The 5-Step System That Keeps Me On Budget Despite My Irregular Income

If you have irregular income and can’t predict how much money you’ll bring in every month, you know all too well how difficult it can be to get on a budget. Sometimes, it feels like there’s no point to budgeting when you make irregular income because you can’t know what you’ll make and, therefore, you can’t plan what you’ll spend. I’m in the same boat. I make money blogging every month and have to decide how much to use and where to use it. This means I have to figure out a budget with irregular income. Luckily, I have found a system that works if you have a side hustle along with your full-time job, you work on commission, or if your freelance income is totally unpredictable altogether.

An Overview of the Zero-Sum Budget

The zero-sum budget means that you allocate all your money to expenses so that you have zero at the end of the month (savings and debt spending is included). Under the zero-sum budget, if you have positive cash flow, you should reallocate your extra money to other expenses. This means putting more money in a miscellaneous category, a savings category, a debt payoff, or something else. The point is to tell each dollar where to go in your expenses so that you get zero when you subtract your total expenses from your income. This gives you total control of your money. Here’s a look at how to create a budget with a regular salary.

With irregular income, you should create a zero-sum budget using a priority list. You rank all your expenses in order of priority (your most important expenses at the top and least important expenses at the bottom) and allocate your money to your priority list each time you’re paid. Here are the steps to get started with creating a budget if you have irregular income.

1. Calculate you bare-bones budget.

First, you need to list your fixed expenses (stuff you’ll have to pay no matter what) at the top of your priority list. This is likely going to include things housing, utilities, food, clothing, and transportation. These are expenses you can’t live without.

2. Add savings and debts, in order of priority, to your list.

Next, add any savings and debts to your list. Examples include student loans, car payments, emergency fund savings, etc.

3. Add discretionary expenses to your list, in order or priority.

After you’ve listed your fixed expenses and your savings and debts, you should list things that aren’t necessary but that you want to include. It’s very important you list these in order of priority because it’s likely you won’t be able to afford all these expenses if you are short in your budget. Examples include entertainment, dining out, personal care, etc.

4. When you’re paid, allocate your money starting at the top and work your way down the list.

The first time you’re paid in a month, use the full amount of money you receive and spread it out among the bare-bones budget to make sure your needs are met. The next time you’re paid, attribute that money to the first savings or debts on your priority list. Once those are taken care of, go down the list to the next savings or debts. Finally, if you receive additional money, go down the list, in order of priority, paying for your discretionary expenses. If you end up with more money than you need for all your expenses, go back up to the top and add more money to certain categories (e.g.: add more money to your savings accounts or debt payments).

5. Repeat this process every month.

You probably won’t have a new priority list every month, but there will be some varying expenses from month to month, so it’s best to fill out a new budget every month (e.g.: December may have a higher expense for gifts compared to June because of the holidays). I use this system to budget for myself with my blogging income. I have a traditional salary (i.e. a predictable paycheck) every month. I use that money for my bare-bones expenses. Then, I use my blog income, which I estimate on the low-end, for my additional expenses. I typically put extra money aside for my student loan payments.

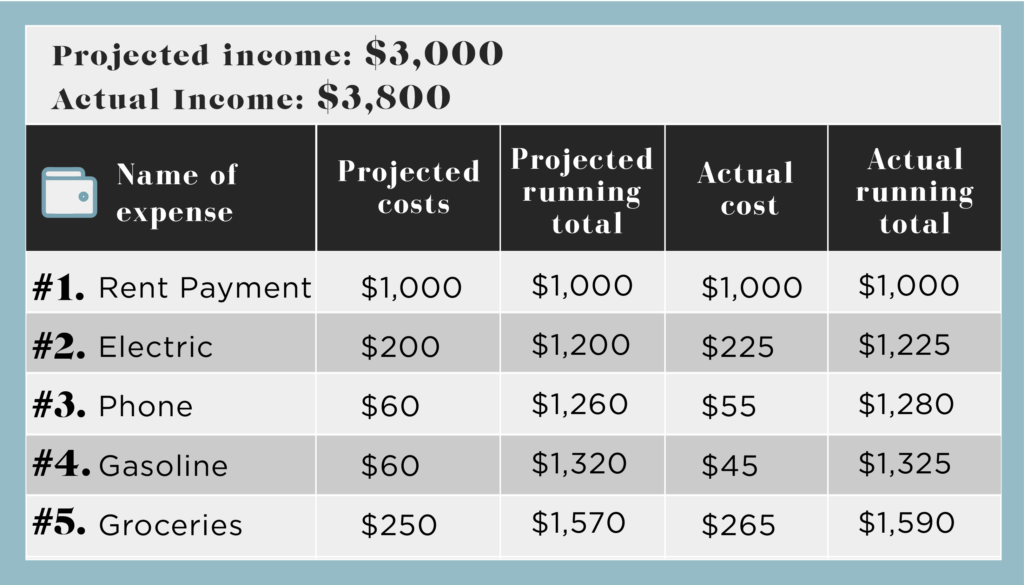

I would’ve never thought I’d be using money from blogging to repay my law school debt, but here I am doing it. Without my blog income, I wouldn’t be able to live off my salary (since I took a 50% pay cut to become a financial planner). If you’re interested, here’s my how to start a money-making blog tutorial if you’re interested in blogging. Here’s an example of what your Irregular Income Budget could look like. This example is from my template that you can download here:

The expenses listed are all part of the bare-bones budget. You would continue to list expenses on the left side and start prioritizing as soon as your absolute fixed expenses are all listed. The “Projected Cost” column is how much you think each expense will cost you in your budget. The “Projected Running Total” is the cumulative total you project to spend. The “Actual Cost” column is what the actual expense cost you (they should be filled in as you track your budget after you’ve spent the money). The “Actual Running Total” is how much you’ve actually spent. Notice that in this example, there is a $20 difference between the Projected Running Total and Actual Running Total. That’s normal. You won’t be able to know for certain what things will cost. The idea is to plan ahead and try to get as close as possible to your reality.

4 Irregular Income Budgeting Hacks

Create a priority list and allocate the money you receive to each expense, in order of priority, (starting with the most important expense first) whenever you’re budgeting on an irregular income. That said, there are also some pretty good budgeting hacks that can make it easier for you. Here are a few that I’ve learned from the pros.

1. Pay yourself a set salary

Instead of following the priority list method of budgeting on an irregular income, you can create a salary for yourself and use a traditional method of budgeting. To do this, you need to get ahead with your finances by one month. This sounds impossible, but if you find ways to make extra money just for one month, it can be completely worth it — it just takes a little short-term sacrifice.

Once you have enough money, put it all into your savings account. Then, the next month take a “draw” from that account based on a set amount you choose. The key is to low-ball yourself so you don’t take out more than you’ll make that month. Here’s an example: Put your irregular income into your savings account as you receive it throughout the month ($3,000, $4,000, $2,000, etc.). On a specific day of the month, withdraw the total amount you’ll allow yourself to spend ($4,000). Repeat this every month. This creates a steady income so you don’t have to budget with an irregular income at all.

2. Use a regular budget and an irregular budget together

Instead of sticking to an irregular budget, which can be difficult to do, consider creating your bare-bones budget using a traditional budget (here’s my post about how to start a regular budget). With this system, you use the lowest amount of money you know you’ll earn and create a traditional budget by using different categories for your expenses. Then, you create a priority list for your irregular expenses and list them in order of priority. You can spend money on these items only after you earn money beyond your traditional budget.

This is a good system if you usually earn a set amount that you can live off, but sometimes you find you earn more. An example would be earning a base salary plus commissions. In this case, you would create a traditional budget with your base salary and then a priority list for additional expenses you’ll spend your income on with the bonuses you earn.

3. Create money habits that make your life easier

Learning how to budget on an irregular income is not easy and it can be time-consuming at first. To make your life easier and increase the likelihood of success, implement a few good habits. Here are my favorite money habits:

- Regularly have budget meetings. Have a specific meeting time for you to review your budget every week (include your spouse if you’re married). I do this every Sunday night.

- Rotate which discretionary expenses are ranked last so you don’t feel deprived. This is super helpful for budgeting on irregular income so you don’t feel completely broke and restricted. Just make sure you’re only rotating the discretionary expenses and not rotating any bills, savings, or debts.

- Take a budgeting course. This may seem counter-intuitive because it can cost money, but if you find one that specifically has budgeting videos, coursework, and worksheets for budgeting on an irregular income, you are likely going to learn how to budget more successfully and increase your budget success in the future. Budgeting For Budget Haters is a good one.

- Use a calendar to remind yourself when bills are due. I use my Google calendar and have a specific color for my bills, so I can see when I have a bill due every day during any month.

- Plan for the month ahead during the last week of the previous month. This is so important for budgeting or else you’ll be behind before the month even starts.

4. Use an irregular income budgeting worksheet

I created an Irregular Income Budget Worksheet for you that is included in the Budget Spreadsheet Bundle. You can use this if you have an irregular income only or if you want to use it with your traditional budget that works, too. It is formatted in Excel and as a PDF if you prefer to hand write vs using a digital format.

*****

Learning how to budget with irregular income is overwhelming at first, but with a little effort, you can get the hang of it. I’m such a spender at heart, and even I have mastered budgeting. From the traditional method of budgeting when I was an attorney to a combination of traditional and irregular income budget as a financial planner and blogger — I’ve done it all.

If I can budget, you can, too. After all, we all aren’t born frugal!

Natalie Bacon is an online entrepreneur. Prior to this, Natalie practiced as a certified financial planner, at a firm that managed over $1B in assets under management. Before her financial planning career, Natalie practiced as a business attorney. Natalie has been featured in CNBC, Forbes, and other publications. Natalie is most passionate about helping young, professional women design their dream lives. Read Natalie’s full story here.

Image via Unsplash