12 Non-Boring Finance Books You Need To Check Out This Summer

Recently, one of our readers wrote in to ask us if we had any recommendations, suggestions, or have ever heard of great personal finance books that would benefit someone in their mid-twenties looking to become more financially savvy. She wrote, “which books would you guys recommend for me to read if I want to really take control of my budget, invest wisely and save as much money as I can while still enjoying being a 27-year-old? I’ll take any and all recommendations!” And that’s the thing — everyone wants to still enjoy being themselves and living their lives, and to me, that’s what any smart financial plan looks like. It’s striking the balance between living your life and saving money, investing, and planning smartly for your future. After diving in deep and researching the best personal finance books (and asking friends who majored in finance/economics), this is a short list of the 12 finance books every twenty-something should have on their shelves. Check it out!

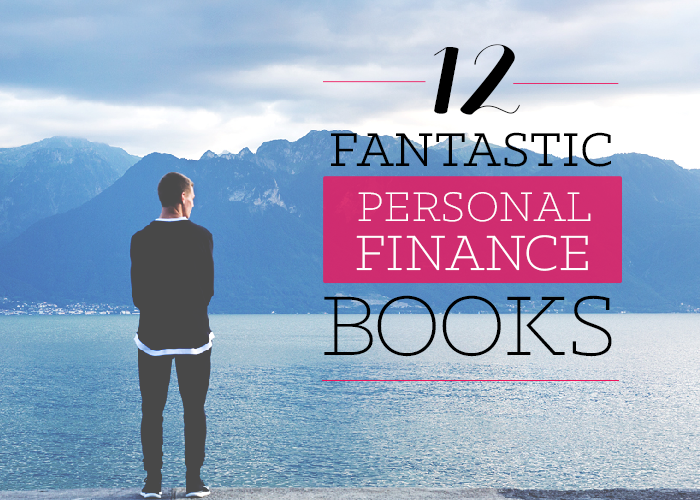

1. Financially Fearless: The LearnVest Program for Taking Control of Your Money by Alexa Von Tobel. Brought to you by the founder and CEO of LearnVest. Financially Fearless gets rave reviews, and it takes an honest approach to personal finance that differs greatly from the tired and traditional “put down the lattes” shtick. This one seems to be relevant, smart, and extremely useful.

2. Thinking, Fast and Slow by Daniel Kahneman. Kahneman — a nobel-winning behavioral economist brings you a book at the two ways in which our mind works, and how it affects the decisions we make about money, business, and our personal lives. It’s a fascinating topic, and a book which the NYtimes called “consistently entertaining and frequently touching.” To me, this seems like it absolutely has a place on every twenty-something’s shelf, since it provides a deep understanding of how the brain works.

3. The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money by Carl Richards. Richards is a financial planner and is on a #quest to help us get smarter with money. He advocates for a simple and straightforward method which yields real results, and asks us to rethink the ways in which we’ve always approached personal finance.

4. Get a Financial Life: Personal Finance in Your Twenties and Thirties by Beth Kobliner. The book was reviewed very favorably here, and from what I’ve read/heard it seems like a must read for anyone navigating this crucial financial period in their life. It speaks the language of a generation who is navigating tough money issues for the first time, and who are just starting out on the road to financial responsibility.

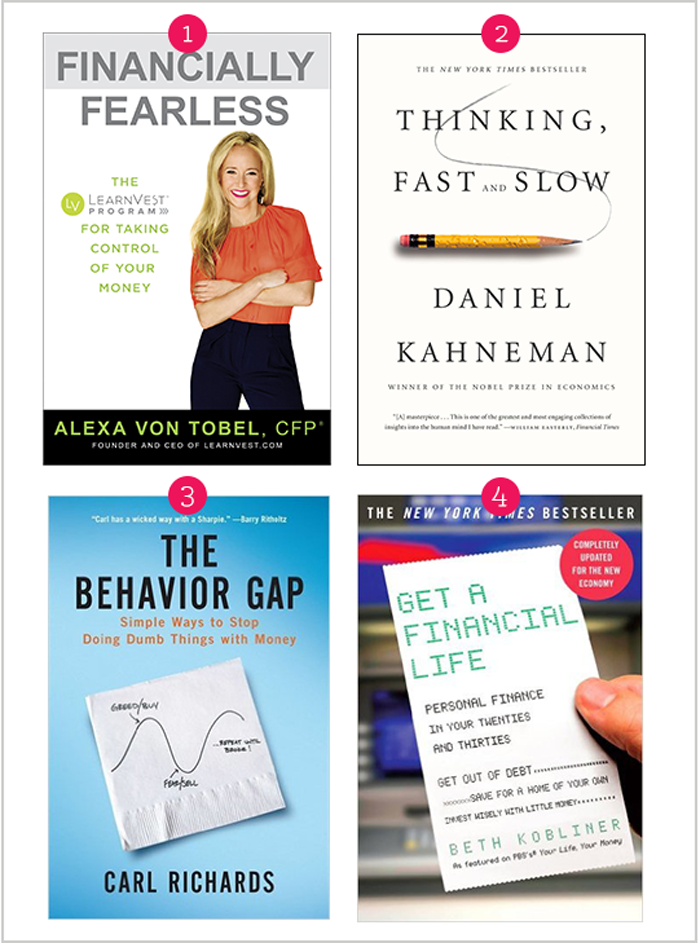

5. Warren Buffett Invests Like a Girl: And Why You Should, Too by The Motley Fool. Who doesn’t love Warren Buffet? This book dives deep into the habits of one of the worlds most successful investors and compares those habits to the latest research on men and women. Some of the main points of the book are that Warren keeps calm, doesn’t have an excessive ego, keeps an even temperament, and doesn’t take excessive risks. Tendencies that women have shown to be especially keen at.

6. Generation Earn: The Young Professional’s Guide to Spending, Investing, and Giving Back by Kimberly Palmer. As the name suggests, this is a great book for young professionals who want to get smarter with money. It covers some fantastic and very relevant topics such as, “what should I be doing with my savings?” “Should I take on freelance jobs?” “Does it make sense to share a mortgage with my significant other?” “Can I afford a baby?” Among other invaluable topics for twenty-somethings to learn about.

7. Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence by Vicki Robin. From what I’ve read, this book is one that has changed innumerable lives and perspectives about/on money. It’s been on more best financial books for millennials/young people than not, and it seems like a financially transformative read. Business Insider says the book “places an emphasis on not working to accumulate possessions, but saving in order to live the life you love. Turning your money philosophy upside down and it’ll inspire positive financial actions, like saving money.”

8. The One-Page Financial Plan by Carl Richards. First off, I love that this guy writes financial advice on the back of napkins. It’s a very approachable and easy way to understand the complexities of personal finance. However, this one is geared toward a more specific audience, “the middle to upper-middle class professional who wants to change money habits to achieve family-related goals.” Still, a very worthwhile and insightful read.

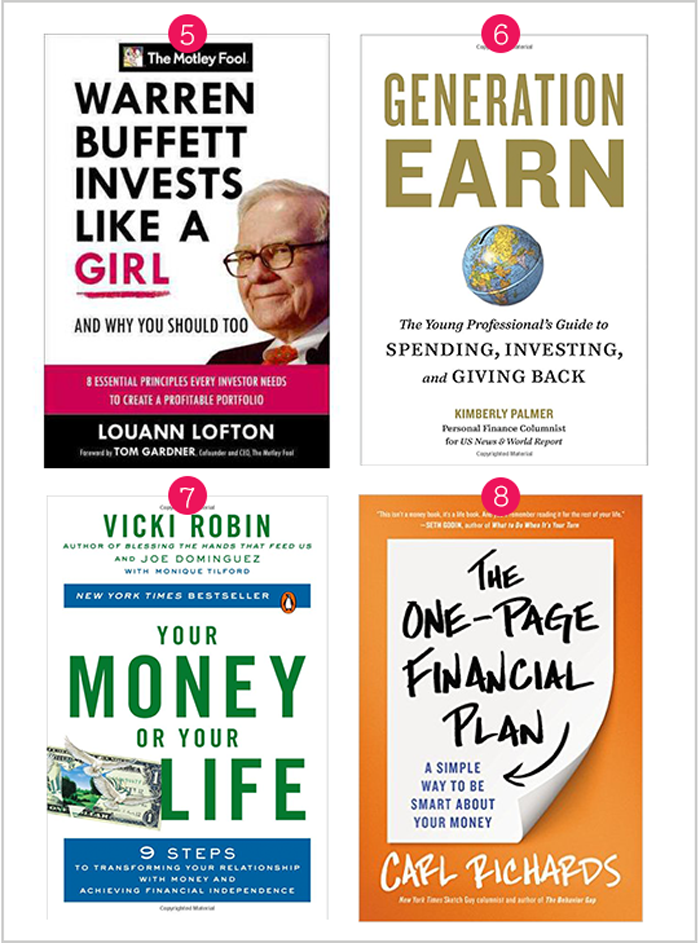

9. I Will Teach You To Be Rich by Ramit Sethiv. Even though the title of this book can be off-putting for some (I had an initial moment of uncertainty), from what I’ve read, this book is another really useful read. Ramit offers up a six-week financial plan for 20-to-35 year old individuals, and advocates that one doesn’t waste time managing money, but rather makes fewer yet smarter choices.

10. The Essays of Warren Buffett: Lessons for Corporate America, Fourth Edition selected, arranged, and introduced by Lawrence A. Cunningham. A collection of Warren Buffets essays that provides invaluable advice and financial guidance for corporate America, and by extension, the rest of us. Warren provides an in-depth understanding of investing, business analysis, and solid takeaways for sound financial practices that serves as a foundation for financial health.

11. Living Well, Spending Less: 12 Secrets Of Good Life by Ruth Soukup. An eye-opening book that explores the nitty-gritty secrets of how to live a good life. The book explores how to “take back your time and schedule by making simple shifts in your daily habits, reduce stress in your home and family by clearing out the clutter, stop busting your budget and learn to cut your grocery bill in half, bring order to a messy life and create a practical cleaning schedule that works.” This is definitely on my to-read list!

12. The Best Investment Advice I Ever Received: Priceless Wisdom from Warren Buffett, Jim Cramer, Suze Orman, Steve Forbes, and Dozens of Other Top Financial Experts by Liz Claman. Having a resource full of the best investment advice from some of the wisest and most successful financial experts, is something that every young person should have on their shelf. For me, real-world practical advice is what I need to help me make well-informed decisions that can lead me down the path to a financially sound, healthy, and happy life.

Image in main graphic via Pexels