Confessions Of A Married Couple Paying $150,000 In Student Debt

This month, TFD is partnering with Credible to talk about how we get into debt, how we pay it back, and how we live better. We’ll be talking about our stories and testing out Credible for you, one number at a time.

The year was 2012, and I walked away from my (now) alma mater — Ramapo College Of New Jersey — with roughly $30k in student loan debt under my belt. I had a degree in graphic design/visual communication design, and was eager to FINALLY start my career and “real” life. Though $30k felt like a lot at the time, I was smack dab amongst the average graduating student, whose debt load was roughly $29,400 back in 2012. Fast-forward four years later, and I’ve got about $18,777 left to pay back on my loans. I’m making progress on it for sure, but damn does it feel like I’m s-l-o-w-l-y climbing up a mountain with a 50-pound backpack strapped to my shoulders. When I do one day arrive at the top and submit that final glorious loan payment (!), I’m going to shimmy my way to the nearest bar and order celebratory shots until I can no longer sing the words to “Take A Chance On Me.” Then, I’ll fall asleep peacefully knowing that I’ve shaken myself free from the tethers of #studentloandebt.

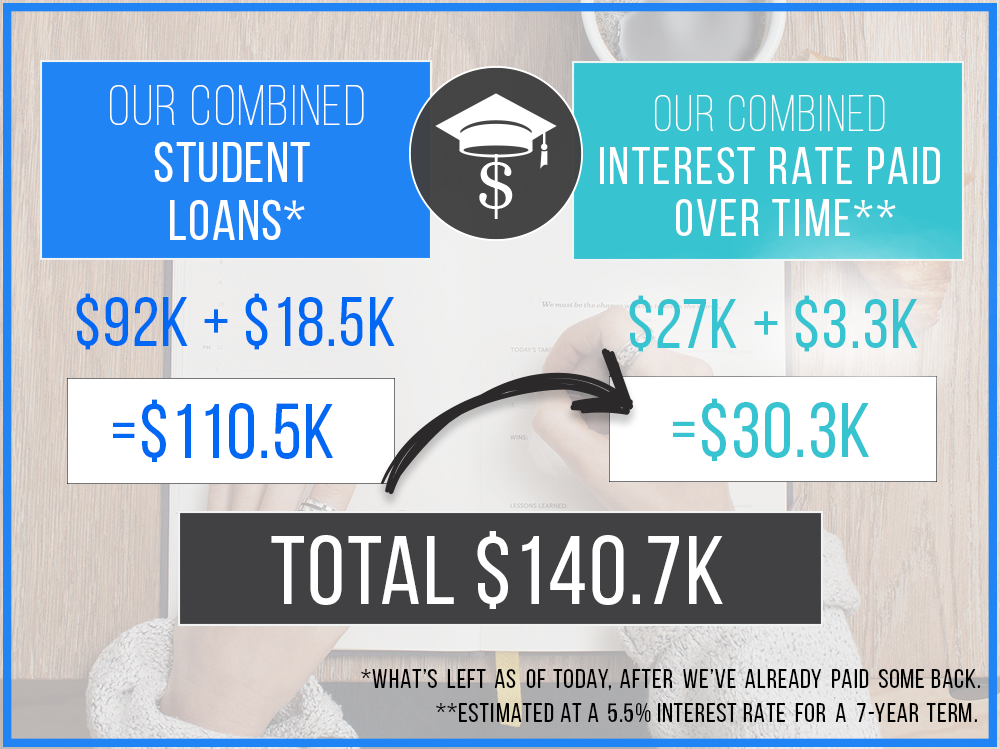

However, the reality is that I’ll wake up the next morning and remember that my husband still has a LOT of debt to pay off. He graduated college with $120k in student debt. For most people, that would be a death sentence — the equivalent of starting off your young adult life with a limb cut off. A loan that large could take nearly your entire life to pay back, especially when you calculate interest payments, which can add $$$ to your loan. For example:

We are both on fairly aggressive repayment plans, and fortunately, my partner was able to refinance, has a well-paying job, and got his loans down to a more manageable *swallows* $80k.

He’ll now be able to pay his loans off completely within the next seven years. Yes, it’s a shit-ton of money, but student loan debt is something we’ve both resigned ourselves to dealing with. When faced with debt this size, you just have to keep plugging along, keep making payments, and keep moving forward. And yes, handling our combined student debt has meant that we’ve had to make certain sacrifices, but what’s done is done, and there’s no use crying over spilled milk (as they say).

xxWith that said, each of us have looked into ways that we can make our student loan debt more manageable by reducing the overall cost of payback. For my husband, it meant refinancing at a lower interest rate and shrinking the period of time during which he has to pay down his loan, from 20 years to 10 years. For me, my objective for potentially refinancing my loan is similar: I want to lower the total amount I’ll pay over the life of the loan (as opposed to having the objective of say, going for a lower monthly payment.) A shorter pay back plan means you’ll typically pay a much lower total in interest over time.

Enter Credible. I first heard of Credible a few weeks back, and it’s a student loan refinancing marketplace, where you can compare a bunch of different options all at once. (Think of Credible like the Kayak of student loan refinancing — one simple search portal to see all your best options.) I decided to give the service a whirl and see if I could find a student loan refinancing option that suited my needs and made sense for my situation. Today, I’m going to briefly take you through my experience navigating the site as I find out exactly how it works. SIDE NOTE: For my old job, I used to write up reviews of websites from an art director/usability perspective, so forgive me if I veer into the ~aesthetics~ a bit too much. Heh.

FIRST IMPRESSIONS.

So, right from the get-go I thought the Credible site was pretty easy to navigate. (Also, the background is a very calming shade of blue, which can’t hurt when people are most likely coming to this site with pre-existing eLeVaTeD stress levels.) The landing page has three different main options to navigate through: student loan refinancing, applying for a private student loan, and applying for a personal loan. Once I started scrolling down, I noticed a claim that said: “132,240: People We Have Helped | $18,668 : Average Savings,” which I didn’t initially strike me as a lot of people and/or money, but I kept scrolling to find out how long Credible has been around. Solid choice of fonts, adorable illustrations, I enjoyed the animated video that explained what student loan refinancing is, and I found it helpful that the information is chunked out into different sections.

This all made it easy and enticing to keep scrolling through. One of the most important things to me is finding out whether or not something gets solid reviews from users, so even though they offered up a few different positive case studies, I decided to navigate away from the site to do some light research on what users think of Credible. Turns out it got an A+ rating from the Better Business Bureau (BBB.org), and a 9.4 from Trust Pilot. I also found out that you have to have at least $3,500 in loans to apply, and if your credit score is below 680, you’ll probably need a cosigner to refinance. Pretty rad, so I kept on clicking through.

I decided to go through the track for Student Loan Refinancing tab, since it was the most relevant and interesting to me — specifically, the section that talked about wanting to explore different rates. Since I’m a small business owner, the only thing that was tricky for me was having to provide a set annual income. As I was going through the various fields in the online form, I had some questions regarding what they meant and why they needed certain information. I was pleasantly surprised to see there were little highlighted click-through answers to some of my most pertinent questions, which were answered right there. After I was done filling them out, I was assured that submitting my request for rates wouldn’t affect my credit score, which was a HUGE relief. (One thing to remember about refinancing is that it will often require a hard credit check, which can lower your score if done too often. An awesome thing about Credible is that they can get you serious offers without doing a hard check or sending any of your information to lenders.)

SOME CONSIDERATIONS I HAD TO KEEP IN MIND.

When exploring student loan refinancing options (and reading about it in articles such as this), it’s important to keep in mind that each person’s situation will be different, depending on the type of loans they have. For example, I have a mix of federal subsidized and unsubsidized loans. If and when someone like me refinances from a federal loan program to private student loan program, it might mean that I lose out on some protections offered by the federal loan. These could include things like a grace period if I’m fired from my job and an income-based repayment plan. It’s important to do research and look into the way it can affect the status of your personal school loan, so you aren’t surprised by any changes in your loan details.

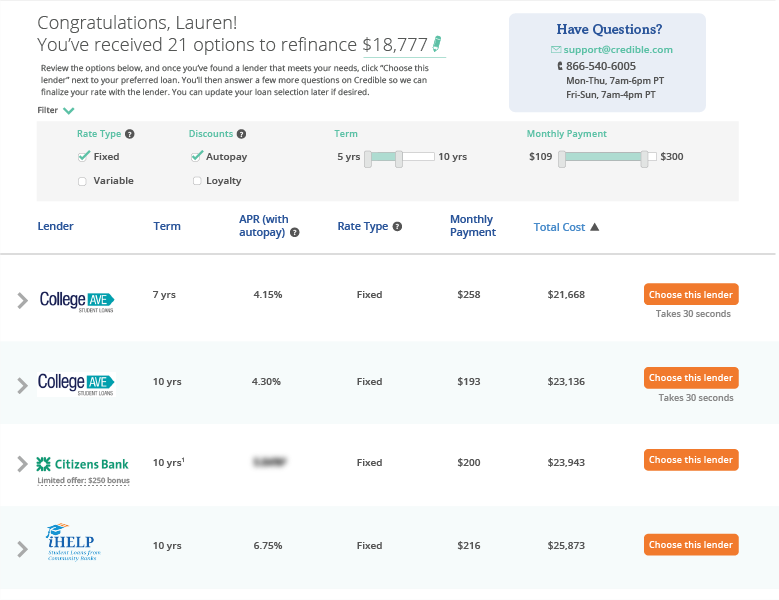

I’m currently on a 10-year repayment plan. Since I’ve already paid three years’ worth of it, I wanted to look at 7-year loans to make sure I didn’t extend the life of my loan. The Credible platform also made it really easy to see which loan refinancing option offered variable vs. fixed interest rates, which is an important consideration. Fixed interest rates are locked in, while variable rates can change over time.

OVERALL.

Make sure that you’re serious about student loan refinancing before you apply for a loan, since that will generate a hard inquiry on your credit report. You can check rates without affecting your credit score. I found Credible to be really useful, and I’ve screencapped what my options looked like once it generated by request. Check it out!

Image via Unsplash