What Your “Net Worth” Is, Why You Should Always Know It, & How To Calculate It

As someone new to the world of personal finance, I’ve spent the last couple of years learning a lot of information. 401(k) rollovers, high-interest savings accounts, budgeting apps, side hustles, the list goes on. I’ve accomplished so much, but I didn’t get my hands fully around my financial strategy until earlier this year, when I learned about net worth and calculated mine for the first time.

What is net worth?

At its most basic, net worth is an indicator of your financial status. It can help you see what’s coming in and what’s going out, and give you the information you need to make better choices with your money. For example, do you have enough money in your emergency savings? Can you actually afford to buy a home? Are you making choices that improve your worth or decrease it?

Before we go any further, I want to emphasize that there is an enormous difference between net worth and value — your net worth has absolutely zero bearing on your value as a person. It’s strictly a way to understand your financial foundation so you can make the right decisions for yourself.

Calculating your net worth

Unlike many other financial calculations, this one’s pretty easy:

Your assets (what you own) – your liabilities (what you owe) = net worth

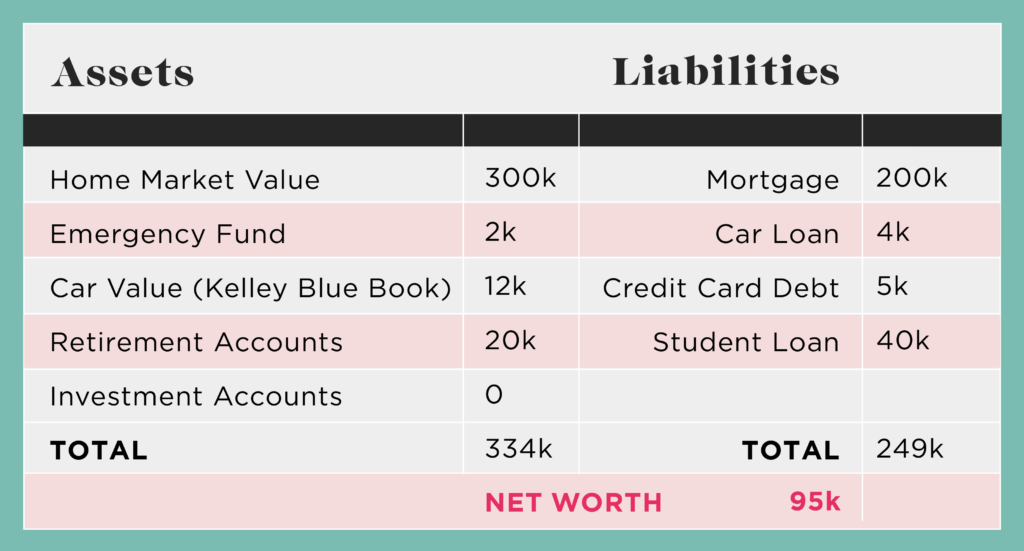

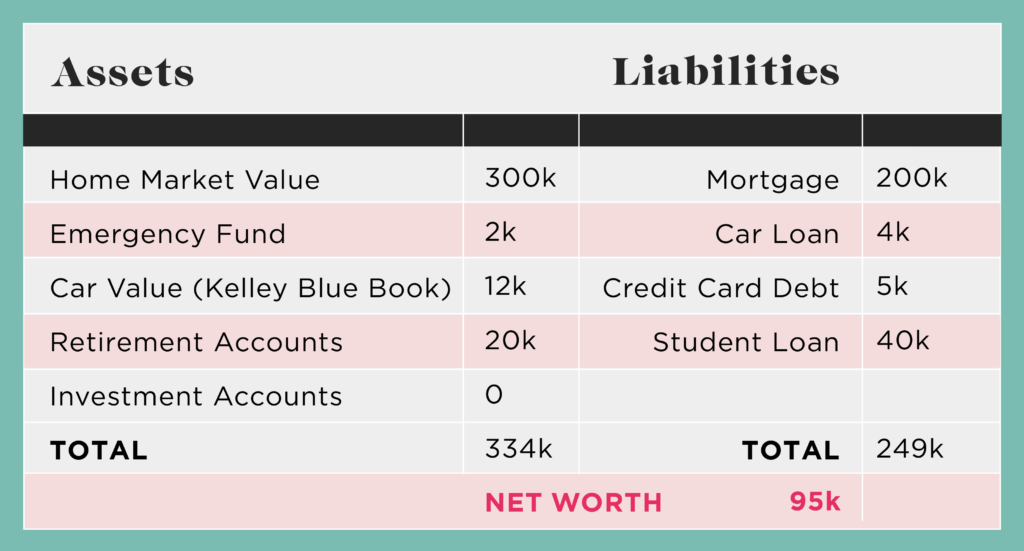

Here’s what this could look like (numbers totally made up for illustrative purposes):

Your first goal should be a positive net worth, which I’ve got in this scenario. Your second goal should be to have a net worth equal to one year’s gross pay — if your salary is $75,000, your net worth should be at least that as well. I run this equation every quarter and keep track of my totals in a Google Sheet, but you can check on your net worth as often as you want. I definitely recommend updating it after reaching a financial goal, like funding your emergency savings or paying off a debt. Take that update as an opportunity to celebrate meeting your financial goals.

If this is the moment when you feel yourself starting to panic, take a breath. Your numbers may be vastly different, and your net worth may actually be negative. The point of this exercise is to find out where you are today so you can make a plan to get to where you want to be. Your financial life will ebb and flow: you’ll pay off and take on new debt, the stock market will do whatever it does, you may get laid off or take a pay cut in trade for a job that makes you happier. As long as your net worth trends up over time, you’re on the right track. You won’t get to where you want to be today, or tomorrow — but knowing your net worth now is the next step to reaching your goals.

Digging deeper

I’ve been rambling a lot about net worth, but the truth is, that total may not actually be as important as the numbers that make it up. A positive, upward-trending net worth is awesome. But you can identify all kinds of financial opportunities and traps by looking at the individual pieces. Let’s check out our imaginary numbers again:

I’ve got a positive net worth, but look at my emergency fund. On average, it takes an unemployed person a little over three months to find a new job — is $2,000 enough to cover my expenses and debt payments if I were to get laid off and spend three months with no income? Very likely not.

When I look at the numbers this way, it’s easy to see what my next step should be: beef up my emergency fund so it’s got enough to cover multiple months of my expenses and debt payments. Not only will this make me more financially secure in case of emergency, but it will also increase my overall net worth. Win-win! Checking over on the Liabilities side, I’m seeing some debt I should probably be focused on paying down. The average new credit card has a 16.71% interest rate, which means the longer it sits there, the more I pay. Time to send that $5k the way of the popcorn shirt.

By keeping a close eye on your net worth and the numbers that contribute to it, you can set goals that make sense for your needs and will improve your financial security over time.

Keep moving forward

I first calculated my net worth in April 2018. I’m incredibly blessed to have few liabilities, but my assets aren’t where I want them to be. And that’s okay! Thanks to my net worth tracker, I know where my opportunities lie. Over the next year, I’ll be focusing on building up my savings (for a house down payment) and paying down more of my car loan. I’m probably a couple years away from having my net worth match my gross pay, but at least I have a plan for getting there.

Mastering your financial life is entirely about knowledge — how can you be expected to make the right decisions for yourself if you don’t have the right information? Your net worth is just a piece of your overall financial picture and plans. However, it’s a foundational piece, one that has the power to better inform every other decision you make with your money. Calculate it and figure out what you can do to consistently take it in a positive direction. Your future self will thank you.

Amy is trying her best to read every book ever written. She takes breaks from this endeavor to work, play video games with her husband, and obsess over to-do lists. Say hello on Twitter or Instagram.

Image via Unsplash

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.