The 2 Most Effective Strategies For Paying Down Your Debt

When you’ve racked up a significant amount of debt, it’s easy to feel buried, pinned down under a weight that can feel as though it will never be lifted. Upon graduating college, I was faced with $32,000 in debt across multiple school loans and credit card bills (at times I would shop in attempt to forget about all the homework I had piling up. Yikes.) and I spent the first several months reacting to bills as they arrived in the mail without a well-thought out plan for managing my debt over time. But I have since come across two great strategies that have really helped me as I have tried to chip away at those balances: the Avalanche Method and the Snowball Method.

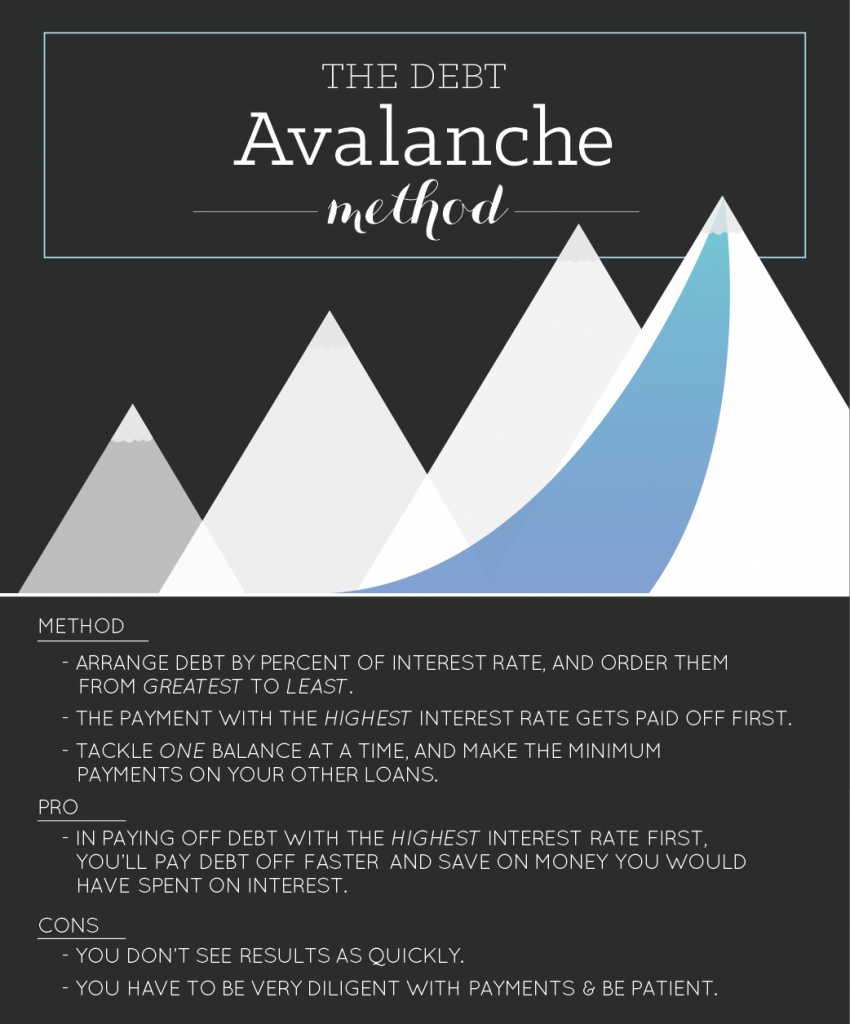

According to the Avalanche Method, you should focus on first paying off balances that carry the highest interest rates. By prioritizing those amounts first, you will reduce balances that accumulate interest most quickly and can help prevent compound interest from causing your balances to grow.

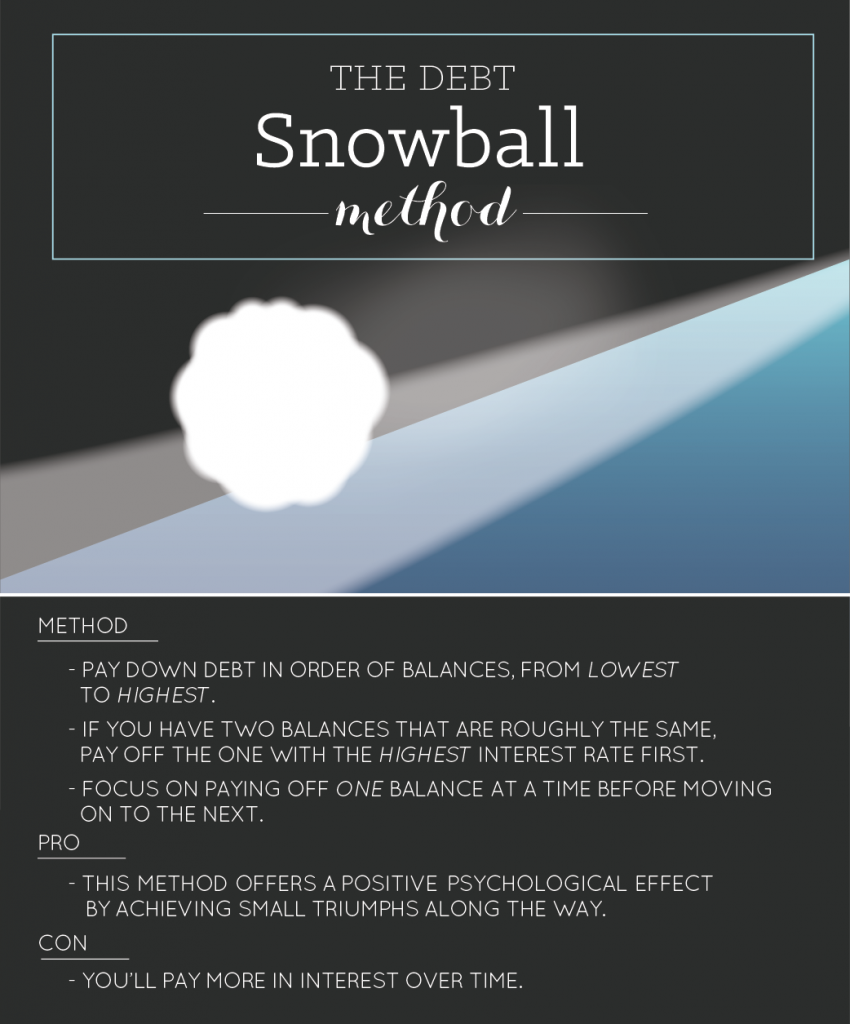

According to the Snowball Method, you should pay off debt with the lowest balances first in order reduce the number of your bills that need to be managed. This method is useful for those of us who have difficultly making consistent payments over long periods of time. It allows one to build the momentum and confidence needed to tackle larger balances by dealing with smaller ones first, much in the way a snowball picks up size and speed as it travels down a mountainside!

I found that for my situation, the Avalanche Method was the more effective one to use, and it allowed me to save a great deal of money on interest. My credit card balance associated with the highest interest number was the one to get wiped out first. Next I moved onto my one other credit credit card that had the second highest interest rate. Finally, I moved onto my sizable chunk of student loan debt (I’m still paying this off at the moment) which had the lowest interest rate. It’s important to stay positive and focused! Reward yourself with a small treat each time you reach a milestone and pay off a balance in full. Both of these methods are effective tools that can help you in achieving your financial goals.

Use this free online tool to run your own numbers to see which method works for you. Here are some additional resources that you can look to for guidance. You’ve got this!

“Debt Snowball vs. The High Interest Approach”

“Paying Down Your Debt: The Snowball Plan vs. The Avalanche Method”