The Great American Credit-Off: Winners Announced!

This series is sponsored by CreditRepair.com.

Whether you need to finance a car or get your name on an apartment lease, we all know how important it is to have a solid credit score. Of course, growing it can be a pain, not to mention elusive — but even though it takes time, it doesn’t have to be so time-consuming.

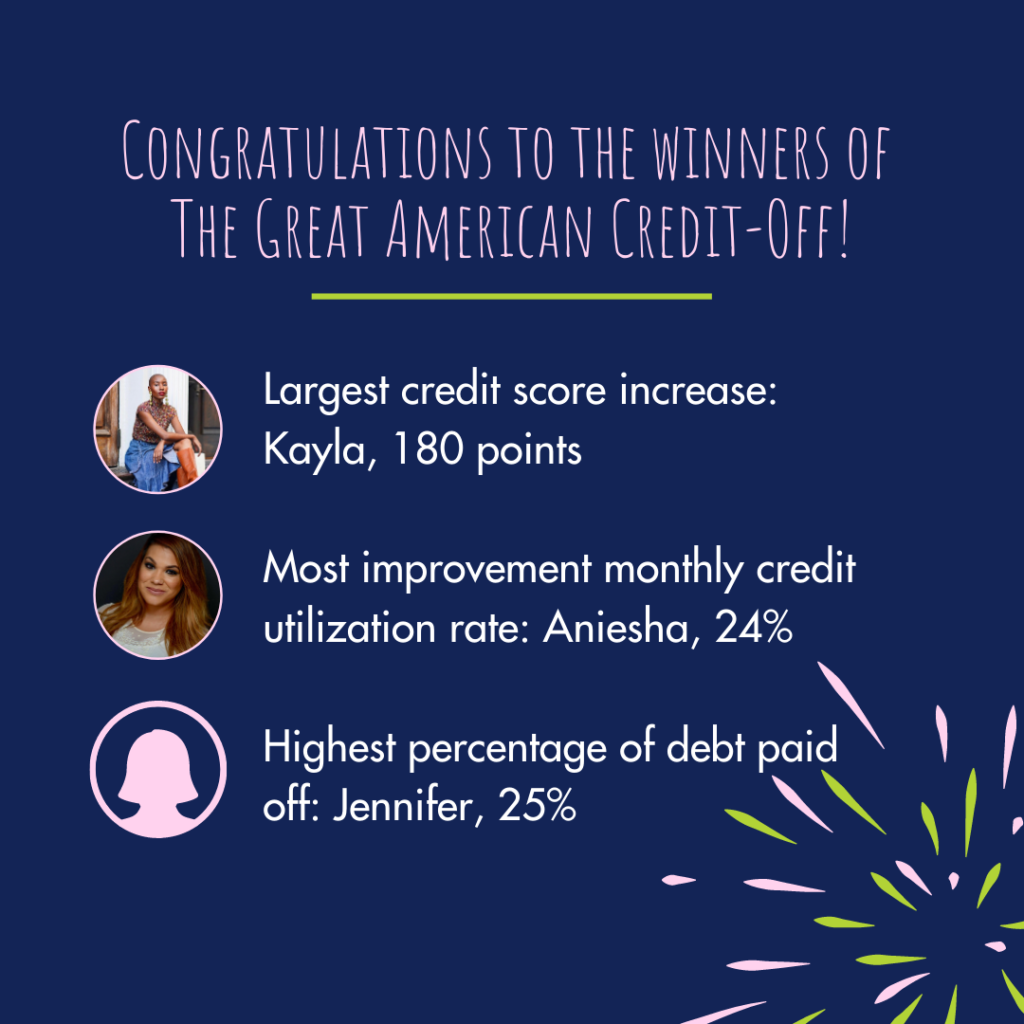

In partnership with CreditRepair.com, we launched the Great American Credit-Off. Our contestants have competed over an eight-month period to improve their credit scores. They’vel been working to improve in 3 different categories: 1) the largest increase in credit score, 2) the biggest improvement monthly credit utilization rate, and 3) paying off the highest percentage of consumer debt.

CreditRepair.com provided all participants with 6 months of free access to their services. Below, we speak with each of our contestants to see how they’ve worked to improve their credit, how far they’ve come, and how they’re taking on their money goals going forward. Thank you so much for following along! [Please note: In order to have a different winner for each category, we selected the second-highest debt payoff percentage.]

1. Mallorie, Nashville, TN

- FICO score in March: 490

- Current FICO score: 521

- Score growth: 31 points

What is your monthly credit utilization rate now compared to when you entered the competition?

This doesn’t apply to me, as I don’t have any open credit card accounts.

How much debt have you paid off since entering this competition (if applicable) What percentage of your debt have you paid off?

I have put $4000 toward my car bill since February. I have also paid off $1,130 in outstanding debt/collection accounts.

Do you feel like you’re closer to your major money goals than you were when we last checked in in August? Why or why not?

I’m definitely not exactly where I want to be with my money goals — having lost my job in June and not being able to get another one (I work in the music business), I’ve had to use my savings to stay afloat. However, I have been able to keep up with rent & bills, so I’m pretty happy about that! I’ve taken up working side hustles like Instacart and have also taken a temp gig working for the election!

How has your experience been working with CreditRepair.com?

I would say my experience has been great, I’m so grateful that I’ve been able to use the service at zero cost (since being jobless) so that’s been a blessing and I’m super thankful to TFD. My only critique would be that the accounts are not removed from your credit report as fast as I’d like, but I know these things take time.

2. Aniesha, Hoboken, NJ

- FICO score in March: 523

- Current FICO score: 685

- Score growth: 162 points

What is your monthly credit utilization rate now compared to when you entered the competition?

It is 9%. It was 35% before. To lower my credit utilization, I would put aside $1K a month to go toward credit cards. And then another $1K for saving. Instead of trying to tackle all of my credit cards at once, I started with the ones with the highest interest level first and slowly but surely got them all down. I also utilized an app called Digit that helps you save to put money towards savings or to help drive down credit card debt.

How much debt have you paid off since entering this competition (if applicable) What percentage of your debt have you paid off?

$12,355, about 33%.

Do you feel like you’re closer to your major money goals than you were when we last checked in in August? Why or why not?

Yes I am. I have saved $8K during this time. Quarantine helped a lot [with saving] to be honest. I was able to save by cutting back on expenses like going to dinner, or shopping or taking Uber’s. I would put $2k aside a month for bills and saving. What was left is what I worked with for the month. I also canceled subscriptions I wasn’t utilizing.

How has your experience been working with CreditRepair.com?

It’s been great. I was given the tools to save and boost my score 🙂

3. Kayla, Brooklyn, NY

- FICO score in March: 351

- Current FICO score: 531

- Score growth: 180 points

What is your monthly credit utilization rate now compared to when you entered the competition?

Currently it is very low, about little to none. I paid my credit card off, but my old account was closed down and I never reopened one, but will again shortly.

How much debt have you paid off since entering this competition (if applicable) What percentage of your debt have you paid off?

I paid off $600 in debt from my first and only old credit card.

Do you feel like you’re closer to your major money goals than you were when we last checked in in August? Why or why not?

I do not feel closer to my money goals, as the coronavirus has made my income uncertain. My anxiety about money has tripled, but I am revisiting new goals in November and making a lot of changes to my lifestyle.

How has your experience been working with CreditRepair.com?

I didn’t use it much, but it was nice to just look at every now and then.

4. Jennifer*, Crofton, MD

- FICO score in March: 654

- Current FICO score: 664

- Score growth: 10 points

What is your monthly credit utilization rate now compared to when you entered the competition?

It’s now at 30%.

How much debt have you paid off since entering this competition (if applicable) What percentage of your debt have you paid off?

$2,500, about 25% of my total debt.

Do you feel like you’re closer to your major money goals than you were when we last checked in in August? Why or why not?

Not quite. My score still isn’t strong enough to refinance my car, BUT I did refinance my house payment down!

How has your experience been working with CreditRepair.com?

Aside from tracking everything through the website, I haven’t had much contact with them. Would have been great to get some tips on what I could have improved or where to focus my energy.

*****

If you’ve been struggling to grow your credit score, check out CreditRepair.com to learn more. They can help you work to repair, build, and maintain your credit score by working directly with the credit bureaus to challenge any unfair, inaccurate or unsubstantiated items on your credit report, and teaching you how to understand both your own score and the rating system.

Like this story? Follow The Financial Diet on Facebook, Instagram, and Twitter for daily tips and inspiration, and sign up for our email newsletter here.