How To Make Your Savings Start Working For You

This past New Years, the most commonly reported resolutions involved commitments to save more money throughout the coming year, with a whopping 31% of those surveyed reporting such a goal. Wow. While many resolutions go unfulfilled (I know mine do), I still found the statistic to be impressive, and so I asked friends and family in my age group about their savings habits. I was surprised to discover that a majority of them told me that they were either a) not saving, b) saving only a tiny amount of their incomes, or c) saving with little familiarity with the details of their accounts like the interest rate, the minimum balance, or number of withdrawals allowed. Everyone seems to be aware that saving money is a great goal conceptually, but so many of us find it difficult to follow through. By doing just a small amount of research, it should be clear why getting an early start can be hugely beneficial in the long run. Since the expected retirement age currently stands at 73 years old for millennials, it may seem as though there is plenty of time to build the financial security we need to really enjoy our retirement, but those years are sure to go fast! We should make good use of the time we have to begin saving now, and saving smartly.

Everyone should seek to diversify their savings across a good number of financial products that provide different degrees of access, growth, income, and capital preservation. One of the most important goals of millennial investors should be to grow our savings into what will hopefully be a sizable nest egg come retirement. But before evaluating some of the different options out there, it’s important to understand compound interest, one of the most basic, yet powerful concepts in personal finance that can help your savings increase by startling amounts if given the proper time to mature. Below are a few pointers that will help you understand this concept in the context of a basic savings account, a low-returning financial product. Although it is low-returning, it’s a great place to start because it’s simple to understand, and one that the majority of people will have throughout their lives. We have also included the top 10 savings accounts for 2015 to get you going in the right direction. (In its most basic form, this concept generally applies not just to savings accounts, but to all types of investments that allow you to reinvest your interest or earnings. If you’re looking to read up on more investment options that are more advanced, see Bridget Casey’s posts here and here.)

Everyone should seek to diversify their savings across a good number of financial products that provide different degrees of access, growth, income, and capital preservation. One of the most important goals of millennial investors should be to grow our savings into what will hopefully be a sizable nest egg come retirement. But before evaluating some of the different options out there, it’s important to understand compound interest, one of the most basic, yet powerful concepts in personal finance that can help your savings increase by startling amounts if given the proper time to mature. Below are a few pointers that will help you understand this concept in the context of a basic savings account, a low-returning financial product. Although it is low-returning, it’s a great place to start because it’s simple to understand, and one that the majority of people will have throughout their lives. We have also included the top 10 savings accounts for 2015 to get you going in the right direction. (In its most basic form, this concept generally applies not just to savings accounts, but to all types of investments that allow you to reinvest your interest or earnings. If you’re looking to read up on more investment options that are more advanced, see Bridget Casey’s posts here and here.)

Compound interest — what is it?

Compound interest is the process of interest accumulating not just on your original principal balance, but on interest that has accumulated over previous periods as well. This compounding effect will make a deposit or loan grow at a faster rate than simple interest would, which applies only to your original balance. In very simple terms, compound interest refers to the way your money grows by building upon itself from year to year.

Why it’s essential to get started early.

In the same way that compound interest charges impact the amount of money you ultimately pay on credit card balances and other loans (which can give it a bad rep), compound interest is a concept that you can use to your advantage as you save. For example, if you placed $1,000 into a savings account that offered an interest rate of 1.05%, you would have $1,010.50 by the end of the year. Assuming, for sake of this example, that rates remain constant, the following year you would accrue that same 1.05% interest, but on the new balance of $1,010.50. By the end of the second year, you would have $1,021.11. While these rates are very low, keep in mind that we are in an unusually low interest rate environment following the aftermath of the financial crisis. These rates are likely to rise as the economy gets rolling more quickly, but the idea is that the longer you leave your money untouched in an account, the longer your money has to make money, and the richer you’ll become.

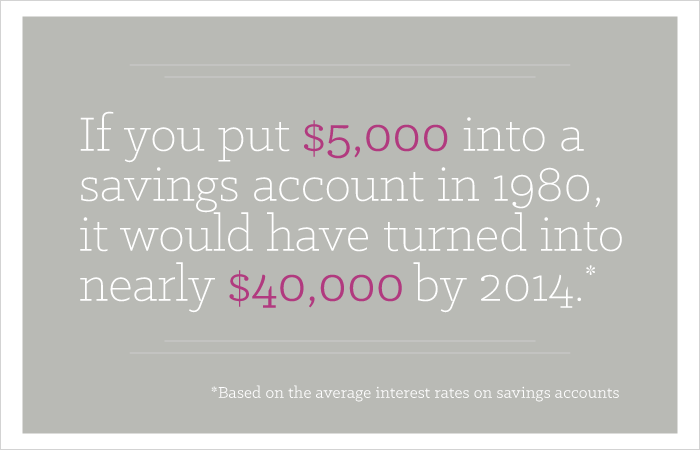

Using the average historical interest rate on savings accounts over the last 30 years, we can see the value in leaving your money in an account for the long-term. Again, there are a variety of financial products that entail different risks and rewards, but a savings account serves as a great example for someone who is just starting out and interested in becoming smarter about personal finance.

If you, like me, have discovered that your savings account offers a depressingly low-interest rate, check out the top 10 savings accounts for your money here and here to see if you can do better! Remember that you’re never too young to start saving up for your future. If you STILL feel like you need an extra bump to help you save, perhaps this mind trick can help!