can be emotionally-scarring. Don’t sweat it — we’ve got a tip to help.

Ever heard the old saying “Don’t put all your eggs in one basket?” It applies to investing. Investing all of your eggs in one venture and trying to knock it out of the park is a recipe for potential disaster if things don’t turn out the way you expected. Why not embrace the practice of diversification and invest in multiple stocks, bonds, or mutual funds? That way, even if one of your investments takes a tumble, your other investments in different asset classes will generally help minimize your losses.

The simplest way to diversify without having to spend excessive amounts of money buying stocks of different companies is to invest in an exchange-traded fund, or ETF. When you buy an ETF, you’re investing in multiple different companies. Think of an ETF as a basket. When you and several others invest in an ETF, the ETF uses the funds they’ve received to invest in a wide portfolio of companies. You get a stake in multiple companies, and your returns are contingent on how those companies perform together. An example of an ETF is the SPY — an ETF that tracks the stocks in the S&P 500.

Make That Growth Automatic

Let’s assume that you bought a stock or an ETF that pays out a dividend. When you receive your dividend, it can be frustrating to pay a transaction fee to reinvest it. Reinvesting your dividend in a retirement account makes a lot of sense (since you won’t be withdrawing the dividend until you’re old and feeble, LOL) and you want your base to grow.

The solution? Sign up for a provider that lets you auto-reinvest your dividends. If you set it up this way, you’re taking advantage of the extra money reinvestment that your dividends provide, AND you also save, because you don’t pay an additional transaction cost.

You Can Do Even Better

I’ve walked through a pretty base case scenario in this blog. If you can get higher than 3% returns per year on average and a consistent dividend yield above 2%, your total after 40 years of investing will be exponentially higher.*

But before you reach these goals, the biggest barrier to your success is getting rid of the natural human tendency to behave like retirement is a long way away. Sock away a little every day ($10 a day, for example!), invest it wisely, and re-invest your earnings (or dividends) every chance you get. Before you know it, you’ll be a real-life Money-Bags when the time comes to hang up the spurs and close out your 9-to-5 career.

*Inflation exists. Get over it.

Jane Hwangbo is a former investment analyst and portfolio manager who founded Money School with Jane, a personal coaching program designed to change the way individuals see and interact with money. Visit her website or find her on Twitter.

Image via Unsplash