Reflections On My 90-Day “No Spend” Challenge

When I reviewed my recent credit card transactions in the final days of 2020, I knew a drastic self-intervention was in store. Even though December gift-buying is the typical culprit for many people’s higher end-of-year spending, I could not in good conscience attribute my high spending to benevolent gifting. With no dependents and minimal recurring expenses since I was living at home (for now), my transaction history’s assertion that my discretionary purchases over the past three months approached $2,000 monthly gave me pause. I couldn’t help but think I was unwittingly channeling Carrie Bradshaw (but only her reckless profligacy and absolutely none of her glamour.)

Since I wasn’t spending more than I was earning, my pandemic-era spending behavior didn’t seem alarming at first glance. However, the shock of seeing the cumulative numbers, especially since I hadn’t encountered any emergency spending situations, spurred me to do some self-reflection; I was confident that I could spend much more responsibly than what those numbers communicated, diverting the difference to my savings account. Inspired by many personal finance YouTube channels, I decided to pursue a “no spend” challenge for the first three months of 2021.

What Is A “No Spend” Challenge?

No-spend challenges involve setting strict rules around reducing or eliminating non-essential spending and demonstrating extraordinary restraint in following them. These challenges’ appeal is in their austerity and the philosophy that intense pain quickly leads to intense gains. Of course, they’re not without their controversy. Some argue that the severe spending rules set participants up to fail in the same manner that highly restrictive diets rarely work. Even Chelsea referenced this in TFD’s “6 Popular New Year’s Resolutions You Won’t Stick To” YouTube video.

Reflections On My Late-2020 Spending

Combing through my purchases and thinking through my rationale for each one, I distilled the drivers of my spending impulses into three main groups that I wanted to tackle:

Content marketing: Although I don’t subscribe to any retailer emails alerting me of flash sales, I am an absolute sucker for original magazine articles that offer product recommendations, particularly the ones from Fast Company. After I built goodwill and trust in their journalism and content, I evolved into easy prey for any product features they slipped in front of me.

The appeal of deals: Many of my unnecessary purchases stemmed from deals on which I felt I couldn’t miss out. Browsing retailer websites out of boredom and noticing low inventory on my specific size or desired color would prompt me to punch in my credit card number so I could snag that deal, even if I didn’t need the item. Offline, my penchant for unnecessary deals led me to overspend on groceries. One of my favorite artisan grocers would regularly mark items approaching expiry at 50% off, and how could I say no to snapping up cupcakes, cobb salads, and cold-pressed juices at such a low price?! Even though they were imminently perishable and often not freezer-friendly, I would justify buying more by telling myself these were bargain gourmet treats that my family members could also consume. Turns out, when you buy items at the cusp of going stale without fielding people’s input on what you’re buying, people don’t want to eat it! This pattern started in the summer and only ceded when I started my “no spend” challenge, costing me hundreds a month; the thrill of finding a good deal was just too hard to abandon.

Small, impulsive purchases: Those small, seemingly innocuous purchases really add up. Scanning my transactions for the various times I popped into a Wendy’s drive-thru while on an errand, grabbed a smoothie while biking, and bought take-out for my family “just because” gave me the wake-up call that these minor trips made a material impact. Furthermore, I was buying much more coffee than pre-pandemic as I liked having a purpose to get out of the house or go for a walk and this was adding up.

My “No Spend” Rules

I opted for a three-month rather than a single-month pursuit because I knew a one-month stint would encourage me to simply delay purchases until the start of the next month, swiftly falling back into my old habits. I prohibited myself from buying any personal care products, clothing, and accessories unless I needed to replace something. Likewise, I banned myself from ordering or impulsively grabbing takeout that wasn’t groceries. I didn’t set a budget on my groceries so my challenge wouldn’t be so austere, but I told myself I would only buy what I personally could finish in a week without the food expiring. Finally, I restricted my cappuccino runs to three times a week, a manageable reduction from the near-constant trips I was making.

My Experience

Being mindful of my spending behavior allowed me to persevere in this marathon, though I’ll admit I wasn’t perfect throughout the challenge. Several strategies kept me focused: When I was bored or needed a mental break, I forced myself to walk around my neighborhood without my wallet as an alternative to browsing online. I found watching YouTube videos about other people’s “no spend” challenges or debt repayment journeys to be extremely cathartic and motivating. The regular updates on their triumphs and shared goal of financial responsibility encouraged me to stay strong.

Meanwhile, planning out my weekly coffee trips encouraged me to make more tea and coffee at home on the days I couldn’t go. When my local barista remarked that I hadn’t visited as often as I used to, I felt guilty but explained to her my no-spend challenge so I could be honest while keeping myself accountable. I made fewer trips to my favorite gourmet grocer and would repeatedly tell myself to not pick up my “deals” as I shopped around. When it came to avoiding take-out and impromptu cravings, I ate before running errands. I was generally successful at avoiding take-out save for a few occasions of weakness.

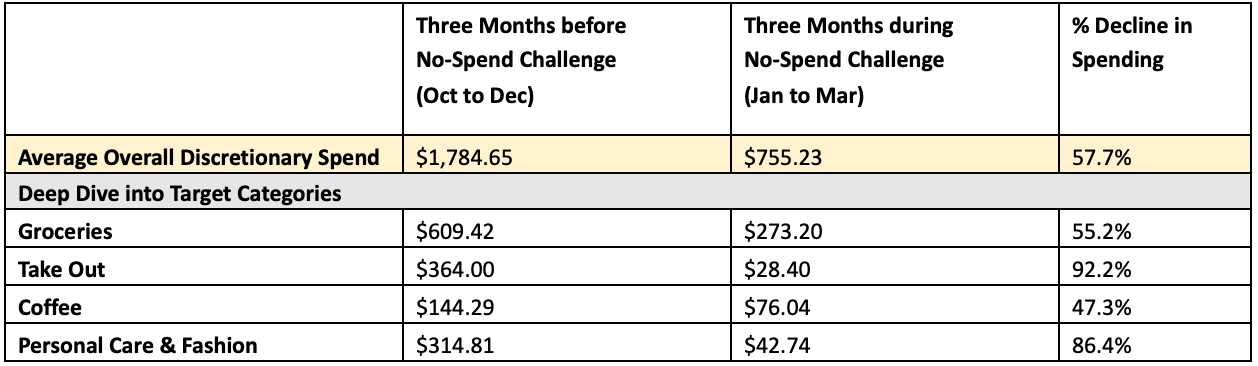

I’m proud of how much I limited my spending on personal care and fashion items even if my total spend didn’t reach zero, due to a steeply discounted pair of sandals to which I had a VERY difficult time saying no even though I knew that this purchase would sabotage my no-spend challenge. I typically average about $300 per month on clothing and shoes (regardless of the time of year), so getting this to $43 per month is still notable.

Results

To measure the results across my three-month “no spend” challenge, I decided to average my spending for the three months before and after the challenge and compare the numbers. Despite encountering some unexpected health-related costs, I still reduced my discretionary spending by 58% overall.

Reflections on my “No Spend” Challenge

Do I consider my “no spend” challenge a success? Would I encourage others to pursue one? I’ve spent time mulling over these questions and I’d say yes. But the value of completing a “no spend” challenge goes beyond the numbers; its success lies in abandoning the idea of “perfection” and focusing on perseverance and long-term behavioral changes.

Maybe the spending categories that I vowed to eliminate didn’t become zero, but focusing on the challenge and being acutely cognizant of my buying decisions has permanently altered how I spend my money. When one of my friends asked what take-out I would buy to celebrate the end of my challenge, I hadn’t even given it much thought. My “no spend” mentality has surprisingly become the norm. I am confident that undergoing a formal, ambitious spending challenge kept me committed in a manner that a casual, less restrictive exercise wouldn’t have.

In fact, I believe that my occasional mistakes actually helped cement my new habits. Making mistakes isn’t license to go on a bender or to give up on the challenge. When I screwed up, I treated it as a mistake, an aberration, and vowed to stick with my original goals. What I find discouraging about others’ recounts of no-spend challenges is that they focus on near-perfect records of success and unwavering commitment, but amid the immaculate veneer of these stories, any deviation seems like a failure when it’s not. I made huge personal spending improvements and my habits have changed even if I didn’t perfectly adhere to the rules that I set for myself.

Cindy is a management consultant in Canada focused on retail analytics and passionate about the topic of algorithmic accountability. She loves writing and biking to her favorite gourmet grocer across town (and this article is a meeting of those two pastimes). Over the course of the pandemic, she has realized that she wears dresses for other people and perfume for herself.

Image via Unsplash