How To Make A Budget When You’ve Literally Never Thought About Money Before

You just woke up on a Sunday morning after spending another Saturday night out late drinking and eating with your best pals. You’re about to open the group chat and see who’s down for getting some late-morning, greasy brekkie when your eyes glance over to your kitchen counter that is currently being used a storage space for your incoming mail. Phone bill, Internet bill, credit card statement, etc. The envelopes are piling up, and once you realize the first of the month is just around the corner, you suddenly have a weird feeling in your stomach that you don’t think is caused by your 2 AM McDonald’s binge.

“Will I have enough money this month to cover my expenses?” you think. You vaguely remember a coworker mentioning her monthly budget the other day and, to your surprise, your thoughts are no longer on the potential eggs benedict and large coffee you could be eating, but rather, “How do I create a budget for myself?”

How do you start a budget?

Starting a budget from scratch can be daunting. Checking your bank balance can be a messy ordeal itself, and now on top of that, you have to search out the best budget app or a budget template, but when you do you’re overwhelmed with features and colors and pie charts and graphs and potential emails that will tell you you’re overspending in all your categories (again).

Before getting involved with any online app service, I recommend getting to know your own finances by creating a simple budget spreadsheet.

Some Basic Accounting Principles

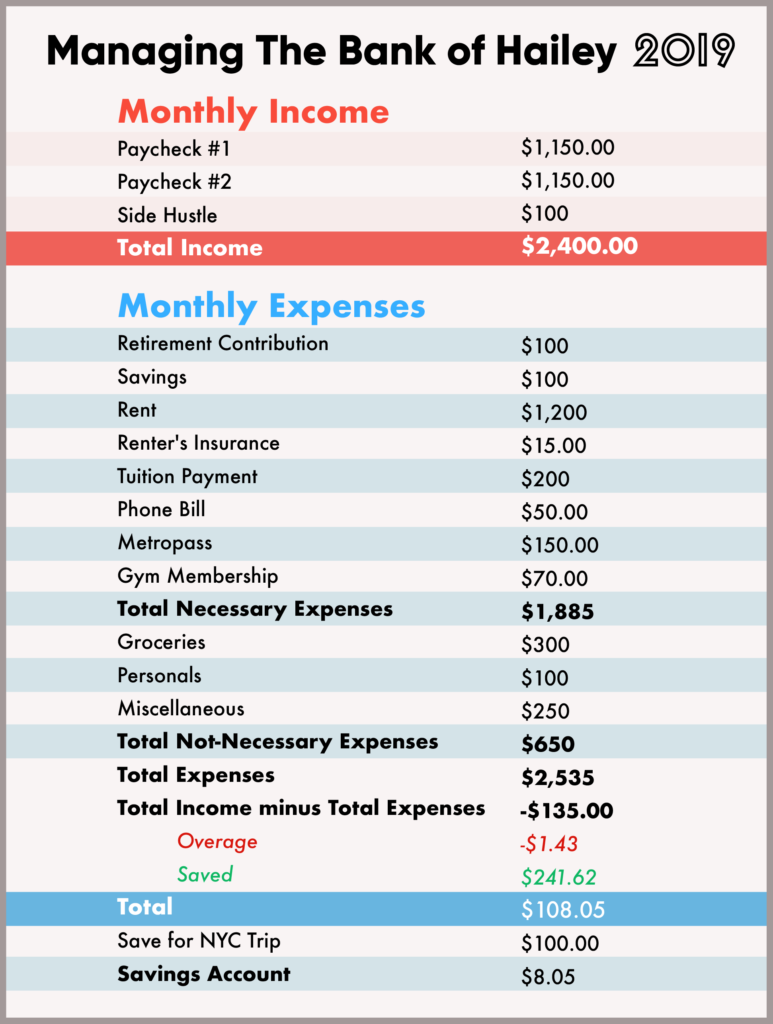

My monthly budget follows the design of a simple accounting income statement. For those of you who have never taken an accounting class before, the concept is pretty simple. An Income Statement is a report of a company’s revenue minus their expenses, to find their net income.

In human words, your monthly paychecks minus your monthly spending equals what you have leftover at the month. To start, create two lists: a list of your necessary expenses and a list of your not-necessary expenses. Necessary expenses are those you can’t get around paying. They are fixed amounts you pay every month. For me, my lists look like this:

Necessary Expenses:

- RRSP Contribution (retirement savings — in the U.S., this would be something like a 401k or IRA)

- TFSA Contribution (other long-term savings — in the U.S., the closest thing might be a Roth IRA, though it is more limited than a Canadian TFSA; this part of your budget might also go to something like a high-yield savings account for your emergency fund)

- Rent

- Renter’s Insurance

- Tuition Payment

- Phone Bill

- Metropass

- Gym Membership

Not-Necessary Expenses:

- Groceries

- Personals (toiletries, self-care, etc)

- Miscellaneous (restaurants, theatre tickets, etc.)

Find the sum of your necessary expenses and add that to the sum of your not-necessary expenses, to find your total expenses. Your total expenses should always be less, or, if need-be, equal to your monthly income. If your expenses are greater than your income, you will be in a deficit at the end of every month. The goal here is to find budget amounts that work for you and your lifestyle, but don’t cause you stress or worry. For example, my groceries budget is $300 month, which breaks down to $75 a week.

On my spreadsheet, I create tables for my not-necessary expenses that I update when I spend in that category, to ensure I am staying on track for the monthly amount I’ve allowed myself. Below is a personal spreadsheet budget example, complete with some fake dollar amounts to show how the formulas work.

Practice Makes Perfect

Once you’ve tracked your spending for a month or two, you may feel brave enough to venture away from the spreadsheet to one of the highly favored apps that are out there. But I recommend steadily tracking your expenses so you really see where it is your money is going each week. You shouldn’t be feeling down on yourself if in the first while you find that you’re consistently going over your ideal budget.

Rather, use this as a way to step back and potentially evaluate and make changes to your different categories. Are you always going over on your Restaurants category but consistently have large amounts left over in your Groceries section? Maybe next month, change those budgets and lower your grocery limit and heighten your restaurant limit. There is not one “right amount” everyone should allocate to categories. Your allocations can also change month-to-month. Oh, your birthday is in June and you know Grandma is giving you an extra $100 that month? Add it to your income, and then up your Shopping category!

Budgeting is not an exact science, but I promise once you start writing down every dollar you spend, it’s only going to get easier and clearer as time goes on.

Here are some other budgeting resources for newbies:

- How to make a budget spreadsheet

- The 3-step budgeting process that helped me break the paycheck-to-paycheck cycle

- The one number you should know even if you hate budgeting

Hailey is a homebody. Follow her social medias @hailmast.

Image via Unsplash

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.