The Exact System I Used To Save Nearly 40% Of My Take-Home Pay Last Month

For the past few years, I’ve had a decent system in place for saving money. I would pay out expenses like rent and other bills at the beginning of each month, put all my spending on my credit card, save a set amount in my retirement account, and save whatever was left over in my online savings account. I’d gotten used to little ways I knew were easiest for me to spend money — keeping “going out” to just once or twice a week, hosting people for dinner or brunch instead of happy hours, bringing my lunch, only shopping sales — and I didn’t feel like I had to monitor my spending. I was saving what I felt like was enough, and I was enjoying my life otherwise.

Then, sometime between September and December, the system stopped working.

In fact, between December and January, I spent so much that I ended up unable to make my monthly $500 deposit into my Roth IRA (the 2019 annual contribution limit is $6,000). I finally maxed out my annual retirement contributions in 2018, so missing my first payment the first month of the next year was completely discouraging — and I knew I could do better.

I could give all kinds of excuses for why my spending got out of control, but the simple truth is that I let my overall expenses go up without making any significant changes to my habits. Peter and I got engaged, and even though my parents are covering most of the wedding, the few things we took financial responsibility for started adding up quickly (literally who knew?). I realized what I normally could count on to save at the end of each month started going to things like a deposit for the wedding photographer or paying for save-the-dates…and then, because I was saving so much less, I started losing motivation to put anything into savings.

I knew this had to change, but I am just not the kind of person who can stick to a super-detailed budget spreadsheet. However, we have so many goals we need to save for (including but not limited to the wedding/honeymoon) that I really needed to figure something out. I luckily came up with a planner-based system that I was able to stick to, and I saved more last month than I did any month last year, about 40% of my net income! (I’m set to keep it up this month, too!) It’s not exactly, um, simple, but as a pen and paper person, it really works for me.

Before I dive in, here are a few clarifications and caveats:

- I put all my expenses on my credit card (except my rent and utilities) because I know myself and my limits well enough that I will always keep that spending within my discretionary income. This was certainly not always the case for me, and I definitely don’t recommend it for everyone. (Plus, I like being able to track all my expenses in one place, and I have a card with a really great rewards system, so I try my best to take advantage.)

- I budget according to my credit card billing cycle, which starts and ends around the 15th of each month.

- This is a LOT easier to do now that I have “real” income than it would have been when I was a 22-year-old temp making $15 an hour in NYC. I’m very fortunate that my overall living costs haven’t really gone up in the last five years, too.

- I don’t have any debt that I’m currently paying off.

- While I wrote all of this down in my planner, you could definitely do the same thing in a Google doc/Excel sheet and use calendar reminders on your phone or something. I think tracking is easiest to do by hand, but that’s definitely not everyone’s preference!

- Honestly, a huge part of this is having a cute planner and colorful pens. Makes tracking expenses a lot more fun.

Here’s a step-by-step look at how I finally figured out how to save 40% of my net income:

1. I calculated my expected income after taxes.

This part is simple! Most of my income comes from TFD, but I also added up what I was expecting to earn from side hustles, minus the 30% I automatically save for taxes. (For reference, any contractor income goes into a separate bank account before I transfer my post-tax savings to my personal account — I make sure I never see money earmarked for taxes in my personal checking account, and I’d recommend this for any freelancer.) I kept the estimates conservative, just in case.

2. I added up all of my recurring monthly expenses and subtracted the sum from my total income.

This included literally everything from rent and bills to my monthly subway pass to my gym membership to my $4/month subscription to Bon Appétit. Combing through all of these also helped me realize what was no longer worth paying for (it made me immediately cancel a couple of recurring subscriptions).

3. I wrote down all of my anticipated expenses for the month and subtracted them from my total.

Last month, I was going to Las Vegas with friends for a few days to see Lady Gaga – EXTREMELY worth it, though I have no intention of returning maybe ever. I had already paid for my plane ticket, hotel room, and concert ticket months ago, so I just needed to account for food/drink spending and transportation costs. We were all on a budget, so I knew I wouldn’t spend a super-indulgent amount, but I overestimated just to give myself a bit of wiggle room. I added up what I assumed I’d end up spending and subtracted that from my total. (I also made sure to track my spending each day I was there so that I didn’t accidentally go over budget and throw a wrench in the rest of my system.)

4. I subtracted the amount I wanted to save, and then came up with my “discretionary spending” total.

Last month, I aimed to save $1,000 for two months’ worth of retirement contributions, plus extra for wedding and honeymoon expenses. I subtracted this from my total and came up with a “discretionary spending” amount. To put it simply, here’s the formula I used to get to this total:

Income – Month’s Expenses – Savings = Discretionary Spending

Now, as I mentioned, I don’t stick to specific budget categories for things like groceries, entertainment, or dining out. These all simply fall into my discretionary spending total. This makes my “budget” feel a lot less restrictive because I definitely have some weeks when I make almost every meal at home, but other weeks when I’m stressed and end up ordering Seamless three times. After accounting for my expenses and savings for the month, I was left with a number that I could spend any way I wanted. In order to stick to that number, though, I had to get a little creative.

5. I picked two days a week to designate as “no-spend” days, and marked them as such in my planner. Then, I calculated my daily “allowance” for my regular-spending days.

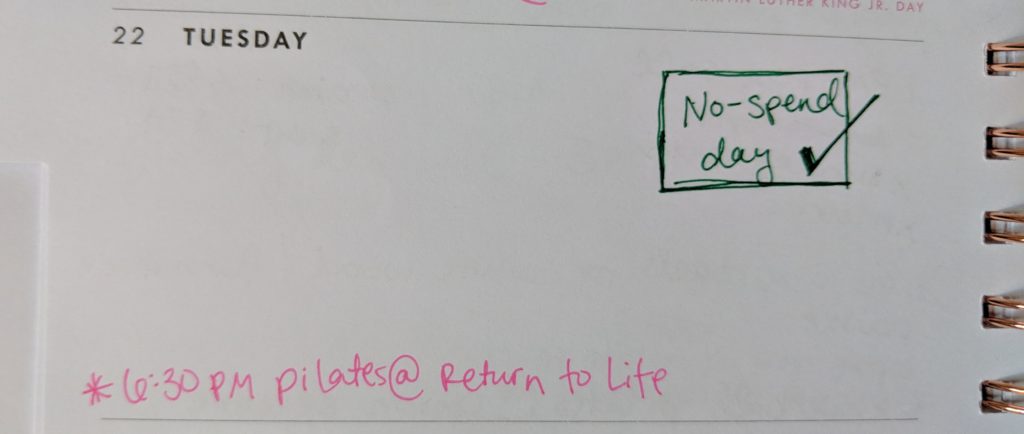

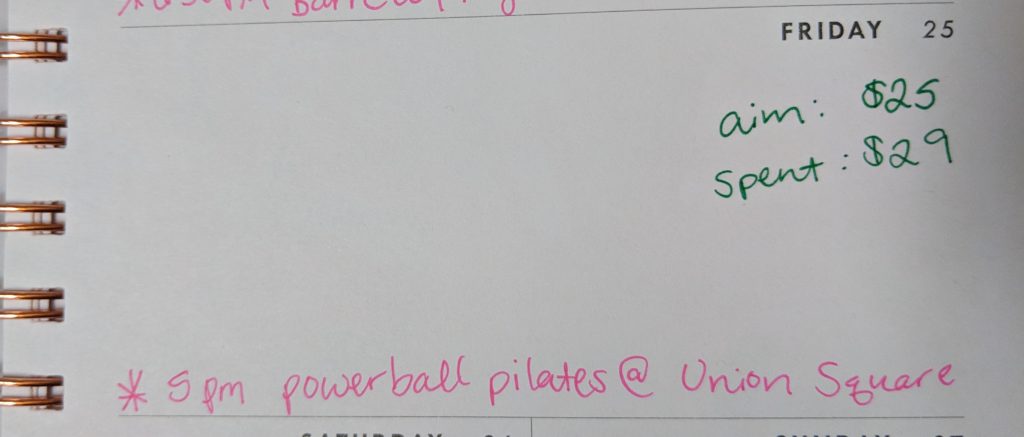

At first, I thought I’d divide my discretionary spending total by the number of days in the month to give myself a daily “allowance.” But the number I came up with seemed too low to be realistic most days, even just considering how much I spend on a normal grocery trip. I decided to designate two days a week as “no-spend” days, where I would rely on eating already-purchased groceries or leftovers, using my already-paid-for transit pass, staying in or only doing free activities, etc. (of course, bills and expected recurring charges that happened to fall on those days wouldn’t count towards my discretionary spending). Then, I divided my total discretionary spending number by the remaining days left. I then wrote either “no-spend day” or my daily allowance on each day’s entry:

6. I tracked exactly how much I spent each day.

As you can see in the photos above, I also recorded my actual spend for each day, including whether or not I stuck with my no-spend goal (hence the little checkmark in the first picture). This is honestly the only part where using my planner was crucial to the process. When I went over budget for a day, I’d have to subtract the overage amount from a different day. So even that tiny $4 overage on the 25th had to be subtracted from a future day’s spending allowance. This helped me stay on track for the entire month because I only had to look at my planner each morning to know what I’d allotted for that day’s spending.

*****

Holding myself to this system helped me save money because it basically forced me to take a close look at my daily spending habits. Since I was holding myself to a relatively strict allowance, I was much less likely to randomly online shop thanks to a tempting 40% off sale (my kryptonite). Even though nothing was “off limits” when it came to my spending, I started being much more mindful about where my money was actually going. I know this is a much more involved form of budgeting than I’ve ever been able to stick with in the past, and it is a little time-consuming — but really only at the beginning of the month, when I’m planning everything out. Otherwise, it’s just a simple way I can take it one day at a time and still stay on budget.

If you’ve come up with a unique system that helps you stay on track, I’d love to hear about it, so be sure to leave a comment!

Holly is the Executive Editor of TheFinancialDiet.com. Follow her on Twitter here, or send her your ideas at holly@thefinancialdiet.com!

Image via Unsplash

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.