4 Topics Finance Experts Always Disagree On, & What That Means For You

Generally speaking, personal finance experts tend to agree on several key rules of thumb: you should start saving for retirement as early as you can; you should make every effort to avoid any high-interest debt; and, if you find yourself with extra funds, you should focus on consistently investing in vehicles like low-cost index funds. When it comes down to it, personal finance is actually quite simple: spend less than your means.

However, there are a few key issues that personal finance experts disagree on:

1. Paying off debt vs. holding a larger emergency fund:

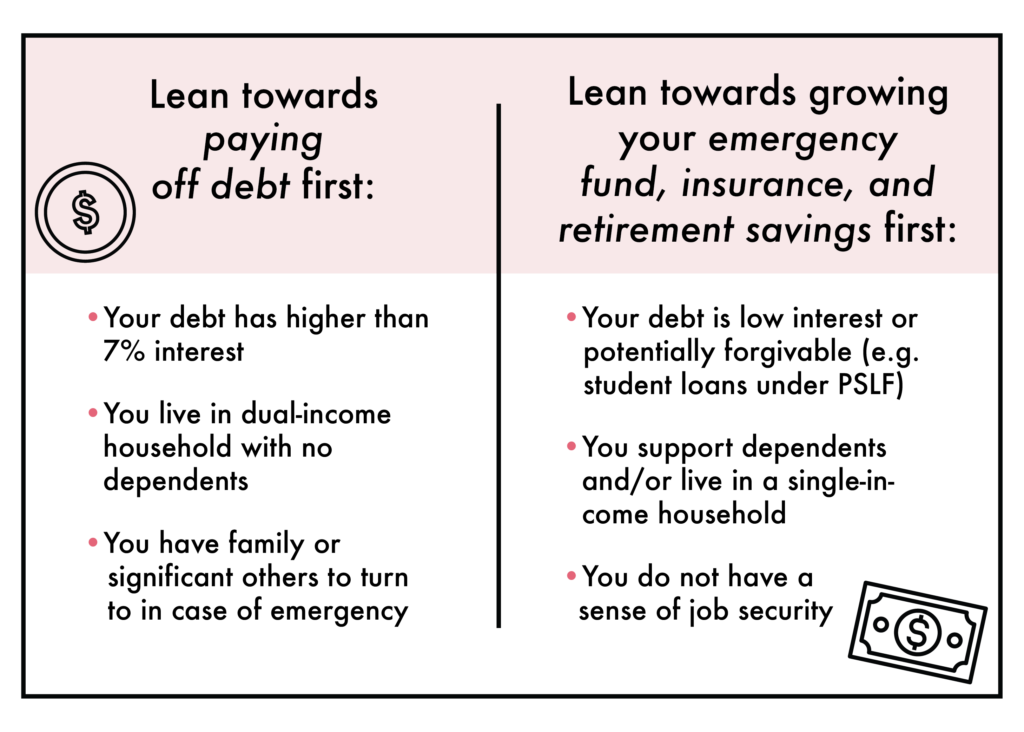

If you listen to the Dave Ramseys of the world, all debt is toxic even mortgage and student loan debts with low interest, and you should prioritize this by putting all your funds toward debt repayment except a small $1,000 emergency fund. On the other hand, there are some experts, such as Tasha Cochran from One Big Happy Life, who focus on starting with a larger emergency fund and insurance instead of paying off all their debt. Their rationale is that in the event of a job loss or medical emergency, you can live off of an emergency fund or insurance, but if you’ve put all of your funds toward debt repayment, you may not be able to find a willing lender and be left in a dire position.

What this means for you:

Ultimately, it comes down to your personal circumstances. For example, if you are in a dual-income household with no dependents, and feel that in an emergency situation, you have family who would be able to help, paying off any high-interest debt rapidly would make sense as your emergency fund will earn lower interest. However, if you rely only on yourself for income and do not feel you have solid job security, holding a larger emergency fund likely makes sense. And if your debts are lower interest, you may find that even after saving an emergency fund, it makes sense to focus on the higher expected returns of investing, rather than rapidly paying off your mortgage or student loan.

2. Budgeting by category vs. simply automating savings:

Some experts, such as Tasha Cochran, are adamant about budgeting by category — making a budget for food, clothes, personal care, travel and more. Others, such as Paula Pant, simply set a savings rate, automate their savings amount and then allow themselves to spend the balance.

What this means for you:

If you’re struggling to save enough, start off by getting a sense of your spending by category through an app like Mint or YNAB. It may help you to think through what you truly value and what you can cut back your spending on. You may find it helpful to continue to budget by category in order to hold yourself accountable. However, if you find budgeting by category tedious and that you have an inherently frugal attitude toward spending, automating your savings amount may be all you need to remain financially stable and will free up your time for potentially higher value activities.

3. Cutting expenses vs. growing income:

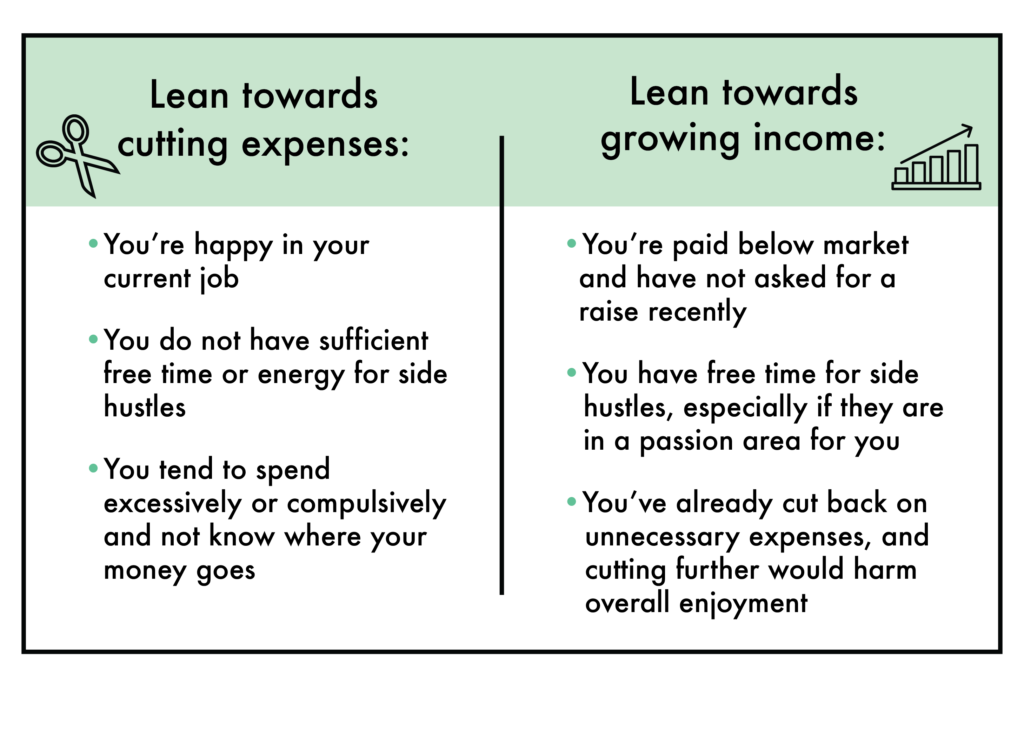

For years, personal finance was all about cutting expenses — with advisors such as the author of The Latte Factor admonishing any expenses that seem indulgent. However, experts such as Farnoosh Torabi began to communicate a different message: some people don’t have a spending problem. They have an income problem.

What this means for you:

If you have a fairly fixed income in a career that you’ve chosen for reasons other than money, such as teaching, it may make sense to focus your efforts on cutting expenses — unless you think you have the time and energy to take on a side hustle. However, if you earn below the average income in your area and feel that you’ve already taken all reasonable efforts to reduce your expenses, you may find that focusing your time on growing your income will be much more powerful than clipping coupons. Of course, telling people to grow their income can seem tone-deaf in an economy where the richest have the means to get richer, and jobs at the lower-rungs continue to be cut. But if you’re privileged enough to have the time or education to grow your income, whether through asking for a raise or taking dogs in your neighborhood for walks, you can have your latte and your retirement savings, too.

4. Rules of thumb vs. more nuance:

Financial news is not unlike any other news: bold headlines tend to get the attention. Quick rules of thumb can help writers make bold headlines and write a punchy story. You may have heard of some of these rules of thumb: you should have 1x your income saved for retirement by the time you’re 30, save 10-15% of your income for retirement, and spend no more than 30% of your income on housing.

What this means for you:

Rules of thumb can be helpful for quick guidance, but if you think you are in a unique circumstance, you should run your own numbers and potentially sit down with an actual financial advisor with a fiduciary duty. For instance, if you live somewhere like New York City, you may find you don’t need to keep your housing expenses to 30% of your income if your transportation expenses are much lower than the national average. If you went to graduate school, you may be “behind” in saving 1x your income for retirement, but by using a retirement calculator, find out you are on track based on your current savings rate and expenses.

*****

In the end, there’s only one rule that applies to everyone when it comes to personal finance: your mileage may vary. Reading expert advice can be helpful, but don’t beat yourself up if the way you find most useful to save is different than any given expert.

Shauna Theel works at the intersection of business operations and policy in Washington, D.C. She holds a B.A. from the University of California, Berkeley and a Master in Public Policy from Harvard University. While at Harvard, she took courses in Finance that helped drive her passion for how personal finance can empower people to make decisions that align with their values and dreams, and courses in Behavioral Science that taught her how to trick herself into saving more. With her background in sustainable transportation and energy, she is particularly interested in the intersection of personal finance and a sustainable lifestyle.

Image via Unsplash

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.