4 Professional & Financial Intentions To Set For The Rest Of The Year

This article is created in sponsorship with Squarespace.

November caught me by surprise this year. One minute I was minding my own business, admiring the fall foliage and turning a blind eye to my neighbors’ truly horrifying Halloween décor, and then suddenly Thanksgiving was around the corner. Being startled by the passage of linear time has rendered me reflective.

Around this time in 2020, I was doing my best to hold a dead sprint through the end of the year. I was desperate for January, struggling to get there as fast as I could, convinced that everything would change when the clock struck midnight and we could leave 2020 behind. Needless to say, I had entirely too much faith in the power of a new year, but I doubt I was the only one operating under this hopeful delusion.

I don’t feel the same way this year. 2021 has not been for the faint of heart, to be sure, but I’m not in such a hurry to watch it fade in the rearview mirror. My life changed dramatically in 2021, for the better, and I want to honor this season of change by making these last two months count. And I’m formally inviting you to join me.

We’ve got enough space between now and the New Year to make some pretty serious headway in our careers and our finances. So, in partnership with Squarespace, let’s hit “pause” for a second and make a plan to squeeze as much value as we can out of these final months of 2021. Here are four intentions to consider for the rest of the year.

Intention #1: Make a short-term savings plan so you can comfortably afford holiday gifts—and maybe a cute festive outfit.

It goes without saying that presents don’t have to be expensive to be special, but holiday gifts still represent a one-off expense that may not fit in your usual budget. It sucks when the joy of giving your mom a beautiful scarf is dulled by the pain of what the purchase did to your checking account.

Take a few minutes to figure out how to earn or save a little extra this month so you can buy gifts without worrying. If you skip out on just one restaurant meal a week, that’s easily over $100 saved by Thanksgiving—and that’s just one idea. Start now, and you’ll have a tidy little nest egg for holiday shopping.

If you’re feeling ambitious, add some extra money to your goal so you can treat yourself to a cute holiday outfit or accessory. Just make sure you buy it early in the season so you can wear the hell out of it before January 2 hits and we leave Sparkly Season behind us.

One final intention to consider: Don’t just start saving early. Start shopping early. All signs point to another year of the global supply chain being absolutely bananas, so don’t wait until the last minute!

Intention #2: Finally, set up your website.

Social media has its merits, but if you really want to take ownership of your online presence, you need a website. If you want to attract and maintain an audience, a website lets you do exactly that without the vulnerability of relying on another platform. (Remember the Great Facebook Outage of 2021? Pretty scary stuff if that’s your only way to reach your people.)

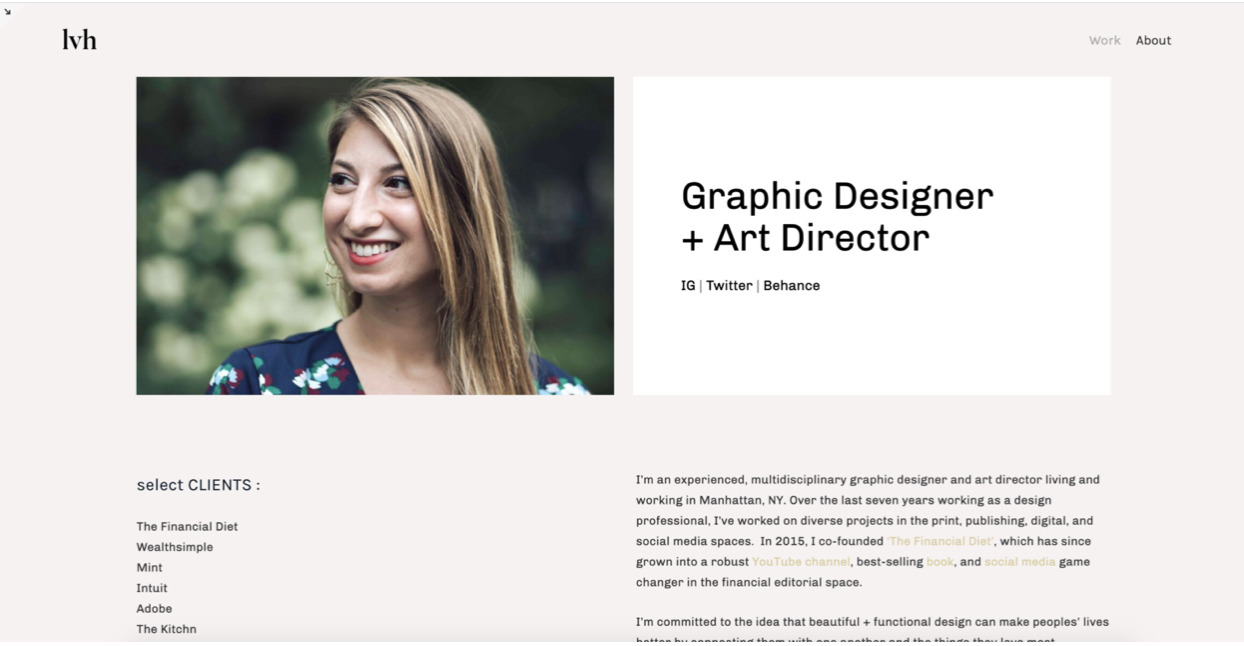

Plus, search engine optimization (SEO) actually is pretty important if you have an online presence. You can boost the search value of your own name (what a time to be alive) by creating a good website that showcases you, your portfolio, and your mad skills.

For me, the main barrier to entry is all the back-end admin. Buying a domain, finding a web hosting service, and integrating with the actual web design sounds about as fun as a root canal. I’d much prefer a one-stop-shop that can do all that stuff for me so I can focus my energy on picking cute fonts.

Thankfully, such a thing does exist: Squarespace. They make the technical stuff extremely easy, so you don’t have to be overwhelmed with coding or registering anything. You need way less than two months to set up a really nice Squarespace website, so it’s a totally doable intention to set for the end of the year.

Squarespace also has great SEO tools that are easy to use, so you don’t need to understand what “search engine crawling” means to get people to visit your website. Click here to read our designer Lauren’s step-by-step guide to creating a chic, professional Squarespace website in no time, and check out her own beautifully designed website below.

Intention #3: Review the professional development goals you set at the beginning of the year.

I am wildly guilty of forgetting about my professional goals five minutes after I emailed them to my boss in January. (Sorry, Todd.) I’m also a child of the Great Resignation and quit my job earlier this year (lol, sorry, Todd), which means my primary professional intention has simply been “earn enough money to pay rent and bankroll my cat’s baller lifestyle.” But now that I’m pulling a steady income and getting in the freelance groove, I’m starting to think about loftier professional aspirations.

Now is a great time to dig out your 2021 professional goals again and see where you stand. Are you still excited about them? Is there one you really want to accomplish by the end of the year? Or is there something else you want to do that will give your career a boost?

Think about what you can reasonably accomplish in just two months. Maybe you’d like to earn a particular certification, finish a special project, or apply to join a professional organization. Take stock of what you need to meet that goal and put a plan in writing. Two months feels fast, but you can get a lot done in that time. Take advantage of it.

Intention #4: Set up that account you’ve been meaning to open.

We’ve all got one, right? That savings account for your future wedding, a brokerage account or a Roth IRA so you can start investing, or maybe an extra checking account to stash your freelance tax money. Yes, the process can be annoying, but the inconvenience is not significant enough to merit delay into a new year.

Think of it this way: Every day you delay, you pay the price of lost growth potential. I put off opening my Roth IRA for months because I thought it would be a huge pain, and it literally took five minutes. This will go down in history as the most expensive procrastination of my life. Imagine how much more money I’d have in there if I hadn’t put it off due to unfounded fear. The thought haunts me.

Be ye not so stupid as me. Whether it’s a Roth IRA, a brokerage account, or a savings account for something special, block off 30 minutes and get it done. If doing it yourself freaks you out, make an appointment with someone at your bank or financial services company and get them to do it for you. That’s literally their job, and in my experience, they’re always very friendly and helpful. Plus there’s something comforting about having a go-to person you can call if you have a question.

****

As my bastardization of the saying goes, the time is going to pass anyway, so you might as well do the thing. 2022 is going to be here before we know it, and wouldn’t you like to welcome it with the confidence of knowing you finished 2021 with a bang, rather than wishing you’d done something special with this time? Set your intentions now, and you’ll have ample space to bring them to life as the year comes to a close.

If you’re ready to get started building your own beautiful professional website, head to Squarespace.com for a free trial. With our offer code “FINANCIALDIET,” you can save 10% off your first purchase of any website or domain.

Maggie is a freelance writer, editor, and content strategist living in Akron, Ohio. You can see what she’s making on Instagram @maggieolson.

Image via Unsplash