The Average Credit Score By Age 30 (& What It Should Really Look Like)

The other day, a friend I was hanging out with shared a sweet little moment with me, which occurred via text between herself and another girl we both know. The (remote) friend had reached out to her with some good news about a very important financial milestone she just hit, and felt overjoyed about it. My reaction to hearing the news between the two was joyous, but fleeting because we were headed out of the door, and I was subsequently distracted. However, the reaction between the pair of them stayed with me for the next several days, and I kept thinking about it every once in awhile. You see, the woman had successfully raised her credit score after a lot of hard work, patience, and diligence. She raised it to a really impressive number, and even amidst the blur of a busy work day, I felt really happy for her. “What a uniquely special bond,” I thought; friends sharing their badass financial successes and milestones with each other. It’s the thought of interactions like those that fill me with warm ~fuzzies~ of pride, and I’m genuinely thrilled to know that the friends around me take their financial goals seriously.

Sharing our financial triumphs with one another, and amping each other up to reach them is exactly what we try and advocate for here on TFD. And, it feels especially nice to watch someone achieve something as significant as earning herself a soaringly-high credit score — even from the distant sidelines. For a long time I, myself, kept plugging away day-in and day-out to build up my own credit score, and I’ve always tried to do everything I could to make on-time payments consistently. Now that I’m getting older (and getting closer and closer to 30, gah!), I know it’s time to work my hardest at building the kind of financial flexibility I want for myself. To me, 30 always seemed like a huge turning point where I would rid myself of whatever irresponsible behavior I was clinging onto, and refuse to be an impediment to my financial health.

Simply put, a big part of that means having the best possible credit score. I want to do big things with my life, earn money to do the things I love, support stuff I believe in, and generally work super hard toward the goals I set for myself (a la Chelsea’s post from yesterday!). So, about a year ago, I went out of my way to learn as much as I possibly could about how to actually acquire my own credit score, so I could start making a real financial plan and set goals for myself. (Link to different ways you can go about getting your score in a not-damaging way.) It turns out that there are a ridiculous number of credit-score related articles online, all filled with data, charts, and graphics that cover credit scores, and the average age at which a person builds X score. Since I’m 26 years old, and have now aged out of the good ol’ 18-24 bracket, I now look to the 25-34 age bracket (which serves as a sobering reminder of just how fast my 20s are going). So, 30 might seem to be an arbitrary age, but it’s not for me.

What’s a good credit score?

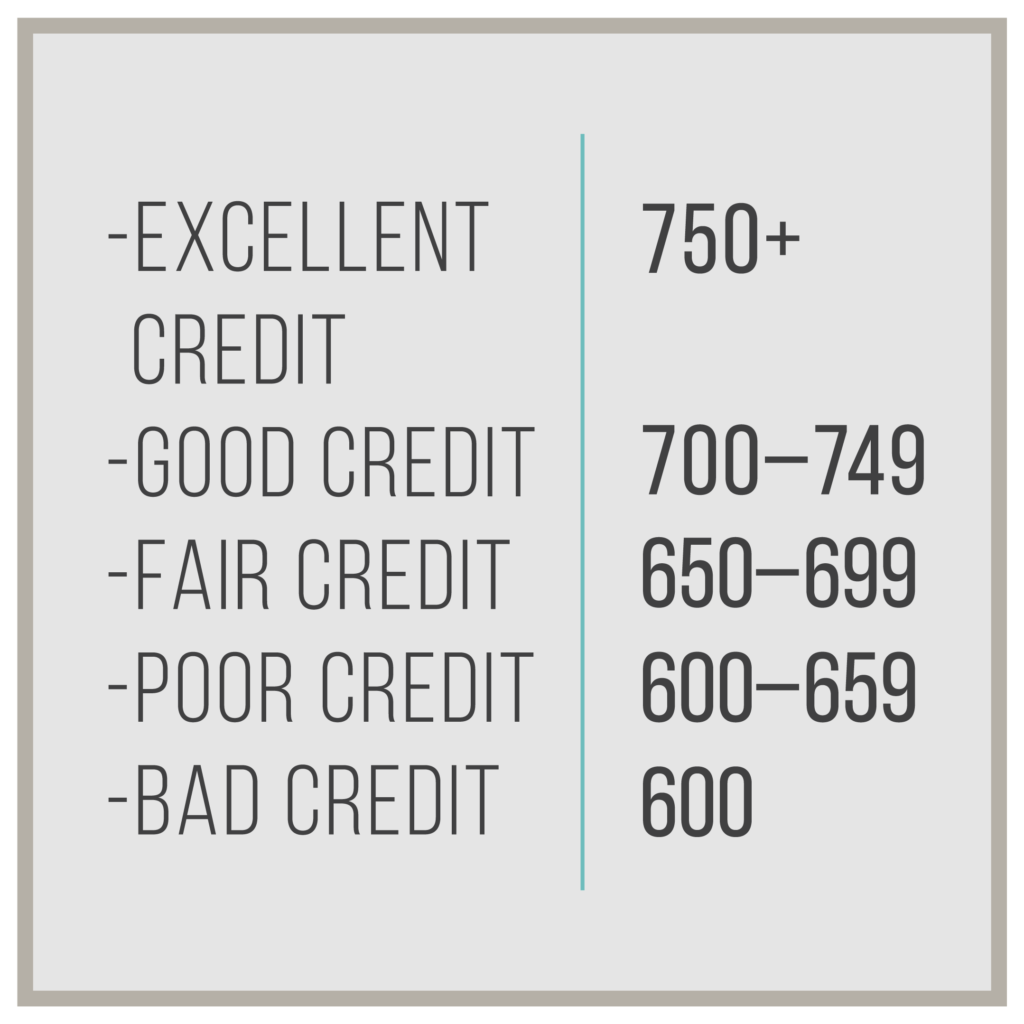

First off, it’s important to understand how your credit score is calculated, and what your credit score means on a scale of “bad” to “good.” This info will help you contextualize your own number. Once you have it, take a look at the chart below to gauge how well you’re doing.

Chart adapted from Credit & The Simple Dollar

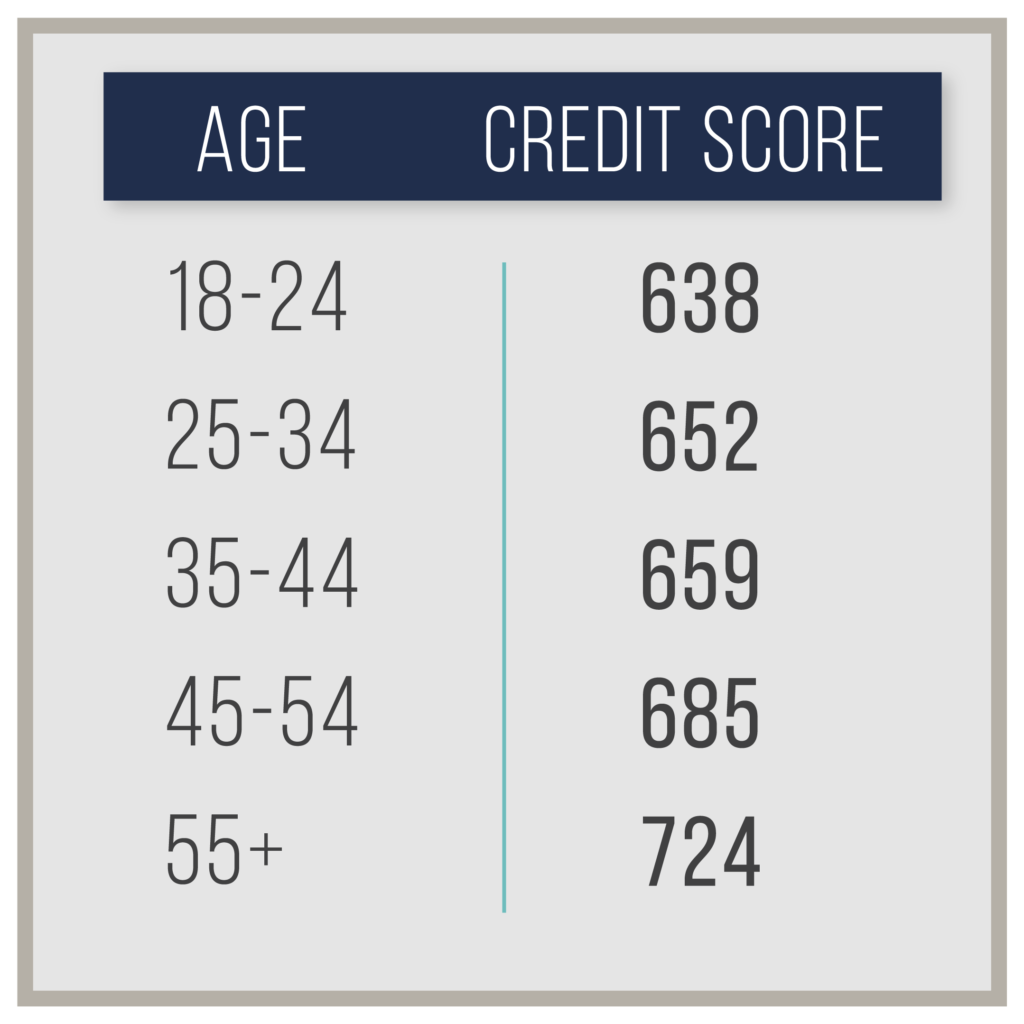

Once you know what you’re looking at, you can then compare your own score to the score of your peers to see if you’re on track, behind, or ahead of the curve. I looked into the average scores of different age brackets to see where I, myself, fell on the spectrum. Take a look at where the average 30-year-old sits on the credit-score spectrum.

Chart adapted from Investopedia

As you can see, the average credit score of a 30-year-old falls between 640 and 660 — It’s actually a little higher than I thought. If you are aligned with the average score of a 30-year old, than you’re right there along with nearly 24% of Americans. An article on The Simple Dollar explains various credit scores as a series of averages across the U.S., saying, “As we can see, a combined 24% of Americans had poor FICO scores below 600, while 22.9% were holding the middle ground between 600 and 699. Happily, more than 53% of Americans had good or excellent scores of 700 or above.”

Knowing that facts gives you the tools to take the information you have and more forward with a concrete #plan for increasing your credit score after college. Does your score need a little TLC, and what can you do about it if so?

If you aren’t on track (or haven’t yet met) the ideal score for someone aged 30 years, there are a number of useful strategies you can use to turn your score around, and make it higher and stronger. Below is a simple overview of the most common and effective strategies for doing so, which are:

Keeping under 30% credit utilization:

According to an article on Credit Karma, “Our data suggests an even better goal is to use your credit some, but keep the utilization rate under 20%. Creditors want to see proof that you can manage credit wisely–something you can’t do without using the credit you’re granted.” So, it seems like not needing to tap into all available credit is a good way to show lenders that you’re responsible. It’s also worth noting that you should try to pay off your balance in full each month so that you avoid paying any interest on charges.

Keeping hard inquiries to a minimum:

What is a “hard inquiry” you ask? MyFico.com says, “Hard inquiries are inquiries where a potential lender is reviewing your credit because you’ve applied for credit with them. These include credit checks when you’ve applied for an auto loan, mortgage or credit card.” Asking for too many of these hard credit checks will reduce your credit score a few points at a time, more specifically “one additional credit inquiry will take less than five points off a FICO Scores.” To lenders, hard inquires typically signal you’re taking on some kind of additional financial obligation, which might affect your ability to pay back other debts.

Considering the number of accounts you have open:

Apparently, having multiple and varied accounts is beneficial to your credit score. Experts suggest you shouldn’t close older accounts, saying “15% of your credit score hinges on the length of your credit history. Once you see your credit report, it might be tempting to close those old, unused accounts, but that can actually hurt your score.” You want to keep them open and show as much of your credit history as possible.

If your credit score doesn’t reflect what the average 30-something has, it’s time to take action. But remember, it’s never too late to start making positive changes that will affect you for years to come. That one brief interaction between my two friends reminded me of the real value in having a financial buddy in your inner circle. It reminded me that when we are there for one another, when we build communities of real support, and when we encourage our friends and keep each other in check, we can get shit done in a BIG way. We can do the things that might have once seemed impossible to our past selves, and we can do it with a little help from our Financially Savvy FriendsTM. (<– lel)

Image via Unsplash