The Simple Tactic That’s Kept Me From Impulse-Spending For 6+ Months (+Downloadable Template)

For the month of January, we’re exploring how to live with intention — how the small choices we make every day impact our lives and happiness in the long run. Click here to read more on this topic!

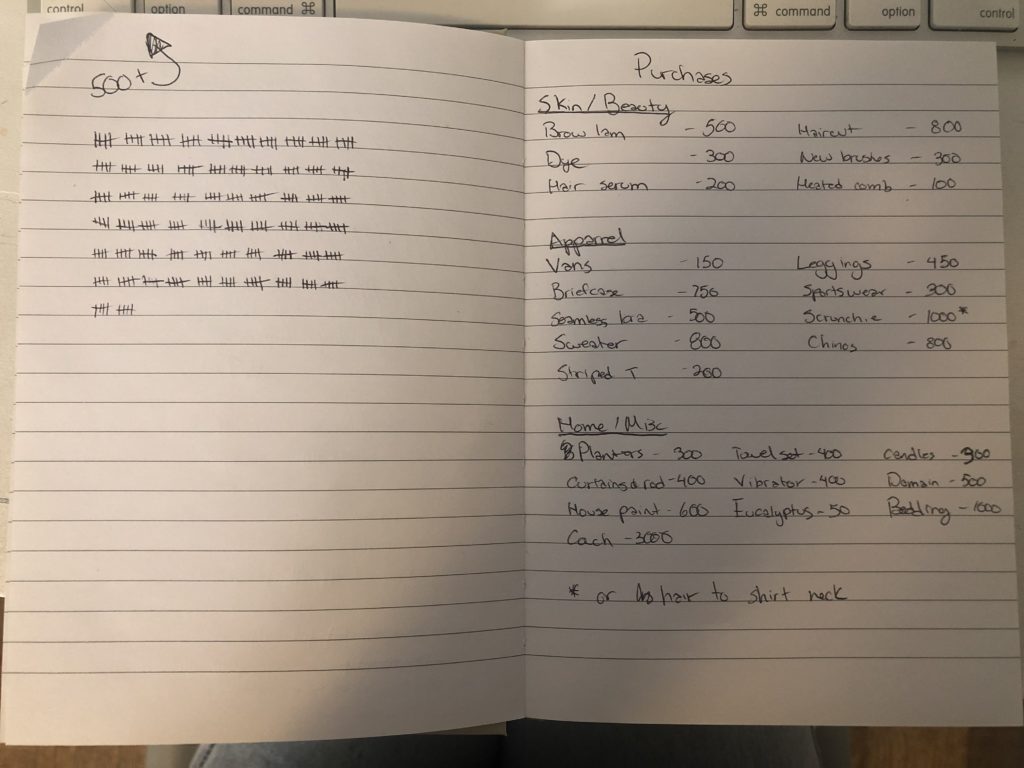

Every morning at 8 a.m., I slide into my home office with my second cup of coffee, open my laptop and go over my agenda for the day. While everything is quiet at work, I also open a second notebook; a beige, inconspicuous little book, pages filled with little tick marks and an ever-fluctuating list of random items: “Sportswear.” “Leggings.” “Briefcase.” “Scrunchie.” All of these have random numbers next to them, to denote point values. The leggings, for example, are “450.”

At first glance, it looks like a shopping list. That’s not quite accurate. It’s a list of things I want to buy at some point. The tick marks represent every day I didn’t buy any of those things. So, with 19 things that I’m currently eyeing, and having not purchased any of them in the last 24 hours, I add 19 marks onto my tally. These are my points – currently, I have 673 points accumulated.

This is my impulse journal, and I’ve been using it every day since June:

I started using it after a few months of staying at home when I realized I’d become very comfortable with online shopping and it was colliding with some subtly toxic spending habits of mine. When I was looking for a way to calm down, I turned to an old TFD piece I wrote about things to try going without for one month. While I felt like maybe something more drastic was needed, I was struck at how in that piece, I had compared spending (and spending sprees) to diets, and how depriving myself too much could sometimes lead to “binges” later on. So I wanted to develop a system that would allow me to balance prudence and pragmatism, while still treating myself.

It started by writing down three things that had been on my mind the last couple days — a cute lip pencil in a trendy tone, a new skin serum I wanted to try and a tube of cream blush. All things I could afford but didn’t necessarily need. I assigned each item a total of points. And every day, I added three points into my journal. After 10 days, I had more than enough points to buy the lip pencil, but I decided to keep going and “save up” for the serum.

A system was born.

How it works

Right now, 19 items on my list is a high number – but like I said, the list has fluctuated since June. Everything on the “purchase list” has a point value. They range from low-value things like a $30 heated brush (100 points) or a pair of classic checkered Vans (150) to mid-range things like some nice planters (300) to big-ticket items like new bedding (1,000 points).

Currently, my 673 points are enough to buy myself the Vans for 150, a new vibrator for 400 (yes, I have a vibrator on that list), and still have enough left over to buy the heated comb. If I were to buy all this in one day, the next day I would only be adding 16 points onto my tally, but I could keep racking up the points for a new sweater (800).

As for how I decide what each item is valued at, there’s no special math formula. I go with what feels right. It’s based partially on price, but also on how much I actually need something. For example, a new set of curtains and a curtain rod (400) surely will cost more than the vibrator I’ve been eyeing, but when I consider that my husband and I have been sleeping with IKEA paper blinds for five years, it’s pretty easy to see that one is a bit more essential than the other.

A few times, I’ve assigned “hybrid” values to my purchases list, meaning sometimes instead of having to accumulate X points to earn it, I will have to earn it by completing a practical milestone. For example, right now, a set of scrunchies are on my purchases list – I’m getting excited about having “long” hair for the first time (and by “long” I mean just barely to the middle of my neck), so I keep feeling an urge to buy scrunchies. However, in order to actually buy a scrunchie, I have to let my hair reach a certain growth milestone. For me, my hair length goal is for it to reach my T-shirt neckline. If I don’t wait until this, the point value on the scrunchies is pretty hefty: 1,000 points. This way, I can technically allow myself to give in and jump the gun on the purchase, but I’ll be rewarded more if I wait.

Here is an impulse tracker (& reference sheet) inspired by my system:

Tracker:

![]()

Reference sheet:

![]()

If you need help mastering a system of your own, start with the above tracker as a template, until you feel comfortable customizing your process.

Why I do it and why it works for me

In the last few years of my career, I’ve steadily earned more money. I’m not rich by any means, but I no longer live in constant fear of my rent checks bouncing, and I’ve lived in the same quiet neighborhood long enough that my rent is well below my means. This means I sometimes have more money left over at the month than I’ve previously been used to. So instead of doing something smart with it like investing it, it burns a hole in my pocket. Because none of these purchases have caused me to struggle financially, I haven’t viewed them as a problem in the past. But they do still present small problems. For one thing, I wasn’t saving as much as I could have, but almost as importantly, I was getting used to a mentality of “just buy the thing I want when I want it” without thinking about it that much. I wasn’t spacing out my purchases or taking time to evaluate.

It works for me precisely because it has helped counter my “do it now!” mentality by visualizing my progress. Now, I have much more peace and patience when making purchases. It also helps me realize when I’ve been depriving myself too much and helps me press “go” on a purchase without feeling that awful, post-spending-binge feeling I used to feel.

Things I don’t do

I never intentionally created “rules” for my impulse journal, but I have a few guidelines I follow to hold myself accountable.

For one, I won’t use my impulse journal or my purchase list to get things that I need. For example, if half my socks have holes in them, I’m not going to make myself earn new socks. When I ran out of mascara, I didn’t make myself earn new mascara. This has also helped me really distinguish what is essential versus what is just for fun/aesthetic.

I also don’t ever add on additional points for random little thing. For example, say, advancing my score because I did something awesome at work or giving myself extra points as a “reward” for hitting an exercise goal. I don’t do this because over the years I’ve taken to small purchases to reward myself for achieving things, but as a hyperactive overachiever, that just made it really easy to justify silly purchases.

Finally, I won’t lower the point value of an item because it went on sale. When I purchased a pair of headphones on Black Friday for 350 points, the headphones themselves had been marked down. But that didn’t change how essential the purchase was.

What surprised me most:

Two things have been most surprising about my journal. First: that I’ve stuck to it. No cheating, no adjustments, no last-minute changes to point values. I’ve become very comfortable with the prospect of waiting and taking my time on purchases.

The other thing that’s surprised me even more, is how many things I’ve crossed off the list because I realized I didn’t actually want them. I’ve crossed at least a half-dozen things off the list – like a new pair of glasses or new boots – simply because I realized the want I felt for them was fleeting (and yes, when I do that, I stop accumulating those points going forward).

I’d say the money I saved surprised me, but honestly, it’s not a surprise. I haven’t gone over, or even come close to, my “personal spending/misc” budget amount in six months, and that’s an amount I set when I made $10,000 a year less than I currently do. That money is being repurposed into smart investments, along with investments I was already making. It all goes with the general feeling of satisfaction I’ve felt from the impulse journal; I now know that I can wait for things, that it feels good to wait, and that occasionally spending on something just to delight yourself isn’t a bad thing.

As for my plans to maintain an impulse journal for the long run, I plan to keep it for some time, lockdown or not. I’d like to keep it up for at least a year.

Bree Rody is a full-time business journalist and part-time choreographer based in Toronto. She covered Toronto City Hall during the Rob Ford era before transitioning to business journalism. Her areas of specialty include advertising, media buying, technology, entertainment and agriculture. Follow her on Twitter.

Image via Unsplash