The Simple Tracking System That Helps Me Save More, While Making Less (+Pics)

You can’t manage what you don’t track.

For years, I have tried — and failed — to live up to the standards of savings targets and aggressive debt repayment plans, all at the expense of enjoying life a little less, and increasing my stress.

I started my financial warfare with student loans, which I eventually paid off, only to replace said payments with car loans and other consumer debt. This was mostly because I’d fallen into the habit of to using credit cards to pretty much pay for everything, having had the bulk of my income go towards student loans, in the past.

Then last year, I replaced my aggressive debt pay-downs with saving money instead, while making smaller payments towards my outstanding accounts. I was preparing my family for a career change (my husband had taken on a new job role), so I wanted to ensure we were prepared for any financial uncertainties. Until then, the most money I’d ever stored away was a small savings pool for emergencies.

However, when the pandemic started, schools and daycares closed, and my first challenge was figuring out childcare for my two sons. Next, the job market crashed, and we were uncertain whether we’d have any income at all. Thankfully, we did not lose our jobs and I didn’t have to exit the workforce to be at home with my children full-time. Instead, I was extended the option to work remotely, without any income loss. And while fortunate to have kept our jobs, my husband, on the other hand, took a 50% pay cut.

At that point, my main concern was figuring out what our finances were going to look like on our reduced household income, as well as how long our savings could sustain and hold us over, for the rest. I also came to terms with the fact that, making minimum payments was still considered paying off my debts, and that was okay, too. My new budget plan was set up in a matter of minutes, and allowed me to figure out what our new spending habits should look like, on our reduced income.

Here are four important steps I took to set up a budget that helped me successfully navigate the global pandemic:

-

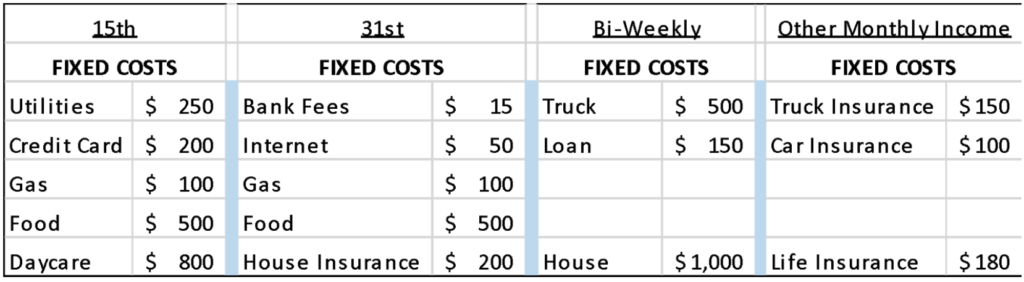

Calculate Fixed Costs

Fixed Costs are anything I could not eliminate without doing physical or financial harm to my family or myself. Necessities like housing, debt payments, insurance costs, and food. In my case, daycare is also essential for me to work and make an income (although during the pandemic, I was able to eliminate this cost while working at home and caring for my children, which was an extra bonus). I did not include the portion of a payment that is on an accelerated schedule or if I was paying more than the minimums.

For starters, inserted all my automatic debt repayments at the lowest payment and then added the accelerated portion separately (see: Variable Costs below). I have always separated my budget by each paycheck; what I had to adjust was my husband’s income by minus 50% of the previous amount. Since my income is less likely to fluctuate than my husband’s, I grouped all the main fixed expenses on my bi-weekly salary.

-

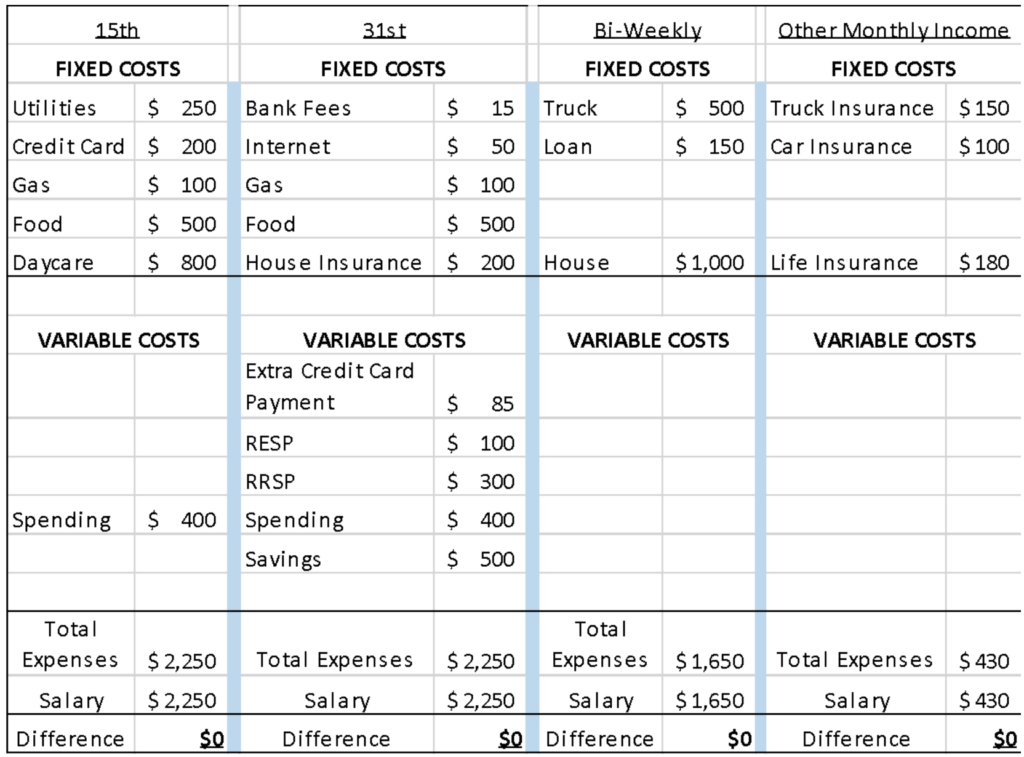

Calculate Variable Costs

Variable Costs include everything that can significantly be reduced or eliminated. I can reduce these not only for job loss but also for emergency expenses or months where my routine changes ( like a vacation). I was conservative in my amounts but ensured that I covered my actual expenses. I use zero-based budgeting, which means I budget to have a difference of zero after every paycheck. This is where I add any accelerated or extra payments.

-

Emergency Savings

I use two savings strategies. The first is Emergency Savings. I calculate my insurance deductibles and use that as my Emergency Savings target. Each month, I have two $500 payments for my vehicles and $1000 for my home, for a total of $2000. In 2019, we had an old pipe in our house dislodge itself and pour water all over the basement floor. It required insurance to fix it. Of course, most policies include the insurance deductible from any cash paid out of the claim, but in our case, I was able to get an emergency crew to start mitigating the damage right away with a $1000 down payment. I called the insurance company and they approved the work, but could not advance the payment immediately. There would have been a lot more damage and possibly mold if we did not act fast. I only use this account as a last resort and I will always try to use spending or the next savings account.

-

Extra Savings

Currently, I am not saving for any specific, individual goal because realistically, I’m not planning any forthcoming renovations, vacations, new furniture, etc. At least not all at the same time. I’m also not going to buy that new washing machine if I need to repair my car.

However, this particular savings is a result of whatever extra money I have left only after I’ve met my Emergency Fund goal above. Then I put all other savings into my “Extra Savings” account. Earlier this year, I had saved about $10,000 (mostly attributing to that year’s tax return) and was preparing to do some major renovations to the house, but that turned into my ‘Pandemic Survival’ pot.

***

When the pandemic hit, I immediately reduced my expected income and started deleting my variable expenses until I got to a “0” balance. When I deleted all the variable spending I could and reduced my food and gas to reasonable minimums, there was a negative balance. I added a line “From Extra Savings” and I would transfer that amount into my account when I got to that paycheck. I was easily able to calculate how long my savings would be able to sustain our finances by deducting this amount from what I actually saved.

Years prior to tracking my expenses, I calculated my net worth every year and it never seemed to change — which was so demotivating. I was getting into different, worse consumer debt trying to pay off my old debt. During the pandemic, even just paying the monthly minimums on my debt and not accumulating any more debt (during the most challenging year for most people on the planet), I was able to increase my net worth more this year than any year previously — and by about $15,000, at that. The key to my financial success is that I no longer accumulate any more debt. Yes, it may take me longer than the financial gurus say I should take to pay off my debt, but I have been dealing with debt for 15 years, and this is the first time I have ever felt like I will actually pay it off — eventually.

(This post was originally published November 2020, and has since been updated)

Charlene Henderson is married and lives in Calgary, Alberta. She is a working mom of two boys: Tidus, 8, and Tycho, 6.

Image via Unsplash

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.