The Zero-Dollar Hack That Helped Cure My Impulsive Spending

In 2018, I graduated with my bachelor’s degree in business and quickly moved to a new city on the opposite coast after signing a contract for the first entry-level job offer I received. Luckily, it was a decent position in my field, with a fair starting salary and benefits. Since I made the big move with my partner, we acquired the enviable 50% rent split that only couples (or paired roommates) often get to take advantage of. I had just enough money saved to support myself in the transition but didn’t have a ton of extra savings left over after paying for a new apartment, furniture, household items, a work-appropriate wardrobe, and groceries.

During my college years, I worked part-time and paid for a decent amount of my daily expenses myself, but I was fortunate that my parents helped with some of my larger expenses. Though I had some experience with budgeting and being somewhat financially independent, after graduation, I was essentially on my own.

My newfound bi-weekly paychecks soon led to a bit of lifestyle inflation after a summer (and four years!) of minimum-wage internships. I finally had a job where I could comfortably make ends meet, and had some discretionary money leftover to have fun with (which is a privilege a lot of my loan-indebted peers didn’t have two months after graduating). I began to let myself shop online solely for fun, which is something I didn’t engage in a ton of during college. So after paying necessary expenses, I mostly spent my excess funds on eating out, alcohol, shows, and random clothing purchases.

Unfortunately, this was also around the time I got really into ordering trendy direct-to-consumer lifestyle goods. You know the type: fancy eco-friendly leggings, beautifully-packaged skincare, and technologically-advanced luggage and travel accessories. I didn’t even have a lot of trips planned that season (since I was still recovering from moving across the country) yet I bought a brand-new suitcase, a matching bag to use as my personal item, and packing cubes(?!).

I also began spending money on subscription boxes (separate memberships for makeup and lifestyle products), an expensive monthly hot yoga membership, and stupidly expensive spin classes. While I could, in theory, afford these things, I kept finding myself stressed out when paying my credit card bills with barely any money in savings. Receiving at least five packages per week was super annoying to keep track of, and was honestly kind of embarrassing. I was also spending a ton of money each week on rideshares since I live in a city where I don’t need a car but often slept in too late to take the bus to work.

During the holiday season, I had to borrow money from my parents to buy a ticket to fly home since I was hemorrhaging all of my money away on things I didn’t need. Around this time, my bank also randomly doubled my credit card limit, which just drove me to spend even more. After taking months to pay my parents back for the not-so-expensive plane ticket, I realized online shopping as often – and saving so little — wasn’t normal or healthy behavior. Aspirational spending on things like expensive blenders, bougie workout gear, and organic skincare also didn’t result in me becoming a better or healthier person. I finally had my epiphany: I had all of these nice, influencer-y goods, but I had been paying for it all on my own dime while influencers receive these things for free.

“I had all of these nice, influencer-y goods, but I had been paying for it all on my own dime while influencers receive these things for free.”

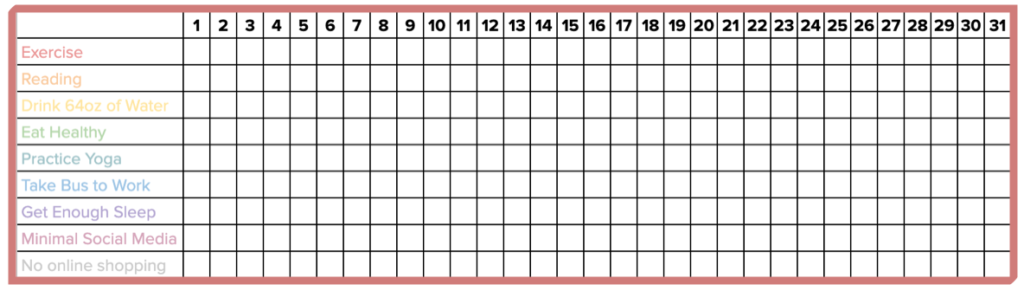

So, I slowly began to intentionally set better habits. I started reading over my bank statements frequently to be more aware of how I was spending my money (even if it was stressful to see the contents of the statements). I unsubscribed from sales emails and unfollowed every single influencer or brand that tempted me to spend. I also made lists of things I actually needed, and waited until there was a sale (which would still somehow be advertised to me, even if I unsubscribed from email lists). I made myself this habit tracker (see below), which really helped me stay on track with my goals.

When overcoming my online shopping addiction, I also found it useful to use my credit card cashback to buy any “treat myself” items I wanted, since it sort of felt like Monopoly money. However, what really helped me grow was simply being mindful and intentional when swiping my credit card. Over time, it was easier to save instead of spend, and seeing the numbers in my savings account grow became a fun little game. Also, the pandemic eventually hit and I knew that many people in the country didn’t even have food or housing security, which made it a very easy incentive and wake-up call to stop buying stupid things online.

Today, I’m critical about the *why* before I *buy* and I’m much better about waiting to purchase things. If I’m feeling emotional or bored, I don’t need to ‘proceed to checkout.’

In the end, what helped most in me curbing my online shopping habit was actually “free.” I used mindfulness and intention. Today, I’m critical about the *why* when I want to buy things, and I’m much better about waiting to purchase them. If I’m feeling emotional or bored, I don’t need to ‘proceed to checkout’ — I’ve finally realized that items rarely actually sell out, and there’s always another sale in a few weeks. I’ve finally overcome my online shopping addiction and have five figures worth of savings, a robust retirement account, and I’m learning about long-term investing and I feel thoroughly in control of my spending habits.

While all of the high-quality items I bought are useful in my life, I have more than I could ever need. I still have an ongoing list of things I want (eventually), but it’s much better to know that I can take care of myself in an emergency. After years of being financially reckless, I’ve finally realized it feels better to have actual money than it does to have a 16th pair of bike shorts. Let me know in the comments below if you have any tips on how to keep yourself from impulsively shopping online!

Lexi lives in the Pacific Northwest and works at a marketing agency. She spends most of her free time reading, cooking, practicing yoga and pilates, looking at pictures of cats on Instagram, watching HBO original programming, and writing on her blog.

Images via author and Unsplash (header)